XIC - ETF Overview

A Comprehensive Guide to the iShares Core S&P/TSX Capped Composite Index ETF (XIC)

For individuals seeking to learn about analyzing Exchange-Traded Funds (ETFs), I suggest reviewing my earlier post that explains the fundamentals of ETFs and the analysis process.

iShares Core S&P/TSX Capped Composite Index ETF (XIC) - Snapshot

Overview

The iShares Core S&P/TSX Capped Composite Index ETF (XIC) is designed to provide investors with long-term capital growth by replicating the performance of the S&P/TSX Capped Composite Index, net of expenses. It offers broad exposure to the Canadian stock market, representing approximately 95% of the Canadian equity market.

Investment Strategy

XIC utilizes an indexing strategy to meet its investment goals. It aims to mirror the performance of the S&P/TSX Capped Composite Index through a diversified portfolio of Canadian equity securities. The fund employs a market-capitalization weighting method, meaning stocks are weighted according to their market capitalization.

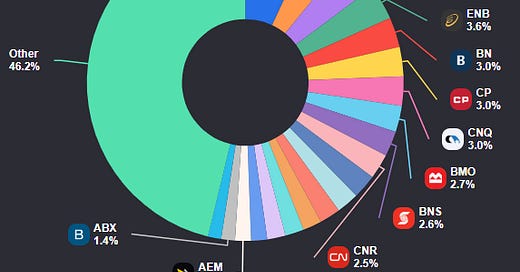

Top Holdings

As of October 2024, the top holdings of XIC include:

Sector Allocation

The top sector allocations for XIC are often in this pattern:

Risk Level

LOW to MEDIUM - due to its broad diversification in helping to mitigate risk by spreading investments across various sectors, including financial services, energy, industrials, and others.

Performance

As of October 2024, XIC has a year-to-date (YTD) return of 19.54%.

It has an annualized performance of 8.3% over the past 20 years.

Expense Ratio

The expense ratio for XIC is 0.06%, making it a low-cost option for investors

This means that for every $1,000 invested, the annual cost would be $0.60.

Dividend Yield

XIC has a dividend yield of 2.51% as of October 2024.

This means that if you invest $1,000 in this ETF, you can expect to receive approximately $25.10 in dividends over a year, assuming the yield remains constant.

Similar Alternatives

Here are some similar alternatives to the iShares Core S&P/TSX Capped Composite Index ETF (XIC):

Vanguard FTSE Canada All Cap Index ETF (VCN): This ETF provides exposure to the entire Canadian equity market, including large, mid, and small-cap companies.

BMO S&P/TSX Capped Composite Index ETF (ZCN): This ETF also tracks the S&P/TSX Capped Composite Index, offering similar exposure to XIC.

TD Canadian Equity Index ETF (TTP): This ETF aims to replicate the performance of the S&P/TSX Composite Index, which includes all the companies listed on the Toronto Stock Exchange.

iShares S&P/TSX 60 Index ETF (XIU): While XIU tracks the S&P/TSX 60 Index (top 60 companies), it offers a similar broad exposure to the Canadian market.

Here's a comparison of the expense ratios, yield, and performance of the XIC ETF and its closest alternatives:

All of these ETFs offer comparable investment strategies and sector allocations, presenting them as viable alternatives to XIC. Deciding among them could hinge on various factors such as management fees, past performance, and individual investment preferences.

Target Investors

The iShares Core S&P/TSX Capped Composite Index ETF (XIC) is designed for a wide range of investors, including:

Individual Investors: Those looking for broad exposure to the Canadian equity market with a single investment.

Retirement Accounts: Investors who want to include Canadian stocks in their retirement portfolios.

Long-Term Investors: Individuals seeking long-term capital growth through a diversified portfolio of Canadian companies.

Income Seekers: Investors looking for a steady income stream through dividends, as XIC offers a dividend yield of around 2.51%.

Passive Investors: Those who prefer a passive investment strategy, as XIC replicates the performance of the S&P/TSX Capped Composite Index without active stock selection.

Reason to Invest…

Broad Market Exposure: XIC provides exposure to approximately 95% of the Canadian equity market, including large, mid, and small-cap companies.

Low Expense Ratio: With an expense ratio of 0.09%, XIC is a cost-effective way to invest in the Canadian stock market.

Diversification: The ETF is diversified across various sectors, reducing the risk associated with investing in individual stocks.

Dividend Income: XIC offers a dividend yield of 2.51%, providing a steady income stream in addition to potential capital gains.

Liquidity: XIC is highly liquid, making it easy to buy and sell shares on the Toronto Stock Exchange.

Long-Term Growth: Designed as a long-term core holding, XIC aims to provide long-term capital growth.

Reason Not to Invest…

Sector Concentration: XIC is heavily weighted towards the financials, energy, and industrials sectors, which can lead to higher risk if these sectors underperform.

Lack of International Diversification: XIC focuses exclusively on Canadian companies, so it lacks exposure to international markets.

Market Volatility: Like all equity investments, XIC is subject to market volatility and the risks associated with investing in the stock market.

All-Equity Fund: XIC does not provide exposure to other asset classes like bonds or real estate, which may be desirable for a more balanced portfolio.

Economic Dependency: The performance of XIC is closely tied to the Canadian economy, which can be a disadvantage if the economy faces a downturn.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.