Tariffs - Will They Matter?

Understanding tariffs and offering a distinct perspective on their significance once all is said and done.

What Are Tariffs?

Definition: A tariff is a tax imposed by a government on goods and services imported from other countries.

Purpose: Tariffs are used to restrict imports by increasing the price of goods and services purchased from overseas, making them less attractive to consumers compared to domestic products.

Reasons for Imposing Tariffs

Protecting Domestic Industries: By making imported goods more expensive, tariffs can help protect local industries from foreign competition.

Revenue Generation: Tariffs can be a significant source of revenue for governments.

Retaliation: Countries may impose tariffs in response to trade barriers set by other countries.

Political Reasons: Sometimes tariffs are used to exert political pressure on other countries.

Effects of Tariffs

On Consumers: Higher prices for imported goods can lead to increased costs for consumers.

On Domestic Producers: Domestic industries may benefit from reduced competition, potentially leading to increased production and employment.

On International Trade: Tariffs can lead to trade wars, where countries continuously impose tariffs on each other, potentially harming global trade relations.

On the Economy: While tariffs can protect certain industries, they can also lead to inefficiencies and higher prices overall.

The primary purpose of implementing tariffs today is to bolster a nation's economy by preventing competing countries from gaining an upper hand. Tariffs serve as a strategic tool in negotiations, allowing a country to fortify its stance in the global market towards a more equitable trade environment. However, for tariffs to be effective, they must be applied judiciously and aimed at the right sectors. A country must assess its own economic strengths and vulnerabilities before engaging in such strategies.

President Donald J. Trump has proposed a 10% tariff on all imports. In fact, he has recently stated he would impose 25% tariffs on Canada and Mexico if they don’t secure their border (as a Canadian, I’m a bit flabbergasted). He stated that "tariffs" are the best word in the world. However, it is improbable that this will pertain to all imports. Rather, his intention is to utilize tariffs to the advantage of American citizens. They serve as a bargaining chip, a negotiation strategy. He recognizes that imposing unjustified tariffs would inflict unnecessary damage upon his own nation.

Examining the manufacturing statistics from before and during his first term, excluding the pandemic year of 2020, reveals that he was on track to surpass his previous administration's performance (+0.81%) on a normalized basis. While mainstream media reports the loss of manufacturing jobs as fact, they often omit the global shutdown caused by the pandemic. By projecting the average growth from the first three years of his presidency (2017-2019 pre-pandemic) onto 2020, it is estimated that the annualized growth over his four-year term would approximate +1.32%.

On a normalized basis, the current administration's performance was dismal. They boast of manufacturing job growth, which is accurate, but only when taking into account the pandemic year's lows. If that year were to be normalized as in the previous analysis, their net job growth would actually be negative, at -0.26%.

And all the fear of inflation? There was actually little to no inflation under Trump’s first term.

Here are the annual inflation rates for the USA from 2012 to 2024:

2012: 2.1%

2013: 1.5%

2014: 1.6%

2015: 0.1%

2016: 1.3%

2017: 2.1%

2018: 2.4%

2019: 1.8%

2020: 1.2%

2021: 4.7%

2022: 8.0%

2023: 4.1%

2024: 2.4% (as of September)

Compared to the previous administration (Obama 2013-2016), there was hardly any noticeable impact. The balance was achieved by integrating policies such as tax reductions, deregulation, and infrastructure investments. It's also argued that the Federal Reserve played a role in moderating some of the 'expected' inflation by increasing interest rates. However, they soon had to reverse course and lower them as the ‘expected’ inflation began to subside. Interpret this as you will. Currently, interest rates are significantly higher than they were previously, suggesting that if experts believe tariffs will harm the American economy, there is ample scope to reduce the rates more aggressively. Ultimately, none of these factors matter.

