Share Buybacks: An Overview

A share buyback, also referred to as a stock buyback or share repurchase, is when a company chooses to reacquire its own shares that were previously issued, either directly from the open market or through a tender offer. Here's what you should understand:

Purpose of Buybacks:

Reducing Share Count: Companies buy back shares to reduce the number of shares available on the open market. These repurchased shares are typically canceled, effectively reducing the total outstanding shares.

Value Enhancement: Buybacks can increase the value of remaining shares by reducing supply. When executed strategically, this can positively impact the stock price.

Control and Compensation: Companies may also buy back shares to prevent other shareholders from gaining a controlling stake or to issue them as compensation to employees and management.

Advantages of Share Buybacks:

Earnings Per Share (EPS) Boost: By reducing the number of shares outstanding, buybacks inflate EPS. This can make the company’s stock more attractive to investors.

Refer to example in the next section.

Tax Efficiency: Buybacks are more tax-efficient than dividends because they are taxed only once, unlike dividends, which are taxed twice.

Optimism Signal: A buyback demonstrates management’s confidence in the company’s future prospects.

Drawbacks of Share Buybacks:

Value Destruction: If shares are repurchased at an inflated price, it can destroy value for shareholders.

Missed Investment Opportunities: Companies may miss out on growth opportunities if they allocate excess capital to buybacks instead of investments.

Market Perception: The market’s perception of the buyback can impact stock price. If viewed as a last resort, it may have a negative effect.

Debt-Fueled Buybacks: Companies may finance buybacks through debt, which can enhance earnings per share (EPS) and stock prices temporarily. However, excessive borrowing can deteriorate a company's financial stability and resilience.

Hypothetical Scenario

Consider Apple Inc. (AAPL) as an example. Let's say Apple declares a share buyback initiative to repurchase 10% of its outstanding shares at the prevailing market rate. Prior to the buyback, Apple reported $1 million in earnings with 1 million shares outstanding, which equates to an Earnings Per Share (EPS) of $1. With a share price of $20, this translates to a Price-to-Earnings (P/E) ratio of 20.

Pre-Buyback:

Net Income: $1 million

Outstanding Shares: 1 million

Diluted EPS: $1.00

Post-Buyback:

Apple repurchases 100,000 shares (10% of outstanding shares).

Diluted EPS post-buyback:

The buyback increases EPS, potentially benefiting the stock price if the valuation multiple remains the same.

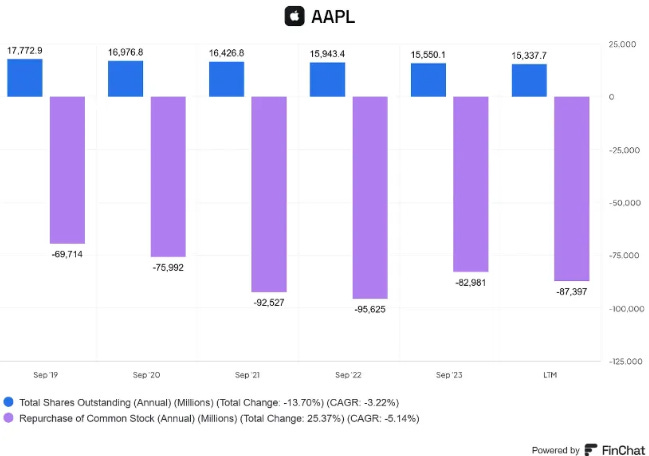

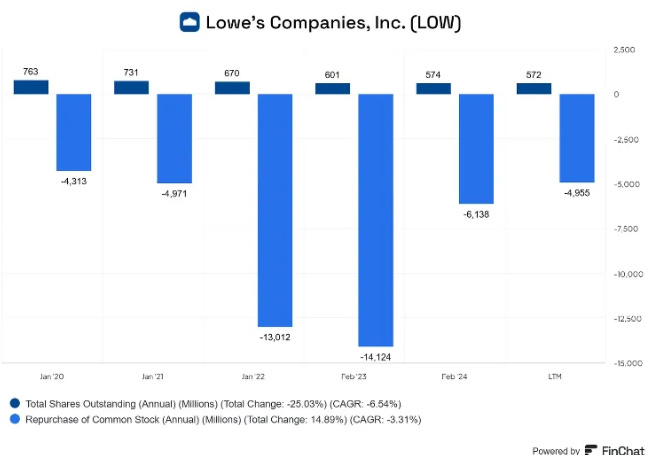

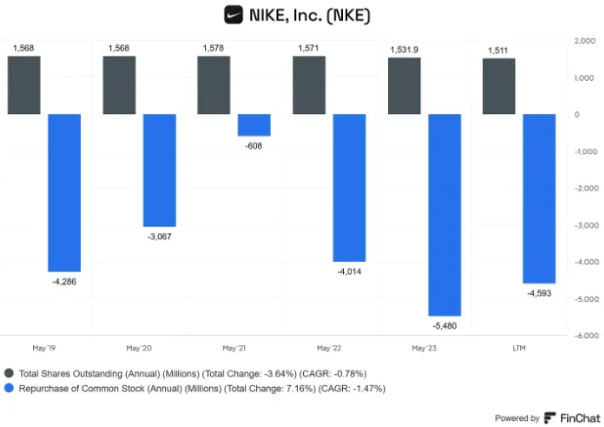

Quality Companies with Recent Share Buybacks

Here are some notable companies that have engaged in share buybacks (the top bars represent outstanding shares, while the bottom bars represent the repurchase of common stock, both in millions). I would also encourage you to track the stock price over the years and see if there is any correlation.

Conclusion

It's important to remember that although share buybacks can be advantageous, companies need to find a balance between returning capital to shareholders and investing in growth opportunities. One should always take into account the broader context when assessing a company's buyback strategy.