The Chowder Rule

Simplify Dividend Stock Investing: A Practical Formula for Maximizing Returns

What is it?

The Chowder Rule is a simple formula for identifying high-quality dividend growth stocks by combining current yield and growth potential. The rule sets specific thresholds for this number depending on the stock’s yield and sector, aiming to identify companies that can deliver a blend of income and growth over time.

Formula

The Chowder Number is calculated as:

Chowder Number = Current Dividend Yield + 5-Year Dividend Growth Rate

The thresholds are:

For stocks with a dividend yield of 3% or higher, the Chowder Number should be 12 or more.

For stocks with a dividend yield below 3%, the Chowder Number should be 15 or more.

For utilities (and sometimes other high-yield, slower-growth sectors like REITs), the target is 8 or more, reflecting their stability and typically lower growth rates.

This approach serves as a final valuation check rather than a screening tool. The premise is that the combination of dividend yield and growth approximates a stock’s potential total return—dividend income plus growth—while incorporating a margin of safety. For instance, a stock with a 3% yield and a 9% dividend growth rate results in a Chowder Number of 12, indicating a potential 12% annual return if growth persists. However, external factors, such as valuation changes, can influence the actual outcome. Even with performance challenges, factoring in a margin of safety can still achieve a respectable long-term return of around 8% on this stock.

Illustration

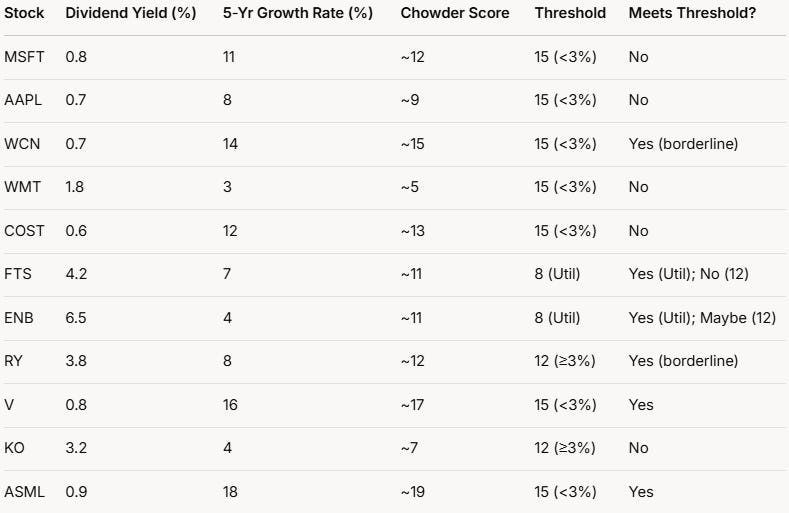

Here are some well-known stocks and their chowder score as of recent data:

Some observations include:

Visa’s (V) exceptional growth pushes it well above the low-yield threshold.

Coca-Cola’s (KO) high yield doesn’t offset its modest growth under this rule.

Costco’s (COST) growth is solid, but its low yield keeps it below the 15 mark.

ASML’s high growth rate makes it a strong performer despite a low yield.

Keep in mind, this score represents a snapshot in time and fluctuates with any changes in its underlying inputs—the dividend yield and the 5-year growth rate.

What Causes the Chowder Number to Increase?

Since the Chowder Number is the sum of two components—dividend yield and the five-year dividend growth rate—any increase in either (or both) will cause it to rise:

Increase in Dividend Yield:

Stock Price Decreases: Dividend yield is calculated as (Annual Dividend per Share ÷ Stock Price) × 100. If the stock price drops while the dividend stays the same or increases, the yield rises. For example, if a stock pays $2 annually and its price falls from $100 to $80, the yield increases from 2% to 2.5%.

Dividend Increases: If the company raises its dividend payout without a proportional increase in stock price, the yield goes up. For instance, if the dividend rises from $2 to $2.50 while the stock price remains $100, the yield increases from 2% to 2.5%.

Increase in 5-Year Dividend Growth Rate:

Faster Dividend Growth: This is the compound annual growth rate (CAGR) of the dividend over the past five years. If a company accelerates its dividend increases, the growth rate rises. For example, if a company’s dividend grows from $1 to $1.50 over five years (about 8.4% CAGR) and then ramps up to $2 (14.9% CAGR), the growth rate component jumps significantly.

Recent Large Dividend Hikes: Since the five-year CAGR is backward-looking, a substantial dividend increase in the most recent year can boost the average growth rate, especially if earlier years had smaller increases.

What Causes the Chowder Number to Decrease?

Conversely, a decline in either component will lower the Chowder Number:

Decrease in Dividend Yield:

Stock Price Increases: If the stock price rises while the dividend remains unchanged, the yield drops. For example, if a $2 dividend stock’s price goes from $100 to $120, the yield falls from 2% to 1.67%.

Dividend Cuts or Stagnation: If the company reduces its dividend or keeps it flat while the stock price holds or rises, the yield decreases. A cut from $2 to $1.50 on a $100 stock drops the yield from 2% to 1.5%.

Decrease in 5-Year Dividend Growth Rate:

Slower Dividend Growth: If the company reduces the pace of dividend increases, the five-year CAGR declines. For instance, if growth slows from 10% annually to 5% annually over five years, the growth rate component halves.

Aging Out of High-Growth Years: The five-year CAGR is a rolling average. If a big dividend hike from six years ago drops out of the calculation and is replaced by smaller recent increases, the growth rate falls. For example, if a stock went from $1 to $2 five years ago (14.9% CAGR) but has since flatlined at $2, the CAGR could drop to 0% as that early jump fades.

Final Thoughts for Beginners

The Chowder Rule serves as a practical shortcut for beginners aiming to identify promising dividend stocks. While it’s not a foolproof method, pairing it with essential due diligence—such as ensuring payout ratios remain below a certain threshold and reviewing earnings trends—can enhance its effectiveness. Additionally, diversifying your portfolio across 10–20 stocks help manage risk.

Though not statistically "proven," the rule's emphasis on quality dividend growers aligns with long-term strategies that have historically succeeded in dividend growth investing. Instead of pursuing the highest yields, prioritize stocks that consistently pay and increase dividends. Over time, compounding dividend growth outpaces stagnant high-yield stocks, as larger payouts and value appreciation often accompany dividend growth.

To maximize results, focus on companies with strong competitive advantages, stable cash flows, and a solid history of dividend increases. Start small—perhaps by applying the rule to a watchlist—and refine your approach as you gain experience.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.