For individuals seeking to learn about analyzing Exchange-Traded Funds (ETFs), I suggest reviewing my earlier post that explains the fundamentals of ETFs and the analysis process.

iShares S&P/TSX Global Gold Index ETF (XGD) - Snapshot

Overview

The iShares S&P/TSX Global Gold Index ETF (XGD) is an exchange-traded fund that provides investors with exposure to global securities of producers of gold and related products. It seeks to provide long-term capital growth by replicating the performance of the S&P/TSX Global Gold Index, net of expenses.

Investment Strategy

XGD aims to provide long-term capital growth by replicating the performance of the S&P/TSX Global Gold Index, which includes companies involved in the production of gold. The fund focuses on large-cap gold producers primarily listed on the Toronto Stock Exchange (TSX).

Top Holdings

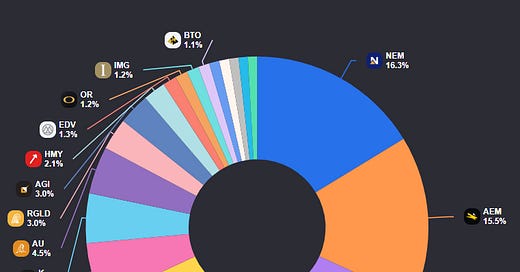

As of the latest data, the top holdings of XGD include Newmont Corporation (NEM), Agnico Eagle Mines Limited (AEM.TO), Barrick Gold Corporation (ABX.TO), Wheaton Precious Metals Corp. (WPM.TO), Franco-Nevada Corporation (FNV.TO), among others.

Sector Allocation

XGD is entirely invested in the Basic Materials sector, with a focus on gold producers.

Risk Level

HIGH - due to its focus on the volatile gold mining sector. The fund's performance can be significantly affected by fluctuations in gold prices and the financial health of its holdings.

Performance

Since its inception on March 23, 2001, XGD has had varying performance:

Expense Ratio

The management expense ratio (MER) for XGD is 0.61%.

This means that for every $1,000 invested, the annual cost would be $6.10.

Dividend Yield

The average dividend yield for XGD has been around 1.60%.

This means that if you invest $1,000 in this ETF, you can expect to receive approximately $16 in dividends over a year, assuming the yield remains constant.

Similar Alternatives

Here are some alternatives to the iShares S&P/TSX Global Gold Index ETF (XGD) that you might consider:

1. iShares Gold Bullion ETF (CGL.TO)

Investment Focus: Physical gold bullion

MER: 0.55%

5-Year Average Annual Return: 8.70%

Inception Date: May 28, 2009

Assets Under Management: $751 million

2. VanEck Vectors Gold Miners ETF (GDX)

Investment Focus: Gold mining companies globally

MER: 0.52%

5-Year Average Annual Return: 7.45%

Inception Date: May 16, 2006

Assets Under Management: $12.3 billion

3. Sprott Gold Miners ETF (SGDM)

Investment Focus: Gold mining companies globally

MER: 0.65%

5-Year Average Annual Return: 7.20%

Inception Date: April 24, 2018

Assets Under Management: $1.2 billion

4. Global X Gold Explorers ETF (GOEX)

Investment Focus: Junior gold mining companies globally

MER: 0.65%

5-Year Average Annual Return: 6.80%

Inception Date: January 30, 2012

Assets Under Management: $150 million

5. BMO Junior Gold Index ETF (ZJG)

Investment Focus: Junior gold mining companies globally

MER: 0.55%

5-Year Average Annual Return: 6.50%

Inception Date: January 30, 2012

Assets Under Management: $200 million

These ETFs offer different approaches to investing in gold and gold mining companies, so you can choose one that aligns best with your investment goals and risk tolerance.

This is a comparison of the of the iShares S&P/TSX Global Gold Index ETF (XGD) and its close alternatives based on their Management Expense Ratios (MER), yield, and annualized performance:

Target Investors

The iShares S&P/TSX Global Gold Index ETF (XGD) is designed for investors who are looking to gain exposure to the gold mining sector. Specifically, it targets:

Long-term investors: Those who are interested in holding assets for an extended period to benefit from potential capital growth and dividends.

Diversified portfolio holders: Investors who want to diversify their portfolios with exposure to gold and related products.

Risk-tolerant investors: Due to the volatility of the gold mining sector, XGD is suitable for investors who are comfortable with higher risk levels.

Canadian investors: Since XGD is traded on the Toronto Stock Exchange (TSX), it is particularly accessible to Canadian investors, including those with registered accounts like RRSP and TFSA.

Reason to Invest…

Exposure to Gold Producers: XGD provides investors with exposure to a diversified portfolio of large-cap gold producers, which can be a good hedge against inflation and economic uncertainty.

High Liquidity: As an ETF traded on the Toronto Stock Exchange, XGD offers high liquidity, making it easy to buy and sell shares.

Dividend Income: XGD has a decent dividend yield, providing investors with regular income in addition to potential capital gains.

Diversification: Investing in XGD allows you to diversify your portfolio with exposure to the gold mining sector without having to pick individual stocks.

Professional Management: The ETF is managed by BlackRock, a reputable asset management firm, ensuring professional management and adherence to the S&P/TSX Global Gold Index.

Gold as a Safe Haven: During economic downturns or periods of high inflation, gold is often considered a safe-haven asset that can preserve value when other assets decline.

Potential for High Returns: The gold mining sector can offer substantial returns during periods of rising gold prices, driven by factors such as geopolitical instability or changes in currency values.

Currency Diversification: XGD includes companies operating globally, offering indirect exposure to various currencies, which can be beneficial for diversifying currency risk.

Reason Not to Invest…

High Volatility: The gold mining sector is highly volatile, and XGD's performance can be significantly affected by fluctuations in gold prices.

High-Risk Investment: Due to its focus on gold producers, XGD is considered a high-risk investment, which may not be suitable for risk-averse investors.

Management Expense Ratio (MER): While the MER is relatively low compared to mutual funds, it still adds to the cost of holding the ETF.

Limited Sector Focus: XGD is entirely focused on the gold mining sector, which means it lacks diversification across other sectors.

Geopolitical Risks: Gold mining companies often operate in politically unstable regions, which can pose additional risks to the investment.

Limited Exposure to Other Precious Metals: While XGD focuses on gold, it provides limited exposure to other precious metals like silver and platinum, which might also be attractive to some investors.

Regulatory Risks: The gold mining industry is subject to stringent environmental and regulatory requirements, which can impact the operations and profitability of the companies within the ETF.

Cyclical Nature of Mining: The mining industry tends to be cyclical, meaning it goes through periods of boom and bust. This cyclicality can lead to significant volatility in the performance of XGD.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.