For individuals seeking to learn about analyzing Exchange-Traded Funds (ETFs), I suggest reviewing my earlier post that explains the fundamentals of ETFs and the analysis process.

VanEck Morningstar Wide Moat ETF (MOAT) - Snapshot

Overview

The VanEck Morningstar Wide Moat ETF (MOAT) seeks to replicate the performance of the Morningstar Wide Moat Focus Index, which includes attractively priced companies with sustainable competitive advantages. The ETF was launched on April 24, 2012, and is managed by VanEck Associates Corporation.

Investment Strategy

MOAT is dedicated to investing in companies that, according to Morningstar analysts, possess a "wide moat," indicating a sustainable competitive edge. The fund's objective is to pinpoint companies that have robust long-term competitive advantages and are reasonably valued. It undergoes semiannual rebalancing to maintain consistency with the Morningstar Wide Moat Focus Index.

Top Holdings

As of the latest data, the top holdings of MOAT include:

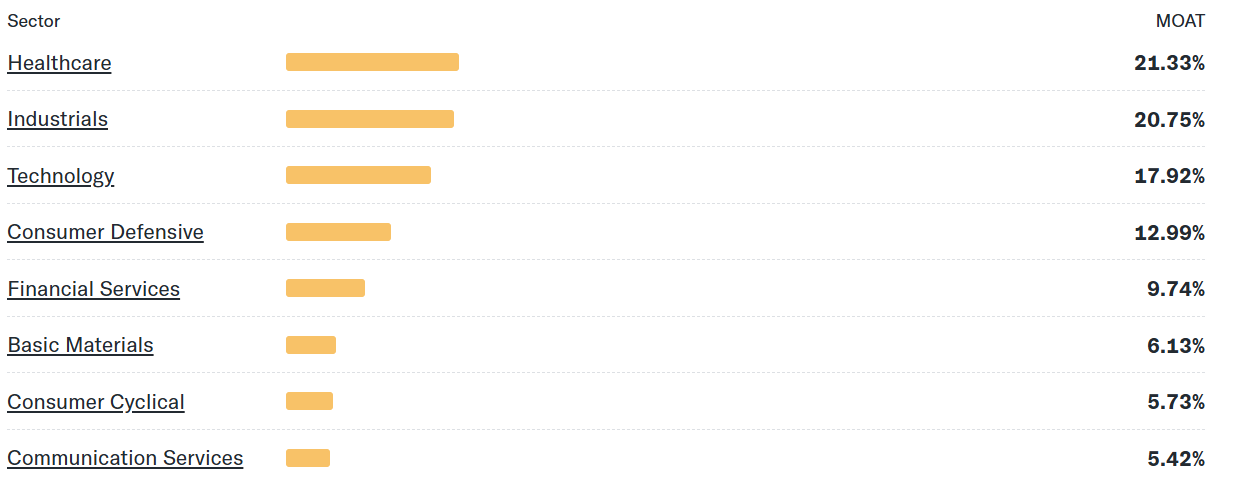

Sector Allocation

MOAT's sector allocation is diversified across various industries:

Risk Level

MEDIUM-to-HIGH - with a beta of 1.02, indicating that it is slightly more volatile than the overall market. The ETF may be more susceptible to economic downturns than the broader market due to its concentration in high-quality, often higher-priced stocks.

Performance

Since its inception on April 24, 2012, MOAT has delivered an annualized performance of approximately 14.55%.

Expense Ratio

The management expense ratio (MER) for MOAT is 0.47%, which is relatively low compared to other ETFs.

This means that for every $1,000 invested, the annual cost would be $4.70.

Dividend Yield

MOAT has an average dividend yield of 0.75%.

This means that if you invest $1,000 in this ETF, you can expect to receive approximately $7.50 in dividends over a year, assuming the yield remains constant.

Composition Methodology

The VanEck Morningstar Wide Moat ETF (MOAT) selects its stocks based on a systematic and transparent process. This strategy focuses on assembling a portfolio of high-quality, attractively valued companies with the potential for sustained growth.

Moat Rating: Morningstar analysts identify companies with a "wide moat," meaning they have sustainable competitive advantages. These advantages can come from cost advantages, intangible assets, network effects, efficient scale, or switching costs.

Read more on MOATs here:

Fair Value Estimate: Each identified company must have a fair value estimate from Morningstar analysts. This estimate represents the intrinsic value of the company's stock based on its earnings, growth prospects, risk, and overall financial health. It helps determine whether a stock is overvalued, undervalued, or fairly valued compared to its current market price.

Market Capitalization: Companies with the smallest 3% by float-adjusted market capitalization are excluded from consideration to ensure the ETF focuses on more substantial, liquid stocks.

