Analyzing an ETF

A Comprehensive Guide to Understanding and Evaluating Exchange-Traded Funds (ETFs)

An Exchange-Traded Fund (ETF) serves as both an investment product and a collective investment scheme. Let’s break down what this entails:

Nature of ETFs: Think of an ETF as a collection of various securities that are available for trading on a stock exchange, much like individual company shares.

What’s Inside: An ETF’s portfolio may be composed of diverse assets, including but not limited to equities, commodities, and bonds, or a blend of these investment classes.

Market Activity: The trading of ETFs occurs throughout the day with prices set by the market, which can fluctuate from the actual net asset value of the underlying assets.

How They’re Handled: ETFs might be passively managed, mirroring the performance of a benchmark index, or they might be under the active supervision of managers who select the assets.

Expense Aspect: Typically, ETFs are known for their lower management fees in comparison to mutual funds, making them an economical option for investors looking to diversify their holdings.

As the famous Warren Buffett has advised, “the best thing to do is own the S&P 500 index fund (…) The trick is not to pick the right company. The trick is to essentially buy all the big companies through the S&P 500 and to do it consistently and to do it in a very, very low-cost way.”

Some ETFs that track the S&P 500 include ZSP, VFV, and XUS. I personally invest in ZSP, so this post will use this index fund to guide you through the main attributes to consider when researching an ETF.

ZSP - A Simple Exposure to the Best Market

The easiest way to research these funds is to download their factsheets. There are five main considerations which will be touched on here.

Consideration #1 - Investment Goals

Does this ETF match what you want to achieve in your investment journey? Will your objectives be met? For beginner investors with little to no investing knowledge, an index fund/ETF is the place to start. If you have a long-time horizon, it makes even more sense to go into funds with a large exposure to equities. Find the portfolio strategy of your index ETF and see if it meets your objectives. This will also include your risk tolerance.

Consideration #2 - Fund Size and Liquidity

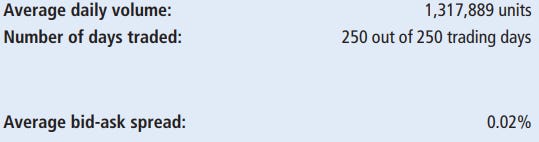

Fund size and liquidity are important factors in ETF investing. Larger ETFs offer a sense of security and sustainability, as well as higher liquidity. This is often gauged by daily transaction volume. A more liquid ETF minimizes the risk of price fluctuations and assures investors of a prompt exit when needed. The average bid-ask spread can also help determine this. A narrower spread usually indicates a more liquid market with high trading volume, while a wider spread can indicate lower liquidity and higher transaction costs. ZSP is on the narrower end - highly liquid.

Consideration #3 - Underlying Holdings and Investment Mix

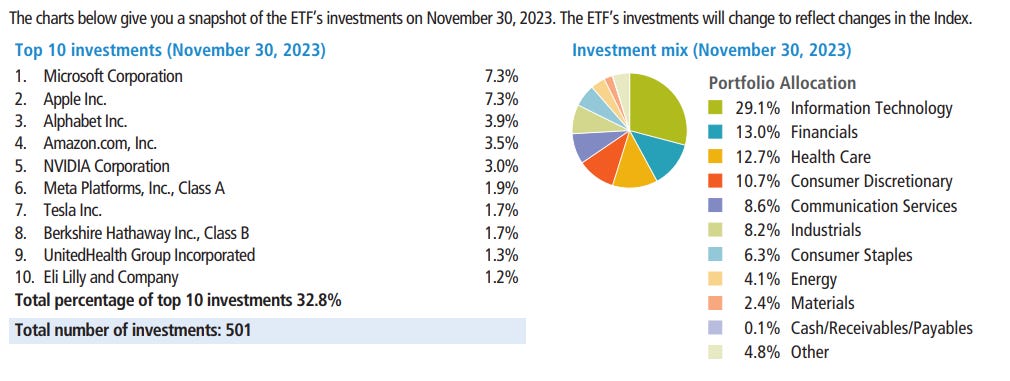

This is probably the most fun thing to do when analyzing an ETF factsheet. This can tell you which sectors are invested in, the allocation between them, the underlying stocks it holds, as well as the geographical exposure.

You’ll need to consider whether you like the mix it offers and the companies it holds. For those who also invest in individual stocks, ask yourself if this ETF offers more diversification or if it is just a repeat of what you currently hold. If it is the latter, then perhaps you should reconsider or as an alternative altogether, just invest in the ETF instead.

Consideration #4 - Tracking Ability

How well does the ETF track its benchmark index? This is highly important as you will want to make sure you are investing in something that enhances the confidence in the fund’s ability to deliver returns in line with the broader market or specific sector it intends to represent.

Consideration #5 - Expense Ratio

This is something that investors, especially beginners, tend to overlook. The expense ratio is the annual fee expressed as a percentage of average assets under management. Why is it important? A lower expense ratio can lead to higher net returns over time. You will truly understand this impact if you have money invested in mutual funds, or have had in the past - these tend to have much higher management expense ratios (MERs).

For example, in the case of ZSP, a MER of 0.09% means that if you hold assets of $10,000 in the fund, the annual cost would only be $9. This is extremely low!

Although I have only highlighted five considerations to researching an ETF, these are the key ones. There are certainly other ones that you can consider - currency risk, dividend policy, tax efficiency - but for the average investor, these are considered secondary.

Conclusion

Always remember to be informed on any investing decision you make. ETFs are a great place to start as it gives you broader exposure to a market or sector.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!

Please refer to the details of the referral program below.

Invite your friends to read DiviStock Chronicles

Thank you for reading DiviStock Chronicles — your support allows me to keep doing this work. Join our referral program!