VIU - ETF Overview

A Comprehensive Guide to the Vanguard FTSE Developed All Cap ex North America Index ETF (VIU)

For individuals seeking to learn about analyzing Exchange-Traded Funds (ETFs), I suggest reviewing my earlier post that explains the fundamentals of ETFs and the analysis process.

Vanguard FTSE Developed All Cap ex North America Index ETF (VIU) - Snapshot

Overview

The Vanguard FTSE Developed All Cap ex North America Index ETF (VIU) is an ETF that provides exposure to a broad range of stocks from developed markets outside North America. It aims to track the performance of the FTSE Developed All Cap ex North America Index.

Investment Strategy

VIU employs a passive investment approach, striving to mirror the performance of the FTSE Developed All Cap ex North America Index. This index encompasses small-, mid-, and large-cap stocks from developed markets beyond North America, offering extensive exposure to international equities.

Top Holdings

The top holdings in VIU include major international players such as:

Novo Nordisk A/S

Nestlé SA

Roche Holding AG

Novartis AG

Toyota Motor Corporation

ASML Holding NV

Sector Allocation

VIU offers a well-rounded diversification across numerous sectors.

Risk Level

MEDIUM - suitable for investors with a moderate risk tolerance. The diversified exposure to international equities helps mitigate some of the risks associated with investing in a single country or sector.

Performance

Since its inception on December 1, 2015, VIU has delivered an annualized performance of approximately 6.30%.

Expense Ratio

The management expense ratio (MER) for VIU is 0.23%, which is relatively low compared to actively managed funds.

This means that for every $1,000 invested, the annual cost would be $2.30.

Dividend Yield

VIU has an average dividend yield of 2.50%, providing a steady income stream to investors.

This means that if you invest $1,000 in this ETF, you can expect to receive approximately $25 in dividends over a year, assuming the yield remains constant.

