The irrational stock market is a fascinating phenomenon that often defies logic and reason. Imagine a bustling marketplace where investors, driven by sheer enthusiasm and psychological factors, push asset prices to dizzying heights (the AI hype is real!) - far beyond what their fundamental valuations warrant. This exuberance, devoid of a solid foundation, is what we call irrational exuberance. The term gained prominence thanks to former Federal Reserve Chair Alan Greenspan, who used it in a 1996 speech during the days of the dot-com bubble. Irrational exuberance can lead to bubbles - inflated asset prices that eventually burst.

When the bubble pops, panic ensues. Investors, once confident, now scramble to sell their assets, often at prices lower than their true worth based on fundamentals. The aftermath can ripple across other asset classes and even trigger a recession. Those who were overconfident, convinced the bull run would last forever, suffer the most.

This serves as a cautionary tale if the AI story doesn't play out as expected. The excess liquidity back then fueled internet stocks, and when the bubble burst, it wiped out years of gains. So, next time you see the market dancing to an irrational tune, remember the past rhymes.

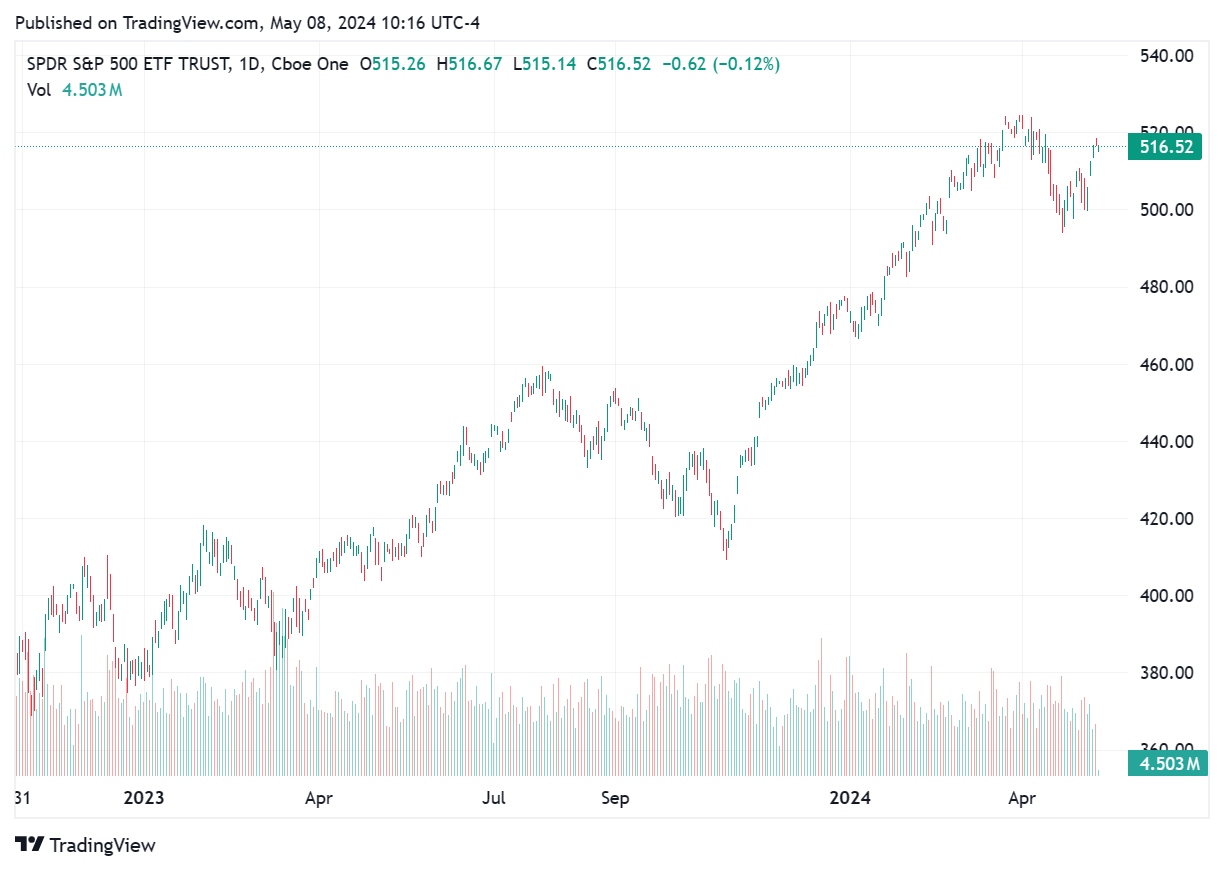

Just some metrics for the S&P500:

Dot-Com Era

Peak P/E during dot-com bubble = 47

Average P/E ratio over prior 30 years = 24

Traded at 1.96x above average

High point of Shiller P/E = 44.19

Today’s Era

Approximate P/E ratio today = 32

Average P/E ratio over prior 30 years = 17.6

Trading at 1.81x above average

Current Shiller P/E = 35

Make it what you want, something will eventually give.