H2H Battle - Home Depot vs. Lowe's

Enjoy a spirited clash between two industry competitors, pitted against carefully chosen financial metrics and benchmarks.

The home improvement retail industry has experienced significant growth in recent years, driven by increased consumer spending on home renovations and DIY projects. This sector includes the sale of building materials, appliances, décor, and other home enhancements, as well as services provided by contractors and tradespeople. Major players in the U.S. market include The Home Depot, Lowe's, Ace Hardware, and Menards. The industry has also seen a trend towards smart home technology, with consumers investing in integrated devices that automate various home functions.

Key Competitors

Home Depot: The largest direct competitor, known for its extensive product selection and strong contractor focus.

Lowe's: The largest direct competitor, with a strong focus on customer service and a growing online presence.

Menards: A regional player with a strong presence in the Midwest, known for its competitive pricing and large store formats.

Ace Hardware: A cooperative of independently owned hardware stores, offering a strong local presence and personalized service.

Online Retailers: Amazon and other online platforms are increasingly competing for market share in the home improvement sector.

Headwinds

Economic Recession: A decline in economic activity could lead to reduced consumer spending and lower demand for home improvement products.

Competition: Intense competition between listed competitors above and smaller regional players.

Supply Chain Disruptions: Global supply chain issues can impact product availability, pricing, and profitability.

Interest Rate Hikes: Rising interest rates can make home improvement projects more expensive, impacting demand.

Labor Shortages: Finding and retaining skilled workers for installation and other services can be challenging.

Tailwinds

Aging Housing Stock: Many homes in the U.S. are over 40 years old and require repairs and renovations.

Rising Home Values: Increasing home values can encourage homeowners to invest in home improvements.

E-commerce Growth: The shift to online shopping provides opportunities to expand its digital sales channels.

Innovation and Product Authority: Continuous innovation and offering quality products can attract and retain customers

Home Depot (HD)

Company Overview

Home Depot is the largest home improvement retailer globally, operating a vast network of stores across the United States, Canada, and Mexico.

Founded in 1978, the company has grown significantly through a combination of organic growth, acquisitions, and a focus on customer service and innovation.

The company is publicly traded on the New York Stock Exchange (NYSE: HD) and is part of the Dow Jones Industrial Average and the S&P 500 Index.

Business Model

Home Depot's business model focuses on selling tools, construction products, appliances, and services for home improvement projects.

The company is implementing interconnected retail, store, supply chain, and technology initiatives to enhance its business model.

Home Depot's mission is to provide the highest level of service, the broadest selection of products, and the most competitive prices.

Product and Service Offerings

Home Depot offers a wide range of products, including tools, building materials, appliances, lighting, flooring, and home decor.

The company also provides installation services for roofing, siding, windows, and other products through its At-Home Services.

Additionally, Home Depot offers special order services for products not in stock and provides credit services for customers.

The company has also expanded its assortment in downstream supply chain facilities for faster delivery and made website enhancements for faster delivery options.

Competitive Position

Home Depot holds a dominant position in the home improvement retail market, with a market cap of approximately $381.7 billion and a market share of around 47%. The company's extensive store network and strong brand recognition contribute to its competitive edge.

Competitive Advantages

Stock Performance

Home Depot's stock has historically delivered strong returns for investors, with consistent revenue growth, high profitability, and a history of returning capital to shareholders through dividends and share repurchases.

Current Stock Price: As of February 8, 2025, HD is trading at $406.69.

52-Week Range: The stock is trading 25.1% above its 52-week low of $325.10 and 5.72% below its 52-week high of $431.37.

Total Returns: Over the past month, HD has returned 5.03%, and over the past year, it has returned 14.55%. The compound annual growth rate (CAGR) for the past 3, 5, and 10 years are 6.69%, 14.08%, and 16.82% respectively. Since inception, the total return CAGR is 18.40%.

Lowe’s (LOW)

Company Overview

Lowe's is a major home improvement retailer operating a large network of stores across the United States and Canada.

Known for its focus on customer service and a wide range of products, Lowe's competes directly with Home Depot as a key player in the industry.

Business Model

Lowe's operates as a brick-and-mortar retailer with a growing online presence.

The company generates revenue through the sale of a diverse range of home improvement products, including building materials, hardware, appliances, tools, and home décor.

Lowe's caters to both professional contractors and DIY homeowners.

The company also offers various services, such as installation, delivery, and rental equipment.

Product and Service Offerings

Extensive Product Selection: Lowe's offers a wide array of products across various categories, including:

Building Materials: Lumber, drywall, roofing, flooring, windows, doors

Hardware: Tools, fasteners, paint, plumbing supplies, electrical components

Appliances: Refrigerators, stoves, dishwashers, washers, dryers

Home Décor: Furniture, lighting, home furnishings, décor items

Outdoor Living: Lawn and garden supplies, patio furniture, grills, power equipment

Services: Installation services (e.g., flooring, appliances), delivery, rental equipment, online ordering and in-store pickup, customer service support.

