Michael Howell - Global Liquidity Runs the Show

Summaries of YouTube Videos featuring experts on global economic affairs.

Who is Michael Howell?

Michael Howell is the CEO and founder of CrossBorder Capital, a London-based independent research and investment firm established in 1996. With over 40 years of financial market experience, he pioneered a quantitative liquidity research methodology while serving as Research Director at Salomon Brothers in the 1980s. He later became Head of Research at Baring Securities (1992–1995), earning top rankings as an "Emerging Market Strategist." Howell holds a Doctorate in Economics from the University of London and is a qualified US Supervisory Analyst. A regular international conference speaker and media commentator, he has authored books including Capital Wars: The Rise of Global Liquidity (2020) and advised the World Bank on capital flows.

Key Views

→ Centrality of Liquidity: Howell emphasizes that liquidity—defined as the flow of money and credit through the financial system—is the primary driver of asset prices and economic cycles. He argues that understanding liquidity dynamics is critical for predicting market movements and economic outcomes.

→ Global Debt Dynamics: He frequently highlights the exponential growth of global debt, particularly in advanced economies like the U.S., as a structural risk. High debt-to-GDP ratios and the reliance on short-term refinancing create vulnerabilities, especially in a rising interest rate environment.

→ Interconnected Financial Systems: He stresses the interconnectedness of global financial markets, where capital flows across borders amplify risks. Emerging markets, reliant on dollar-denominated debt, are particularly susceptible to U.S. monetary policy shifts or a stronger dollar.

Debt Refinancing Crisis

This video from the Macro Voices YouTube channel, hosted by Erik Townsend, features a discussion with Michael Howell. The episode explores global liquidity, debt dynamics, and the potential for a debt refinancing crisis.

Here are some key points from the discussion:

Global Liquidity and Debt Levels

Howell highlights the unprecedented rise in global debt, particularly in the U.S., where federal debt has surged due to fiscal deficits. He notes that debt-to-GDP ratios are at historic highs, raising concerns about sustainability.

Liquidity, defined as the flow of money and credit, is critical to understanding debt dynamics. Howell argues that central banks, particularly the Federal Reserve, have been injecting liquidity to stabilize markets, but this may mask underlying issues.

Debt Refinancing Risks

A significant portion of global debt is short-term and requires frequent refinancing. Howell warns that rising interest rates could increase borrowing costs, making it harder for governments, corporations, and households to roll over debt.

The U.S. Treasury faces challenges with its $33 trillion debt pile, as maturing bonds need to be refinanced at higher yields, potentially crowding out other economic priorities.

Central Bank Policies

Howell discusses the Federal Reserve’s balancing act between controlling inflation and supporting economic growth. Quantitative tightening (QT) has reduced liquidity, but emergency measures like the Bank Term Funding Program (BTFP) have offset some effects.

He suggests central banks may be forced to pivot back to quantitative easing (QE) if refinancing pressures intensify, potentially leading to currency devaluation or inflation.

Market Implications

Howell predicts increased volatility in bond markets due to refinancing pressures. He also sees risks in equity markets if liquidity tightens further.

Emerging markets, heavily reliant on dollar-denominated debt, are particularly vulnerable to a stronger U.S. dollar and higher rates.

Potential Crisis Triggers

A sudden spike in interest rates, a loss of confidence in sovereign debt, or a geopolitical shock could precipitate a crisis. Howell emphasizes the interconnectedness of global financial systems, where a failure in one region could cascade.

He references historical examples, like the 1980s Latin American debt crisis, to illustrate how refinancing issues can escalate.

Mitigation and Outlook

Howell advocates for proactive liquidity management by central banks to prevent a systemic crisis. He also suggests that investors diversify into assets like gold or commodities to hedge against inflation and currency risks.

While a crisis is not inevitable, Howell stresses the need for vigilance, as the global economy is “walking a tightrope.”

The episode concludes with Townsend and Howell agreeing that while the system has been resilient, the growing debt burden and refinancing challenges warrant close monitoring.

Dynamics in the Financial System

The discussion centers on global liquidity, Federal Reserve policies, and emerging risks in the financial system.

Here is a quick summary of the key points:

Liquidity as the Core Issue

Howell emphasizes that global liquidity—money and credit flows—is the primary driver of markets and economies. He argues the Federal Reserve is not adequately monitoring liquidity dynamics, likening it to ignoring a growing "fire" in the financial system.

