For individuals seeking to learn about analyzing Exchange-Traded Funds (ETFs), I suggest reviewing my earlier post that explains the fundamentals of ETFs and the analysis process.

Invesco NASDAQ 100 Index ETF (QQC) - Snapshot

Overview

The Invesco NASDAQ 100 Index ETF (QQC) aims to provide investors with exposure to a diversified portfolio of high-quality stocks, primarily focusing on companies listed on the Nasdaq-100 Index.

Investment Strategy

The ETF seeks capital appreciation by investing at least 80% of its net assets in equity securities, primarily through ETFs that track the Nasdaq-100 Index. It may also use derivatives and structured products to enhance returns.

The Nasdaq-100 Index is a stock market index comprising 100 of the largest non-financial companies listed on the Nasdaq stock exchange. It operates as a modified capitalization-weighted index, which means companies with larger market capitalizations significantly influence the index's performance. This index encompasses a wide range of industries, including technology, healthcare, and consumer goods, but it does not include financial corporations such as banks and insurance companies.

Top Holdings

The top holdings include major companies like Apple Inc. (AAPL), Microsoft Corp (MSFT), Amazon.com Inc (AMZN), Alphabet Inc (GOOGL), and Tesla Inc (TSLA).

Sector Allocation

The ETF is heavily weighted towards the Information Technology sector and Telecommunication Services.

Risk Level

MEDIUM - primarily due to the high concentration in technology and consumer discretionary sectors, which can be more volatile and sensitive to market changes.

Performance

Over the past year, the QQC ETF has had a total return of 36.08%. Since its inception, the average annual return has been 16.49%, including dividends.

Expense Ratio

The expense ratio for the QQC ETF is 0.20%, making it a cost-effective option compared to the broader market.

This means that for every $1,000 invested, the annual cost would be $2.

Dividend Yield

The ETF has an annual dividend yield of 0.53%, with dividends paid quarterly.

This means that if you invest $1,000 in this ETF, you can expect to receive approximately $5 in dividends over a year, assuming the yield remains constant.

Similar Alternatives

Here are some alternatives to the Invesco NASDAQ 100 Index ETF (QQC):

iShares NASDAQ 100 Hedged to CAD ETF (XQQ): This ETF provides exposure to the Nasdaq-100 Index with currency hedging to mitigate the impact of currency fluctuations.

BMO NASDAQ 100 Equity Index ETF (CAD-Hedged) (ZQQ): Another currency-hedged option that tracks the performance of the Nasdaq-100 Index.

Invesco NASDAQ 100 Index ETF (QQC.F): Similar to QQC but traded on a different exchange.

Vanguard S&P 500 ETF (VOO): While not identical, it offers exposure to large-cap U.S. stocks and can be a good alternative for broad market exposure.

QQC serves as the Canadian equivalent to the American QQQ.

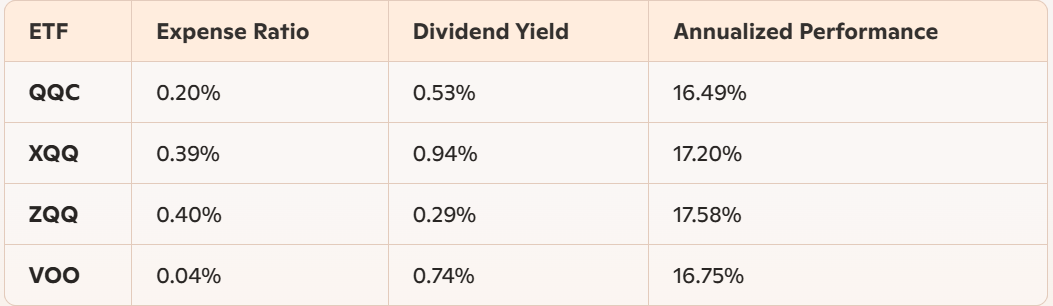

Here's a comparison of the expense ratios, yield, and performance of the QQC ETF and its close alternatives:

Target Investors

The Invesco NASDAQ 100 Index ETF (QQC) is designed for investors who:

Seek long-term capital growth: Those looking to grow their investment over an extended period.

Want exposure to U.S. equities: Investors aiming to diversify their portfolio with U.S.-based companies.

Plan to diversify their holdings: Individuals who own or plan to own other types of investments and want to add U.S. equities to their mix.

Are comfortable with medium to high risk: Investors who are willing to take on a moderate to high level of risk for potentially higher returns.

Note: The value of QQC changes with the CAD-USD exchange rate. If the Canadian dollar rises or falls against the US dollar, QQC’s trading price will reflect this change. In contrast, QQC.F, XQQ, and ZQQ use a hedging strategy to minimize currency exposure, ensuring their performance closely matches the actual performance of the US securities they hold.

Reason to Invest…

Exposure to Leading Companies: QQC provides access to the 100 largest non-financial companies listed on the Nasdaq, including tech giants like Apple, Microsoft, and Amazon.

Strong Performance: Historically, QQC has shown strong performance, with an average annual return above the norm.

Specific Diversification: It offers diversification across various sectors, primarily technology and telecommunications.

Low Expense Ratio: With an expense ratio of 0.20%, it is cost-effective compared to many actively managed funds.

Currency Hedging: QQC.F, XQQ, and ZQQ are CAD-hedged, which helps mitigate the impact of currency fluctuations on returns.

Reason Not to Invest…

Volatility: The ETF is heavily weighted towards the technology sector, which can be more volatile than other sectors.

Market Risk: As an equity-based ETF, it is subject to market fluctuations and can be affected by economic downturns.

Interest Rate Sensitivity: High-growth stocks can be sensitive to interest rate changes, which may impact their performance.

Nasdaq-Only Focus: The ETF focuses solely on Nasdaq-listed companies, excluding successful tech companies listed on other exchanges.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.