Navigating the Canadian Savings Landscape: TFSA, RRSP, and FHSA

A short synopsis of three different savings vehicles in Canada.

In the realm of personal finance, Canadians are presented with a variety of savings vehicles, each with its own set of rules and tax implications. Understanding the differences between a Tax-Free Savings Account (TFSA), a Registered Retirement Savings Plan (RRSP), and the newly introduced First Home Savings Account (FHSA) is crucial for making informed decisions that align with individual financial goals. Below is an in-depth comparison of these accounts.

TFSA

Purpose - General savings, flexible withdrawals. Introduced in 2009, the TFSA allows individuals to earn tax-free investment income.

Eligibility - 18+.

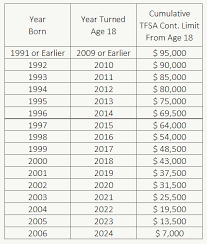

Contribution Room - Annual limit set by government, cumulative over years. Contributions are made with after-tax dollars.

Tax Deductibility - Contributions are not tax-deductible.

Tax on Withdrawals - Withdrawals are tax-free, meaning no tax is levied on withdrawals or investment growth.

Carry Forward Room - Yes, indefinitely.

Investment Growth - Tax-free.

Over-Contribution Penalty - 1% per month on excess amount.

Withdrawal Flexibility - Can withdraw any amount at any time, re-contribute withdrawn amounts. However, re-contributing in the same year may result in over-contribution and penalties.

FHSA

Purpose - Launched in 2023, the FHSA is a hybrid between a TFSA and an RRSP, aimed at helping first-time home buyers. This is defined as not having owned a home in the current or preceding four calendar years.

Eligibility - 18+ first-time home buyers, up to age 71.

Contribution Room - $8,000 annual, $40,000 lifetime.

Tax Deductibility - Contributions are tax-deductible.

Tax on Withdrawals - Withdrawals for qualifying home purchase are tax-free.

Carry Forward Room - Yes, up to a maximum of $8,000.

Investment Growth - Tax-free.

Over-Contribution Penalty - 1% per month on excess amount.

Withdrawal Flexibility - Restricted to first home purchase, non-replenishable contribution room after withdrawal. Any unused funds must be transferred to an RRSP or withdrawn subject to tax implications.

RRSP

Purpose - Retirement savings. Enables withdrawal of funds during years of lower income to benefit from a lower marginal tax rate.

Eligibility - 18+ with earned income, up to age 71.

Contribution Room - 18% of previous year's earned income up to a maximum limit set by the Canada Revenue Agency (CRA), cumulative over years.

Tax Deductibility - Contributions are tax-deductible meaning they reduce taxable income dollar-for-dollar, providing immediate tax relief.

Tax on Withdrawals - Taxed as income at withdrawal at the individual's marginal tax rate.

Carry Forward Room - Yes, until age 71.

Investment Growth - Tax-deferred.

Over-Contribution Penalty - 1% per month on excess amount.

Withdrawal Flexibility - Withdrawals are taxed as income, and early withdrawals can have adverse tax implications and potential loss of contribution room.

Which One is More Beneficial?

The benefits of each account depend on individual circumstances:

TFSA: Ideal for flexible savings for both short-term and long-term goals due to its liquidity and tax-free growth.

FHSA: Tailored for prospective homeowners, combining the benefits of tax-deductible contributions and tax-free withdrawals for home purchases.

RRSP: Best suited for long-term retirement savings, offering immediate tax deductions and deferred tax on investment growth. It is advantageous for individuals in higher tax brackets who anticipate retiring in a lower tax bracket.

Calculated Examples

TFSA

Initial Investment: $5,500

Annual Contribution: $5,500

Investment Period: 20 years

Annual Growth Rate: 5%

Using these parameters, the future value of the TFSA is calculated to grow to $181,863, with all earnings being tax-free.

FHSA

Annual Contribution: $8,000

Investment Period: 5 years

Annual Growth Rate: 5%

Using these parameters, the FHSA would grow to $44,208, which can be used tax-free towards the purchase of a first home.

RRSP

Annual Income: $70,000

Contribution: 18% of income or annual limit set by the CRA (assume 18% in this example, therefore, an annual contribution of $12,600)

Investment Period: 20 years

Annual Growth Rate: 5%

Using these parameters, the future value of the RRSP is calculated to grow to $416,632.

Upon withdrawal in retirement, the individual will be taxed at their marginal rate.

Conclusion

In conclusion, each savings account serves a unique purpose and offers distinct advantages. The TFSA offers flexibility and tax-free growth, the RRSP facilitates retirement savings with upfront tax benefits, and the FHSA provides support for first-time home buyers with its tax advantages. Canadians should consider their financial objectives, tax situation, and investment horizon when choosing between these options.

Ultimately, a combination of these accounts may be employed to diversify savings strategies and maximize financial benefits. Consulting with a financial advisor can provide personalized guidance tailored to one's unique financial situation.

In conclusion, the TFSA, RRSP, and FHSA each play a distinct role in the financial planning toolkit. By understanding their differences and leveraging their advantages, Canadians can effectively navigate their savings journey towards achieving their financial aspirations.