During Trump's first term, several companies listed on the stock market are claimed to have been significantly affected by his first go-around at tariffs. Here are some examples and their suggested impacts, including the change in share price right up until the pandemic hit:

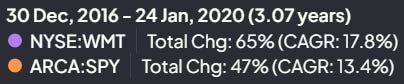

Walmart (WMT):

Impact: Negative

Explanation: Walmart faced increased costs due to tariffs on imported goods, which led to higher prices for consumers. The company expressed concerns about the impact of tariffs on their supply chain and overall costs.

Stock Return: Increase of 65% beating the S&P 500.

Lowe's (LOW):

Impact: Negative

Explanation: Lowe's reported that nearly 40% of its cost of goods sold were sourced outside the U.S. Tariffs increased product costs, which were passed on to consumers, affecting sales and profitability.

Stock Return: Increase of 69% beating the S&P 500.

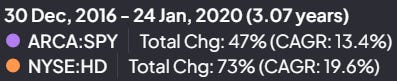

Home Depot (HD):

Impact: Negative

Explanation: Similar to Lowe's, Home Depot faced higher costs for imported goods due to tariffs. This led to increased prices for consumers and potential impacts on sales.

Stock Return: Increase of 73% beating the S&P 500.

Stanley Black & Decker (SWK):

Impact: Negative

Explanation: The company reported that tariffs were costing them nearly $100 million annually. This significantly impacted their profitability and led to increased prices for their products.

Stock Return: Increase of 45% almost matching the S&P 500.

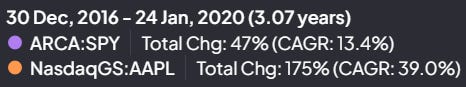

Apple (AAPL):

Impact: Mixed

Explanation: Apple faced higher costs for components imported from China. However, the company managed to secure some exemptions from tariffs, which mitigated the overall impact. Still, the uncertainty around tariffs affected their supply chain and pricing strategies.

Stock Return: Increase of 175% crushing the S&P 500.

Nvidia (NVDA):

Impact: Negative

Explanation: This tech company faced increased costs for components sourced from China. The tariffs disrupted its supply chains and led to higher prices for their products.

Stock Return: Increase of 135% crushing the S&P 500.

Tapestry (TPR):

Impact: Negative

Explanation: As a luxury goods company, Tapestry faced reduced demand due to higher prices resulting from tariffs. Consumers were less willing to spend on luxury items when prices increased.

Stock Return: At last, one company whose growth was stunted. Decrease of 22%.

The morale of the story - tariffs did not harm the majority of the population. While certain companies may have suffered, the stock market, which is the ultimate indicator for the US economy, remained unaffected. Again, the tariffs won’t matter.

How about unemployment figures? Here's a snapshot of the U.S. unemployment rate (%) from 2012 to 2024:

2012 8.07

2013 7.38

2014 6.17

2015 5.28

2016 4.87

2017 4.36

2018 3.90

2019 3.67

2020 8.06

2021 5.35

2022 3.65

2023 3.63

2024 3.63

Indeed, during Trump's presidency, there was a significant decrease in the rate until the onset of the pandemic. Did tariffs matter in the end? Absolutely not.

Did you know?

President Biden has retained many of the tariffs implemented during the Trump administration. Indeed, he has escalated tariffs on specific products, including Chinese electric vehicles and solar panels. These tariffs are sustained by the Biden administration as a component of a comprehensive strategy to shield American workers and industries from inequitable trade practices.

Why do I say tariffs will not matter?

Tariffs will not be significant unless the U.S. government manages to cut spending, generate surpluses instead of deficits, and yet maintain a robust economy.

This seems quite improbable, or rather unrealistic.

The reality is that since the Great Financial Crisis of 2008, the stock market and the economy have been driven by the money supply, meaning a substantial amount of debt. The stock market and the economy generally move in tandem with the global money supply; if it increases, the market rises, and if it decreases, the market falls.

This can only lead to one thing - a bubble burst like no other. And the more it keeps growing, the worse it will be.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!

Please refer to the details of the referral program below.

Invite your friends to read DiviStock Chronicles

Thank you for reading DiviStock Chronicles — your support allows me to keep doing this work. Join our referral program!

Excellent article. Thank you.