Fees - Mutual Funds vs. ETFs

Comparing Mutual Funds and ETFs: Understanding Fee Structures and Their Impact on Your Investments

When comparing the fees between mutual funds and (exchange-traded funds) ETFs, it's important to understand the different structures that affect the cost for investors. Generally, ETFs are known for their lower average costs compared to mutual funds.

ETFs and mutual funds differ primarily in how they are traded, managed, and their fee structures.

Mutual Funds

A type of investment vehicle that pools money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities.

Often have active management, which necessitates higher fees to compensate the managers and cover transaction costs.

They may also impose load fees, essentially sales commissions, in addition to other charges such as redemption, exchange, and account fees.

Less flexibility as they are only priced once at the end of the trading day, and all transactions are executed at that price.

Less accessible as they usually require a minimum dollar investment.

Weaker transparency as generally disclose holdings quarterly or semi-annually.

Security sales required for redemptions may result in capital gains distributions, creating potential tax liabilities for the remaining investors.

The expertise of a professional fund manager is considered an advantage by some, as it provides the flexibility to react to market fluctuations, economic predictions, and company performance in real-time, which may lead to capitalizing on short-term opportunities. They can also utilize strategies such as market timing and selective stock picking, which passive funds generally do not employ, as well as enhance tax management through methods like tax-loss harvesting.

ETFs

A type of investment fund that holds a collection of assets, such as stocks, bonds, or commodities, and trades on stock exchanges much like individual stocks.

Most are passively managed, which means they track a specific index and do not require active management by fund managers, leading to lower operational costs.

Typically do not charge load fees and have lower expense ratios on average.

Greater flexibility as they trade like stocks, with the ability to buy and sell at varying prices throughout the trading day.

Greater accessibility as they can be bought at the price of a single share.

Enhanced transparency as they offer daily visibility into their holdings, providing a clearer picture of investments.

Typically offer greater tax efficiency through a unique creation and redemption process that helps prevent capital gains taxes.

It's evident that ETFs have an advantage over mutual funds in terms of fees. Despite each investment vehicle having its own advantages and disadvantages beyond just the cost aspect, this blog post concentrates exclusively on fees and their impact on diminishing your investment returns.

Illustration

One of the most widely invested ETFs in Canada is the Vanguard S&P 500 Index ETF (VFV).

A comparable mutual fund to VFV is the TD U.S. Index Fund - e Series (TDB902).

These investments are designed to mirror the performance of the S&P 500 Index, catering to Canadian investors seeking exposure to the U.S. stock market.

The Management Expense Ratio (MER) is a fee that investors pay annually to cover the costs of managing a mutual fund or exchange-traded fund (ETF). The MER is deducted from the fund’s returns, so a lower MER can help improve overall investment performance.

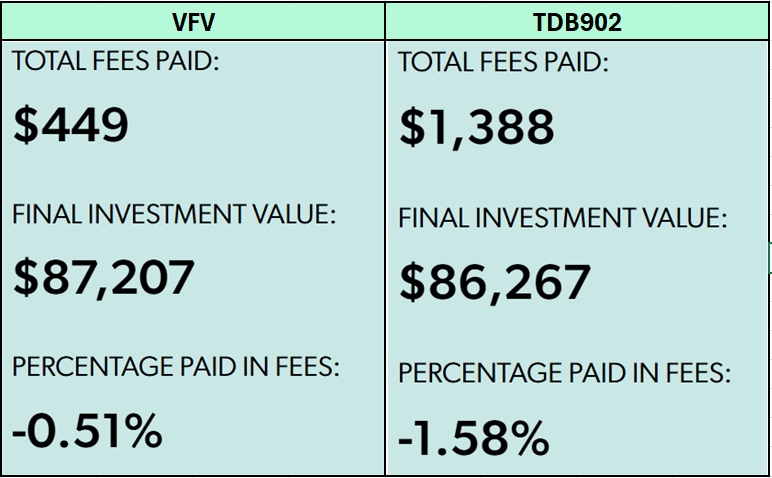

MER of VFV = 0.09%

MER of TDB9021 = 0.28%

Assuming all factors are equal, let’s say they are expected to yield an annual rate of return of 10% for the next 10 years with an annual contribution of $5,000.2

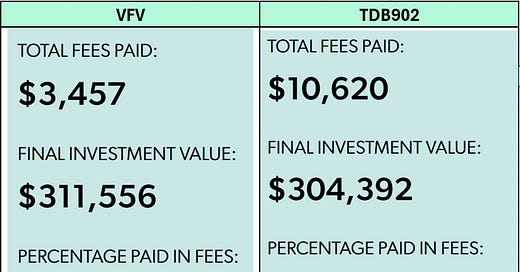

Now what about 20 years…

This example presented a smaller difference between MERs. Envisioning a larger disparity in the MER percentages would further magnify the variance in fees. That’s the intended point.

The average MER for mutual funds in Canada is typically around 2.5%. The average MER for ETFs in Canada typically ranges from 0.25% to 0.50%.

Bottom line: The longer the investment horizon and the larger the annual contributions, the more significant the potential growth one might forego by choosing a mutual fund over an ETF.

Financial institutions prey on those who are ill advised and mutual funds are commonly the first investment option presented to new investors. Why? The management fee hurts your pockets, but inflates the institution’s pockets. They just don’t inform you of this.

Undoubtedly, conducting your own research is beneficial. When presented with an offer, it's wise to seek out the next best alternative before deciding. If the options are highly comparable, opt for the less expensive one to maximize returns.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.