Federal Reserve’s Missteps

He critiques the Fed for focusing too narrowly on inflation and interest rates while underestimating the impact of its quantitative tightening (QT). Howell suggests the Fed’s balance sheet reduction is draining liquidity, risking market instability.

The Fed’s delayed response to liquidity signals, such as the 2023 banking stress, indicates a lack of proactive oversight.

Debt and Refinancing Pressures

Howell highlights the massive global debt burden, particularly U.S. Treasury debt, which faces refinancing challenges as short-term bonds mature at higher yields. This could strain government budgets and crowd out private investment.

Corporate and emerging market debt, especially dollar-denominated, is vulnerable to tighter liquidity and a stronger dollar.

Risk of Systemic Crises

He warns of potential "accidents" in the financial system, such as bond market volatility or a credit crunch, if liquidity continues to tighten. Howell points to the interconnectedness of global markets, where a shock in one area (e.g., Europe or Asia) could cascade globally.

The reliance on central bank interventions, like the 2020 COVID-era QE, has created a fragile system dependent on continuous liquidity injections.

Inflation and Policy Outlook

Howell predicts that persistent liquidity injections to avert crises may fuel inflation over the long term. He believes central banks, including the Fed, may pivot back to QE if faced with significant market disruptions.

He also notes the risk of currency devaluation, particularly for the U.S. dollar, if debt monetization accelerates.

Investment Implications

Howell advises investors to focus on liquidity-sensitive assets, such as commodities, gold, and equities in sectors benefiting from capital flows. He cautions against overexposure to fixed-income assets like bonds, given rising yield risks.

Diversification and hedging against inflation and currency risks are critical in the current environment.

Global Perspective

Emerging markets face heightened risks due to their reliance on external financing. Howell singles out China’s property sector and Europe’s banking system as potential weak points.

He contrasts the Fed’s approach with other central banks, like the Bank of Japan, which are more attuned to liquidity management.

The conversation concludes with Howell urging policymakers and investors to prioritize liquidity monitoring to prevent a systemic crisis. Lake and Howell agree that the Fed’s current framework risks missing critical signals, potentially leading to significant economic fallout.

What to watch for in 2025 – Trump, the US dollar, and China

This video from the Forward Guidance YouTube channel, hosted by Jack Farley, features an in-depth interview with Michael Howell. The discussion focuses on global liquidity trends, central bank policies, and the risks of an economic downturn due to tightening financial conditions. Follow below for the key points of the in-depth discussion:

Liquidity Squeeze Threat

Howell warns of a looming "liquidity squeeze" in global markets, driven by central banks’ quantitative tightening (QT) and reduced money creation. He argues that liquidity, the flow of money and credit, is critical for sustaining asset prices and economic growth, but it’s now contracting.

Central Bank Policies

The Federal Reserve and other central banks are draining liquidity through QT, raising concerns about market stability. Howell notes that without significant liquidity injections by fall 2025, financial markets could face severe disruptions.

He critiques the Fed for misjudging liquidity needs, pointing to funding pressures in money markets as early warning signs.

Debt Refinancing Challenges

Howell highlights the surge in debt refinancing needs, particularly for U.S. Treasuries and corporate bonds, as short-term debt matures at higher interest rates. This could strain borrowers and increase market volatility.

Emerging markets, reliant on dollar-denominated debt, face heightened risks from a stronger U.S. dollar and tighter liquidity.

Economic Slowdown Signals

He identifies signs of an economic slowdown, including weakening industrial activity and consumer spending. Howell argues that the economy is more vulnerable than headline data suggests, as liquidity withdrawal exacerbates these trends.

Market and Systemic Risks

Howell predicts increased volatility in bond and equity markets if liquidity continues to tighten. He warns of potential “breakages” in financial systems, such as credit market freezes or banking stress, if central banks don’t intervene.

He points to historical parallels, like the 2008 financial crisis, where liquidity shortages triggered systemic failures.

Global Capital Flows

The discussion delves into global capital flows, with Howell noting that China’s property sector and Europe’s banking system are weak links. He emphasizes the interconnectedness of global finance, where regional issues can have worldwide impacts.

Investment Strategies

Howell advises investors to focus on liquidity-sensitive assets like gold and commodities to hedge against inflation and market turbulence. He cautions against heavy exposure to bonds due to rising yields and refinancing risks.

He suggests monitoring central bank actions closely, as a pivot to liquidity injections could stabilize markets but risk long-term inflation.

