For individuals seeking to learn about analyzing Exchange-Traded Funds (ETFs), I suggest reviewing my earlier post that explains the fundamentals of ETFs and the analysis process.

Schwab U.S. Large-Cap Growth ETF (SCHG) - Snapshot

Overview

The Schwab U.S. Large-Cap Growth ETF (SCHG) is an exchange-traded fund that aims to track the performance of the Dow Jones U.S. Large-Cap Growth Total Stock Market Index. It was launched on December 11, 2009, and is managed by Charles Schwab Investment Management.

The Dow Jones U.S. Large-Cap Growth Total Stock Market Index is a stock market index that measures the performance of large-cap U.S. equity securities classified as "growth" based on a multi-factor analysis.

Investment Strategy

SCHG seeks to replicate the performance of the Dow Jones U.S. Large-Cap Growth Total Stock Market Index by investing in large-cap U.S. equities that exhibit growth characteristics. The fund uses a passive management approach, meaning it aims to mirror the index's performance rather than actively selecting stocks.

Top Holdings

As of the latest data, the top holdings of SCHG include:

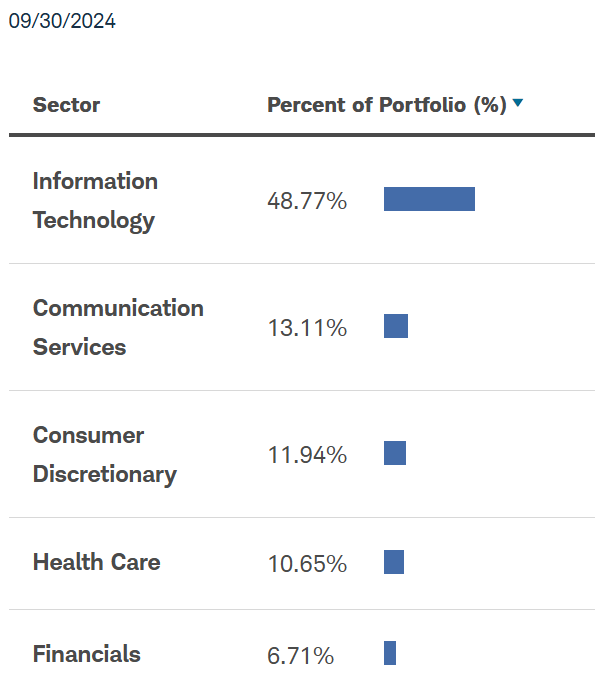

Sector Allocation

SCHG is heavily weighted towards the technology sector, which makes up approximately 50% of the portfolio:

Risk Level

MEDIUM-to-HIGH - SCHG has a beta of around 1.00 compared to its benchmark, indicating that it has a similar risk level to the overall market. As a growth-focused ETF, SCHG is generally considered to have higher volatility than ETFs that invest in value stocks or broader market indices.

Performance

Since its inception, SCHG has delivered an annualized performance of approximately 17%.

Expense Ratio

The management expense ratio (MER) for SCHG is 0.04%, making it a low-cost option for investors.

This means that for every $1,000 invested, the annual cost would be $0.40.

Dividend Yield

SCHG has an average dividend yield of 0.40%.

This means that if you invest $1,000 in this ETF, you can expect to receive approximately $4 in dividends over a year, assuming the yield remains constant.

Similar Alternatives

Here are some alternatives to the Schwab U.S. Large-Cap Growth ETF (SCHG):

Invesco S&P 500 Pure Growth ETF (RPG): Tracks the S&P 500 Pure Growth Index, focusing on growth stocks within the S&P 500.

Invesco S&P 500 GARP ETF (SPGP): Focuses on growth at a reasonable price (GARP) stocks within the S&P 500.

Nuveen ESG Large-Cap Growth ETF (NULG): Emphasizes large-cap growth stocks with a focus on environmental, social, and governance (ESG) criteria.

Invesco Dynamic Large Cap Growth ETF (PWB): Uses a rules-based strategy to select large-cap growth stocks based on various growth factors.

First Trust Large Cap Growth AlphaDEX Fund (FTC): Utilizes the AlphaDEX® Index to select large-cap growth stocks based on growth characteristics and value factors.

SoFi Next 500 ETF (SFYX): Focuses on the next 500 largest companies in the U.S. market after the S&P 500, providing exposure to mid-cap growth stocks.

Each of these ETFs offers a slightly different approach to capturing large-cap growth stocks, so you can choose one that best aligns with your investment goals and preferences.

This is a comparison of the SCHG ETF and similar alternatives, focusing on their Management Expense Ratios (MER), yields, and annualized performances.

Target Investors

The Schwab U.S. Large-Cap Growth ETF (SCHG) is designed for investors seeking exposure to large-cap U.S. growth stocks. It's particularly suitable for:

Long-term investors: Those looking to invest for the long haul and benefit from the growth potential of large-cap companies.

Growth-oriented investors: Investors who prefer stocks with strong growth potential rather than value stocks.

Diversified portfolio builders: Investors aiming to diversify their portfolios with a focus on large-cap growth stocks.

Cost-conscious investors: Due to its low expense ratio, SCHG is an attractive option for those looking to minimize investment costs.

Reason to Invest…

Strong Performance: SCHG has delivered impressive returns over various time frames.

Diversification: SCHG provides exposure to a basket of 227 large-cap growth companies, including top performers like Apple, Microsoft, and Nvidia.

Low Fees: With an expense ratio of just 0.04%, SCHG is one of the most cost-effective options in its category.

Top Holdings: The ETF includes many of the market's most dominant and innovative companies, which are expected to grow significantly over the long term.

Sector Exposure: SCHG has a significant allocation to the Information Technology sector, which has been a strong performer in recent years.

Potential for High Growth: Large-cap growth companies often have strong business models, innovative products, and significant market share, leading to potential high growth over time.

Reason Not to Invest…

Market Volatility: Growth stocks, in general, tend to be more volatile than value stocks. SCHG is no exception, and its performance can be more susceptible to market fluctuations.

High Valuations: Growth stocks often come with higher valuations, which can lead to lower potential returns if the market corrects or if the companies do not meet growth expectations.

Concentration Risk: While SCHG is diversified within the large-cap growth segment, it still has a significant concentration in top holdings like Apple and Microsoft, which can impact performance if these companies underperform.

Interest Rate Sensitivity: Growth stocks can be sensitive to changes in interest rates. Rising interest rates can negatively impact their performance as investors may shift to more stable, income-generating investments.

Sector Concentration: The heavy allocation to the Information Technology sector means that SCHG is more exposed to the risks associated with this sector, such as regulatory changes or shifts in consumer preferences.

Dividend Yield: Compared to value stocks, growth stocks typically have lower dividend yields, which may not be suitable for income-focused investors.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.