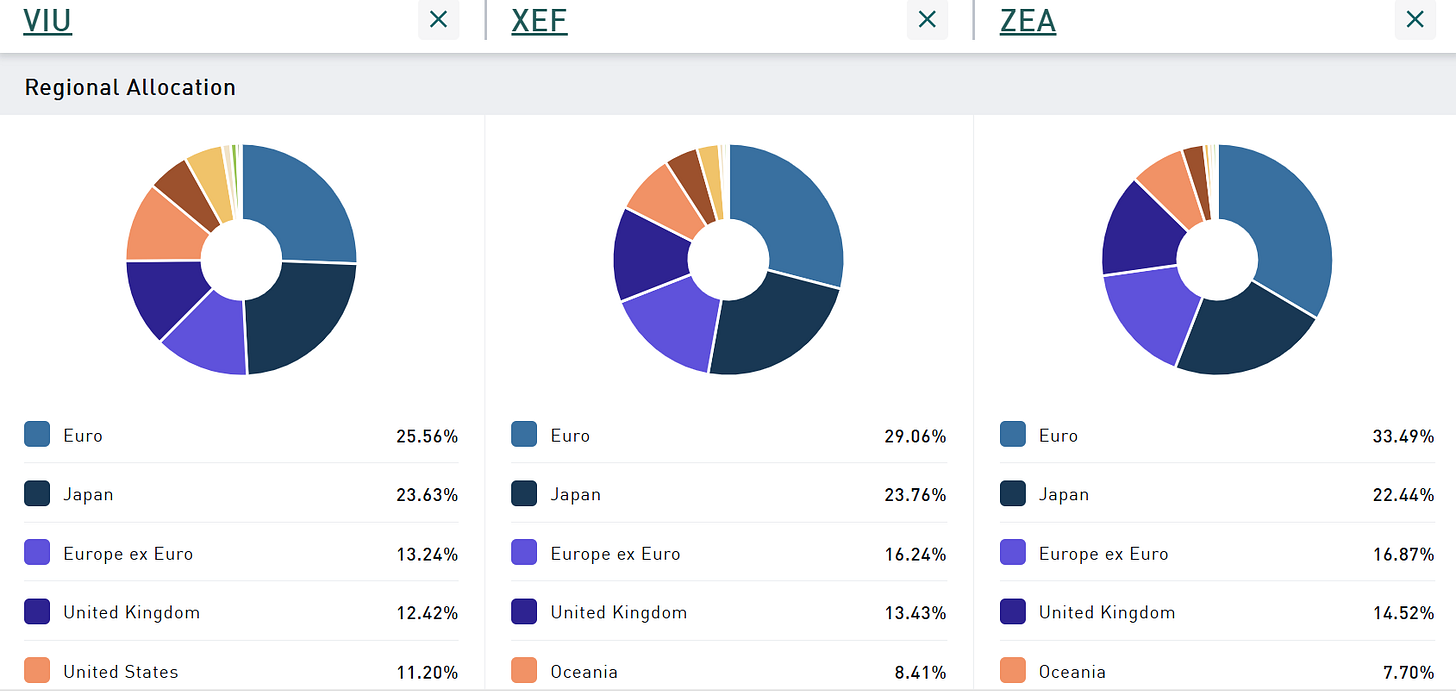

Similar Alternatives

Here are some similar alternatives to the Vanguard FTSE Developed All Cap ex North America Index ETF (VIU):

iShares Core MSCI EAFE IMI Index ETF (XEF): This ETF tracks the MSCI EAFE IMI Index, which includes small-, mid-, and large-cap stocks from developed markets outside North America. It has a slightly lower MER of 0.22% and offers wide diversification.

BMO MSCI EAFE Index ETF (ZEA): This ETF also tracks the MSCI EAFE Index, providing exposure to developed markets outside North America. It has a competitive MER of 0.22% and includes a mix of large- and mid-cap stocks.

Vanguard FTSE Developed Markets ETF (VEA): This ETF tracks the FTSE Developed All Cap ex US Index, offering exposure to stocks from developed markets outside the United States. It has a similar investment strategy to VIU and a low MER of 0.08%.

iShares MSCI EAFE ETF (EFA): This ETF tracks the MSCI EAFE Index, providing exposure to large- and mid-cap stocks from developed markets outside North America. It has a slightly higher MER of 0.32% but offers similar diversification.

Target Investors

The Vanguard FTSE Developed All Cap ex North America Index ETF (VIU) is designed for investors seeking broad exposure to international equities from developed markets outside North America. It's particularly suitable for:

Individual Investors: Those looking to diversify their portfolios with international stocks without the need to research and select individual stocks.

Retirement Accounts: Investors with Registered Retirement Savings Plans (RRSPs), Tax-Free Savings Accounts (TFSAs), and other retirement accounts can benefit from VIU's long-term growth potential and dividend income.

Balanced Portfolios: Investors aiming to balance their portfolios with a mix of domestic and international investments.

Cost-Conscious Investors: Those who prefer low-cost investment options, given VIU's low management expense ratio (MER) of 0.23%.

Reason to Invest…

Diversification: VIU provides exposure to developed markets outside North America, helping to diversify your portfolio and reduce country-specific risks.

Low Fees: With a management expense ratio (MER) of just 0.23%, VIU is a cost-effective option compared to many actively managed funds.

Passive Management: VIU follows a passive investment strategy, aiming to replicate the performance of the FTSE Developed All Cap ex North America Index, which can be less risky than active management.

Steady Dividends: VIU offers a decent dividend yield of around 2.50%, providing a steady income stream.

Long-Term Growth: Historically, VIU has shown a solid annualized performance since inception, making it a good option for long-term investors.

Rebalancing: The ETF regularly rebalances its holdings to stay in line with the index, ensuring that your investment remains diversified and aligned with market conditions.

Historical Stability: Developed markets tend to be more stable compared to emerging markets, which can reduce the overall volatility of your investment.

Reason Not to Invest…

No Emerging Markets: VIU focuses on developed markets and excludes emerging markets, which could limit growth potential in faster-growing economies.

Sector Concentration: The ETF has significant weightings in certain sectors like healthcare and financial services, which could lead to higher volatility if these sectors underperform.

Performance Comparison: Some investors might find better performance in other ETFs or investment options, especially those focusing on specific regions or sectors.

Market Exposure: If you're looking for broader global exposure, including North American markets, VIU might not be the best fit.

Risk Tolerance: Depending on your risk tolerance, the medium risk level of VIU might not align with your investment goals.

Geopolitical Risks: While developed markets are generally more stable, they are not immune to geopolitical risks, which could impact the performance of the ETF.

Potential Overlap: If you already have significant exposure to developed markets through other investments, adding VIU might result in overlapping holdings, reducing the benefits of diversification.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!

Please refer to the details of the referral program.

Invite your friends to read DiviStock Chronicles

Thank you for reading DiviStock Chronicles — your support allows me to keep doing this work. Join our referral program!