For individuals seeking to learn about analyzing Exchange-Traded Funds (ETFs), I suggest reviewing my earlier post that explains the fundamentals of ETFs and the analysis process.

Vanguard Balanced ETF Portfolio (VBAL) - Snapshot

Overview

The Vanguard Balanced ETF Portfolio (VBAL) is an all-in-one ETF that offers a balanced mix of stocks and bonds, designed for investors seeking long-term capital growth and income.

Investment Strategy

VBAL follows a 60% stocks and 40% bonds allocation strategy. This balanced approach aims to provide a mix of growth potential from equities and stability from fixed-income securities. The ETF holds other Vanguard ETFs, which are managed by Vanguard's Equity Index Group and Fixed Income Group.

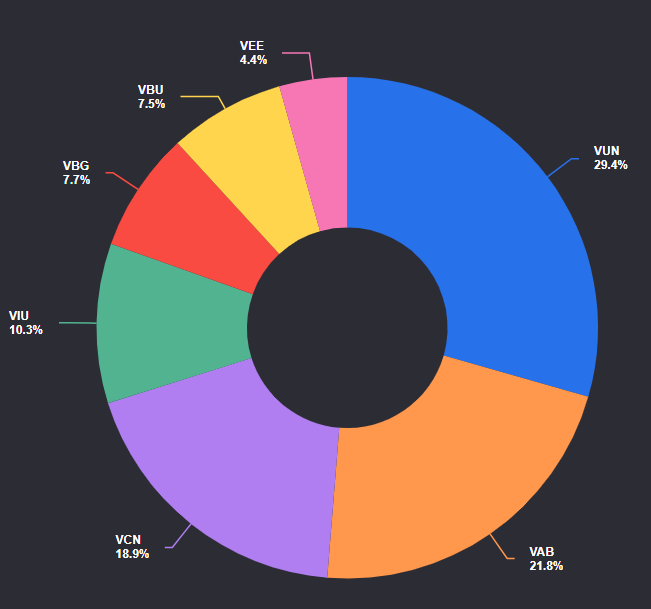

Top Holdings

The top holdings in VBAL include other major index funds such as:

Vanguard US Total Market Index ETF (VUN)

Vanguard Total Bond Market ETF (VAB)

Vanguard FTSE Canada All Cap Index ETF (VCN)

Vanguard FTSE Developed All Cap ex North America Index ETF (VIU)

Vanguard Global ex-US Aggregate Bond ETF (VBG)

Vanguard US Aggregate Bond ETF (VBU)

Vanguard FTSE Emerging Markets All Cap Index ETF (VEE)

The top underlying holdings include famous names such as Apple, Microsoft, NVIDIA, Royal Bank of Canada, Amazon, and so on.

Sector Allocation

VBAL is well-diversified across various sectors, with significant allocations to technology, financials, industrials, and consumer discretionary.

Risk Level

LOW-to-MEDIUM - making it suitable for investors with average risk tolerance. The balanced allocation helps mitigate volatility compared to funds with higher equity weightings.

Performance

Since its inception on January 25, 2018, VBAL has delivered an annualized performance of approximately 6.81%.

Expense Ratio

The management expense ratio (MER) for VBAL is 0.24%, which is relatively low compared to similar funds.

This means that for every $1,000 invested, the annual cost would be $2.40.

Dividend Yield

VBAL has an average dividend yield of 2.26%.

This means that if you invest $1,000 in this ETF, you can expect to receive approximately $22.60 in dividends over a year, assuming the yield remains constant.

Similar Alternatives

Here are some similar alternatives to the Vanguard Balanced ETF Portfolio (VBAL):

iShares Core Balanced ETF Portfolio (XBAL): This ETF also follows a 60% equities and 40% fixed income allocation strategy. It is managed by BlackRock and offers a similar balanced approach to VBAL.

BMO Balanced ETF (ZBAL): Another choice is a 60/40 stock and bond allocation managed by BMO, offering a diversified blend of North American and international equities, as well as domestic and global bonds.

Purpose Core Balanced ETF (PBF): This ETF offers a balanced portfolio with a mix of Canadian and international equities, as well as Canadian bonds.

Horizons Balanced ETF (HAG): This ETF provides exposure to a mix of Canadian and international equities, along with Canadian bonds, following a similar balanced allocation strategy.

Each of these ETFs aims to provide a balanced mix of growth potential and income, suitable for investors with a medium risk tolerance.

Target Investors

The Vanguard Balanced ETF Portfolio (VBAL) is designed for investors seeking a balanced approach to investing. It's particularly suitable for:

Long-term investors: Those looking for steady growth and income over an extended period.

Moderate risk tolerance: Investors who want a mix of growth potential from equities and stability from fixed-income securities.

Hands-off investors: Individuals who prefer a diversified, low-maintenance investment solution.

Retirement savings: Suitable for retirement accounts like RRSPs, RRIFs, and TFSAs.

Non-registered accounts: Investors looking for a balanced portfolio in non-registered accounts.

VBAL aims to provide a simplified, diversified investment option that can help investors achieve their financial goals with moderate risk.

Reason to Invest…

Diversification: VBAL provides a balanced mix of 60% equities and 40% fixed income, offering diversification across different asset classes and regions.

Low Management Fees: With an MER of 0.24%, VBAL is relatively low-cost compared to many mutual funds and actively managed portfolios.

Simplicity: It's a one-ticket solution, meaning you get a diversified portfolio in a single investment, which simplifies portfolio management.

Steady Income: The fixed-income portion provides regular income through dividends and interest payments.

Long-Term Growth: The equity portion offers potential for long-term capital growth.

Professional Management: Managed by Vanguard, a reputable and experienced asset management firm known for its low-cost and high-quality investment products.

Rebalancing: The portfolio is automatically rebalanced to maintain the target asset allocation, ensuring that it stays aligned with your investment goals without requiring your intervention.

Reason Not to Invest…

Lower Returns Compared to Equity-Heavy ETFs: VBAL's balanced approach may result in lower returns compared to more equity-focused ETFs like VGRO or VEQT, especially in strong bull markets.

Interest Rate Sensitivity: The fixed-income portion can be sensitive to interest rate changes, which can negatively impact performance when rates rise.

Not Suitable for Short-Term Goals: If you need the money in the short term, the volatility of the equity portion might not be suitable.

Potential for Underperformance: There's always a risk that VBAL might underperform compared to other investment options, especially if market conditions favor either equities or fixed income disproportionately.

Market Exposure: While the diversification helps mitigate risk, VBAL is still exposed to market fluctuations. Economic downturns can impact both the equity and fixed-income portions of the portfolio.

Currency Risk: The international exposure in VBAL introduces currency risk, which can affect the returns due to fluctuations in exchange rates.

Lower Yield: Compared to more aggressive growth-focused ETFs, VBAL might offer a lower yield, which could be a drawback for income-seeking investors.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.