Competitive Position

Lowe's is a significant player in the home improvement retail market, with a strong brand presence and a loyal customer base.

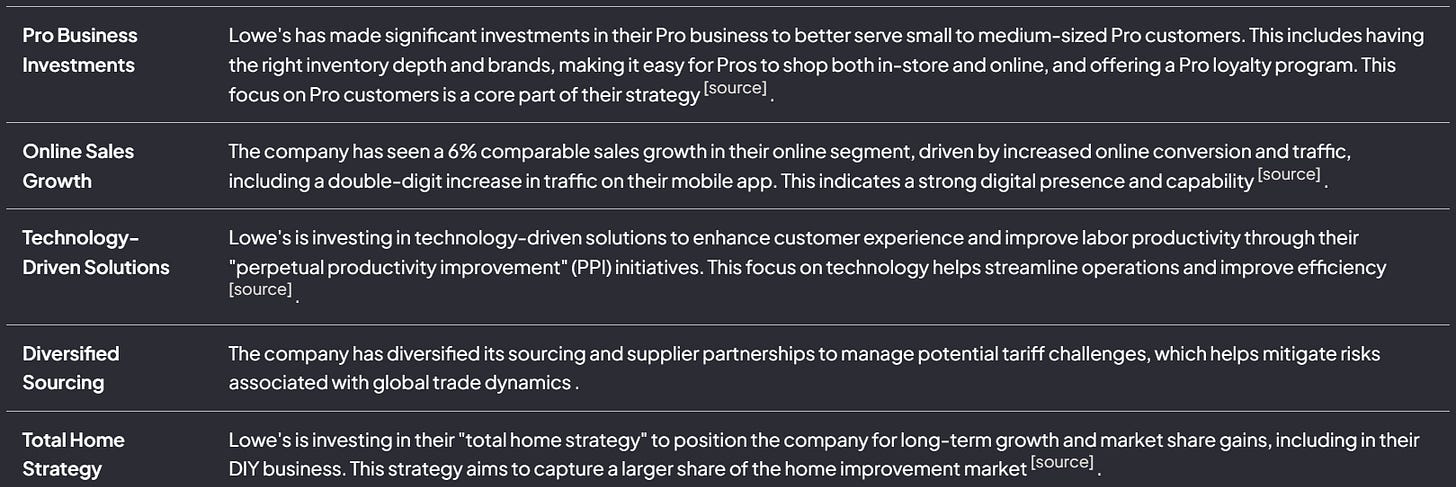

Competitive Advantages

Stock Performance

Lowe's has demonstrated consistent financial performance, though it may have experienced some volatility in recent years.

Current Stock Price: As of February 8, 2025, LOW is trading at $252.00.

52-Week Range: The stock is trading 18.14% above its 52-week low of $213.30 and 11.28% below its 52-week high of $284.05.

Total Returns: Over the past month, LOW has returned 2.52%, and over the past year, it has returned 16.44%. The compound annual growth rate (CAGR) for the past 3, 5, and 10 years are 4.87%, 17.78%, and 15.56% respectively. Since inception, the total return CAGR is 18.79%.

Outcome

At first glance, one glaring difference is that Home Depot (HD) trades at a much higher price than Lowe's (LOW). The narrative is that stronger companies typically trade at more premium valuations than their peers.

This seems to hold true given the results, but LOW is no push over.

Balance Sheet

Both companies exhibit strong metrics across their balance sheets, demonstrating effective debt management. However, Home Depot (HD) holds a slight edge in this regard as of late.

Capital Needs

Excellent ability to maintain capital expenditures at a reasonable level relative to sales and operating cash flows.

Capital Allocation

Both retailers exhibit outstanding Return on Invested Capital (ROIC), which is a key indicator of a high-quality, long-term business. Additionally, Lowe's maintains a well-managed payout ratio, strategically positioning itself to reinvest effectively in its business.

Profitability

As long as the economy keeps running, these two companies remain a staple in everyday business. Home constructions and renovations will continue as long as humanity exists. Margins are impressive. Cash flows even more so.

Historical Growth

Considering the five-year dynamics, Lowe's appears to have been underpriced and has offered better returns compared to Home Depot. If Lowe's revenue growth can match or even surpass that of Home Depot, it might eventually claim the top spot.

Forecasted Guidance

The issue is that forward guidance favours Home Depot, which is expected given its much larger market cap compared to Lowe's. Additionally, Lowe's primary focus on DIY customers, as opposed to Home Depot's stronghold on professionals and contractors engaged in large projects, may deter Lowe's from achieving greater returns.

Valuation

When you are the leading company in your industry, you receive a premium valuation compared to your competitors. Investors have a choice: pay a premium for the leader or opt for a more attractively valued secondary option.

Winner - Home Depot

Verdict - Split DecisionDisclaimer: The information provided is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy, sell, or hold any specific stocks or securities.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!

Get the H2H Battle Template for 3 successful referrals!Please refer to the details of the referral program.

Great read. Love this format. Have been working on a Berkshire/Amazon one. Keep it up! I’d love to collaborate with you in the future.