Outlook and Policy Recommendations

Without meaningful liquidity by late 2025, Howell believes markets and the economy could face significant downturns. He urges central banks to adopt proactive liquidity measures, potentially returning to QE, to avert a crisis.

He remains cautiously optimistic that policymakers will act if conditions deteriorate, but stresses the urgency of addressing liquidity now.

The episode concludes with Farley and Howell underscoring the fragility of the current financial system, with liquidity as the linchpin.

Opinion

Mr. Howell is not alone is attempting to describe the crisis ahead driven by the lack of liquidity. The global liquidity system functions primarily as a debt refinancing mechanism. As the pandemic (Covid) debt refinancing cycle commences later this year, the additional burden of approximately $9 trillion in U.S. Government debt requiring refinancing within the same period creates a significant drain on liquidity. Central banks remain the pivotal force in this dynamic. For years, equity markets have depended on policy interventions, frequently teetering on the brink of collapse since 2008. Ultimately, liquidity is the primary driver sustaining equity markets over the medium and long term.

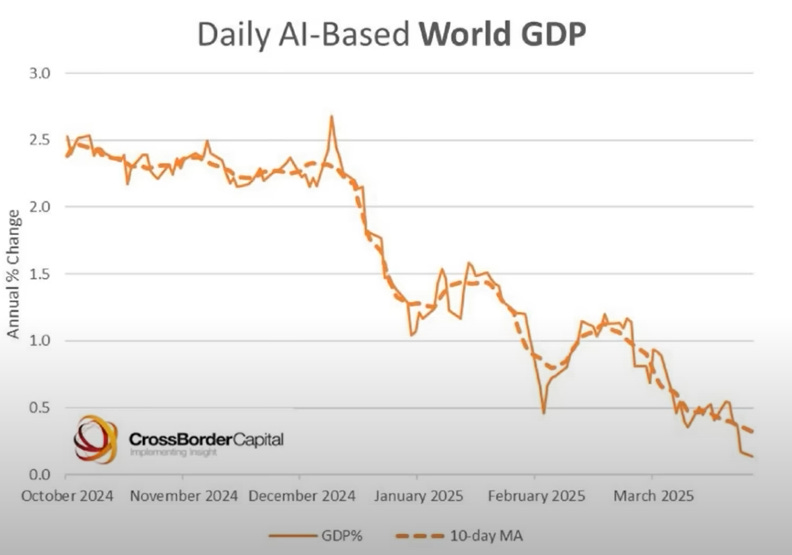

Every crisis is fundamentally linked to a debt refinancing cycle. Take 2008, for instance—while easy credit dominated the narrative, the underlying issue was a debt maturity cycle that led to a scarcity of collateral, precisely the environment we are now approaching. In such conditions, price becomes irrelevant. Global business activity began to slow significantly in January, even before blanket tariffs were announced, as illustrated in Howell’s graph below. Meanwhile, the U.S. Treasury is increasingly losing control of the long end of the yield curve, just as the refinancing cycle is set to mature.

The Federal Reserve appears to be lagging behind, maintaining its focus on inflation risks, unemployment, and trade wars. However, as Howell has suggested, this focus is misguided. Credit is tight, shadow banking1 is highly levered, and hedge funds are falling based on the collapse of the basis trade2. Unless central banks—particularly the Fed—shift their priority to collateral rather than inflation and tariffs, significant risks will persist. Ultimately, the Fed will need to abandon its inflation targets, though, as usual, I suspect they will be late to the party.

Earlier this year, I emphasized that 2025 was shaping up to be a year of significant volatility—and it has certainly lived up to that expectation. When paired with Howell’s deep insights, the broader picture becomes even clearer. Liquidity and volatility go hand-in-hand.

Gold, select commodities, and potentially Bitcoin serve as long-term hedges against currency debasement. Meanwhile, within equity-based investments, consumer staples and dividend-growth stocks present compelling opportunities. Just remember, risk is always present in every decision you make!

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.Shadow Banking refers to a system of financial intermediaries and activities that perform bank-like functions, such as lending and credit creation, but operate outside the traditional, heavily regulated banking sector.

The basis trade is a financial trading strategy, often associated with the U.S. Treasury market, that seeks to profit from the price discrepancy (or "basis") between cash Treasury securities (e.g., Treasury bonds or notes) and their corresponding Treasury futures contracts. This arbitrage strategy is commonly employed by hedge funds.