For individuals seeking to learn about analyzing Exchange-Traded Funds (ETFs), I suggest reviewing my earlier post that explains the fundamentals of ETFs and the analysis process.

Vanguard Total Stock Market ETF (VTI) - Snapshot

Overview

The Vanguard Total Stock Market ETF (VTI) is an exchange-traded fund that aims to track the performance of the CRSP U.S. Total Market Index. Launched on May 24, 2001, VTI provides broad exposure to the entire U.S. equity market.

The CRSP U.S. Total Market Index is a comprehensive stock market index that represents nearly 100% of the U.S. investable equity market.

Investment Strategy

VTI employs a passive investment strategy, meaning it seeks to replicate the performance of its underlying index. The fund uses an index-sampling strategy to hold a broadly diversified collection of securities that approximate the full index in terms of key characteristics. This approach minimizes turnover and keeps costs low.

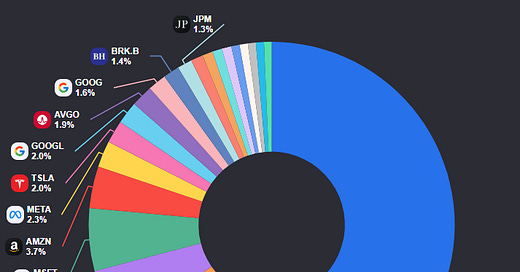

Top Holdings

As of the latest data, the top holdings of VTI include:

Sector Allocation

VTI is heavily weighted towards the technology sector due to the significant presence of highly valued tech stocks in the U.S. equity market.:

Risk Level

MEDIUM-to-HIGH - due to its broad diversification across the entire U.S. stock market. However, it is important to note that the fund includes small-cap and micro-cap stocks, which can be more volatile than large-cap stocks.

Performance

Since its inception on May 24, 2001, VTI has delivered an annualized return of approximately 8.89%.

Expense Ratio

VTI has a very low expense ratio of 0.03%, making it one of the most cost-efficient ways to gain exposure to the entire U.S. stock market.

This means that for every $1,000 invested, the annual cost would be $0.30.

Dividend Yield

The average dividend yield for VTI is around 1.25%.

This means that if you invest $1,000 in this ETF, you can expect to receive approximately $12.50 in dividends over a year, assuming the yield remains constant.

Similar Alternatives

Here are some alternatives to the Vanguard Total Stock Market ETF (VTI):

iShares Core S&P Total U.S. Stock Market ETF (ITOT): This ETF also aims to track the performance of the entire U.S. stock market and has a similar expense ratio of 0.03%.

Schwab U.S. Broad Market ETF (SCHB): This ETF tracks the Dow Jones U.S. Broad Stock Market Index and includes large, mid, and small-cap stocks. It has a low expense ratio of 0.03% and a high overlap with VTI.

SPDR Portfolio S&P 1500 Composite Stock Market ETF (SPTM): This ETF covers 90% of the U.S. equity market by tracking a composite index that includes the S&P 500, S&P MidCap 400, and S&P SmallCap 600. It also has a low expense ratio of 0.03%.

Vanguard S&P 500 ETF (VOO): While not as broad as VTI, VOO tracks the S&P 500 index and offers exposure to large-cap U.S. stocks. It has a slightly lower expense ratio of 0.02%.

iShares Core S&P 500 ETF (IVV): Similar to VOO, this ETF tracks the S&P 500 index and includes large-cap U.S. stocks. It has an expense ratio of 0.03%.

These ETFs provide similar exposure to the U.S. equity market and are known for their low expense ratios and broad diversification.

This is a comparison of the VTI ETF and similar alternatives, focusing on their Management Expense Ratios (MER), yields, and annualized performances.

Target Investors

The Vanguard Total Stock Market ETF (VTI) is designed for a wide range of investors, including:

Long-term investors: Due to its broad diversification and low expense ratio, VTI is ideal for investors looking to hold a well-rounded portfolio over an extended period.

Retirement savers: VTI can be a core holding in retirement accounts like IRAs and 401(k)s, providing exposure to the entire U.S. stock market.

Passive investors: Those who prefer a hands-off investment approach will appreciate VTI's passive strategy, which aims to replicate the performance of the CRSP U.S. Total Market Index.

Diversification seekers: Investors looking to diversify their portfolios beyond the S&P 500 will find VTI appealing, as it includes small-, mid-, and large-cap stocks across various sectors.

Cost-conscious investors: With an extremely low expense ratio of 0.03%, VTI is a cost-effective way to gain exposure to the U.S. equity market.

Reason to Invest…

Broad Diversification: VTI provides exposure to the entire U.S. stock market, including large-, mid-, small-, and micro-cap stocks across various sectors, reducing the risk of relying on a single stock or sector.

Low Expense Ratio: With a very low MER of 0.03%, VTI is cost-efficient, allowing more of your investment to grow over time.

Strong Historical Performance: VTI has delivered strong historical returns, making it a solid choice for long-term growth.

Ease of Use: As an ETF, VTI is easy to buy and sell on the stock exchange, providing liquidity and flexibility for investors.

Tax Efficiency: ETFs like VTI are typically more tax-efficient than mutual funds due to their structure and the way capital gains are handled.

Automatic Rebalancing: VTI's index automatically adjusts to reflect changes in the market, ensuring continuous alignment with its investment strategy.

Reason Not to Invest…

Market Volatility: VTI includes small- and micro-cap stocks, which tend to be more volatile than large-cap stocks. This can result in larger fluctuations in your investment value.

No International Exposure: VTI focuses solely on the U.S. market, lacking international diversification. Investors looking for global exposure will need to supplement with other investments.

Dividend Yield: While VTI does provide a dividend yield, it is relatively modest compared to other income-focused investments. Investors seeking higher yields might need to look elsewhere.

Market Risk: Like all equity investments, VTI is subject to market risk. Economic downturns or adverse market conditions can negatively impact the fund's performance.

Limited Sector Exposure: Although VTI is diversified, it may still be underweighted in certain sectors compared to the broader global market. This can lead to potential underperformance in specific sectors.

Potential Overlap: If you already own other U.S. equity ETFs, there might be significant overlap with VTI, leading to less diversification than expected.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.