Ranking: The remaining companies are ranked based on their fair value ratios, which compare the stock's market price to its fair value estimate. Companies with the most attractive valuations (i.e., those trading below their fair value) are prioritized.

Selection: The top companies are selected to be included in the ETF, with the portfolio typically consisting of up to 40 stocks.

Equal Weighting: Within each sub-portfolio, stocks are equally weighted to ensure diversification.

Rebalancing: The ETF undergoes a semiannual rebalancing, with one sub-portfolio adjusted in December and the other in June, to maintain alignment with its index criteria.

Similar Alternatives

Here are some similar alternatives to the VanEck Morningstar Wide Moat ETF (MOAT):

Invesco S&P 500 Quality ETF (SPHQ): This ETF focuses on high-quality companies with strong fundamentals and competitive advantages. It tracks the S&P 500 Quality Index and has a MER of 0.15% and an average dividend yield of 1.50%.

iShares MSCI USA Quality Factor ETF (QUAL): QUAL targets companies with high return on equity, low financial leverage, and low volatility. It tracks the MSCI USA Quality Factor Index and has a MER of 0.15% and an average dividend yield of 1.60%.

SPDR S&P Dividend ETF (SDY): SDY focuses on high-dividend-yielding companies within the S&P 500. It tracks the S&P High Yield Dividend Aristocrats Index and has a MER of 0.15% and an average dividend yield of 2.90%.

Schwab U.S. Dividend Equity ETF (SCHD): SCHD invests in high-dividend-yielding U.S. companies with a history of consistent dividend payments. It tracks the Dow Jones U.S. Dividend 100 Index and has a MER of 0.06% and an average dividend yield of 3.50%.

Vanguard Dividend Appreciation ETF (VIG): VIG focuses on companies with a history of increasing dividends. It tracks the Nasdaq U.S. Dividend Achievers Select Index and has a MER of 0.10% and an average dividend yield of 1.90%.

This is a comparison of the MOAT ETF and similar alternatives, focusing on their Management Expense Ratios (MER), yields, and annualized performances.

Target Investors

The VanEck Morningstar Wide Moat ETF (MOAT) targets investors who are looking for exposure to companies with sustainable competitive advantages. This ETF is suitable for:

Long-Term Investors: Those who seek steady growth over time by investing in companies with strong, durable competitive edges.

Growth-Oriented Investors: Investors aiming for capital appreciation through companies that have the potential to outperform the broader market.

Diversified Portfolios: Investors looking to diversify their portfolios with high-quality, wide-moat companies across various sectors.

Income Seekers: While MOAT has a lower dividend yield compared to some other ETFs, it still provides a steady income stream through dividends.

Cost-Conscious Investors: Those who prefer a relatively low expense ratio compared to actively managed funds.

Understanding of "moat investing": Investors should have a basic understanding of the concept of "economic moats" and how they contribute to a company's long-term success.

Reason to Invest…

Quality Companies: MOAT invests in companies with strong competitive advantages, or "wide moats," identified by Morningstar analysts. This focus can lead to investments in high-quality, durable companies.

Potential for Outperformance: Companies with sustainable competitive advantages have the potential to outperform the broader market over the long term, offering the possibility of superior returns.

Diversification: MOAT provides diversified exposure across various sectors, reducing the risk associated with investing in a single sector or industry.

Transparent Selection Process: The ETF follows a clear and transparent selection process based on Morningstar's research, which can provide peace of mind to investors.

Regular Rebalancing: MOAT is rebalanced semiannually, ensuring that it remains aligned with the index and reflective of the latest market conditions.

Dividend Income: Though MOAT's dividend yield is modest, it still provides a steady income stream for income-seeking investors.

Moderate Expense Ratio: With an MER of 0.47%, MOAT is relatively cost-effective compared to other actively managed funds.

Reason Not to Invest…

Higher Volatility: The ETF can be more volatile compared to broader market indices, given its focus on a relatively smaller number of stocks.

Concentration Risk: MOAT's focus on companies with wide moats can lead to sector concentration, increasing the risk if those sectors underperform.

Performance Dependency: The ETF's performance is highly dependent on the accuracy of Morningstar's moat ratings and fair value estimates, which may not always be accurate.

Lower Dividend Yield: Compared to other ETFs focused on dividend income, MOAT's yield is relatively low, which might not be attractive to income-focused investors.

Potential Overlap: If you already have exposure to high-quality companies through other investments, adding MOAT might result in overlapping holdings.

Market Risk: Like all equity investments, MOAT is subject to market risk, and its value can fluctuate based on market conditions.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.

Very interesting. I’m a huge fan of Morningstar. Love their fair value estimates and reports.