Wal-Mart- A beacon of success in dire times?

As companies start reporting on their FY 2023 earnings, here is one of my owned stocks that have reported.

Note: Original post dated February 20, 2024 on the Blossom Social platform (https://share.blossomsocial.ca/RprVpvaZsukTayTt5). This solely acts as a preview of an annual analysis that I perform on my stocks upon the company’s fiscal year-end, which you can expect on this substack.

Year-End Results

WMT 0.00%↑ was impressive! This is a clear example of a company with small dividend growth but high returns. A sign that a company believes in its cash allocation into investments that will propel the company to new heights. We shall see how the expected Vizio acquisition may help or not in the coming years. To add, they did increase their upcoming dividend 9%, which was surprising.

6% increase in revenues

34% increase in EPS, 6% increase in adjusted EPS

2% increase in DPS

$35.7B in OCF and $15.1B in FCF

40% payout ratio

0.61 LTD to Equity (quite the increase)

Outstanding share count decreased slightly

Average share price growth: 11% - 5YR, 5% - 3YR, 12% - 1YR

Presentation Highlights

eCommerce becomes a strong growth vector for the foreseeable future

Commerce net sales globally up 23%, reaching $30 billion and 18% of net sales, led by pickup and delivery

Stock split announced

On January 30, 2024, WMT announced a 3-for-1 forward split of common stock and a proportionate increase in the number of authorized shares. As a result of the stock split, each holder of record of common stock as of the close of business on February 22, 2024 will receive two additional shares of common stock, to be distributed after the close of trading on February 23, 2024.

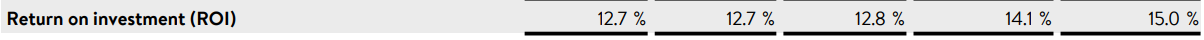

ROI showcases strong business performance and improvements over the year.

My Own Valuation

Wal-Mart tends to perform stronger in recessionary times over most stocks. Current price is slightly overvalued. Target range $50-55. There’s Costco, then there is Wal-Mart. Outside of those two mega-stores, I do not see a viable competitor. Amazon is an indirect competitor, especially on the e-commerce side.