In this series on exchange-traded funds (ETFs), I will examine each of the Select Sector SPDR (Standard & Poor’s Depositary Receipts) Funds. Managed by State Street Global Advisors (SSGA), this family of ETFs allows investors to tailor their exposure to specific segments of the S&P 500 Index. Each fund represents a different sector of the index, as illustrated below, and is designed to track the performance of that sector.

For individuals seeking to learn about analyzing Exchange-Traded Funds (ETFs), I suggest reviewing my earlier post that explains the fundamentals of ETFs and the analysis process.

Analyzing an ETF

An Exchange-Traded Fund (ETF) serves as both an investment product and a collective investment scheme. Let’s break down what this entails:

Materials Select Sector SPDR Fund (XLB) - Snapshot

Overview

The Materials Select Sector SPDR Fund (XLB) is an exchange-traded fund (ETF) that provides exposure to companies in the materials sector of the S&P 500 Index. It includes firms involved in chemicals, construction materials, containers and packaging, metals and mining, and paper and forest products. The ETF is designed to track the Materials Select Sector Index.

Investment Strategy

XLB employs a passive, replication strategy to track the Materials Select Sector Index. It invests at least 95% of its total assets in the securities that comprise the index, aiming to mirror its performance. The index is market-cap-weighted and includes U.S.-listed companies from industries such as chemicals, metals and mining, paper and forest products, containers and packaging, and construction materials. This approach ensures that the fund closely follows the index’s composition and weightings, providing a straightforward, low-turnover way to gain exposure to the materials sector without active management.

Top Holdings

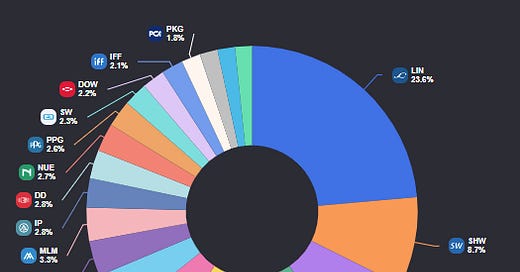

As of the latest data, XLB’s portfolio is heavily concentrated in a few mega-cap technology companies:

The top five holdings account for a significant portion of the fund and are:

Linde PLC (LIN) - A global industrial gases and engineering company.

Sherwin-Williams Co (SHW) - A leading producer of paints and coatings.

Air Products & Chemicals Inc (APD) - A major supplier of industrial gases.

Ecolab Inc (ECL) - A provider of water, hygiene, and energy technologies.

Freeport-McMoRan Inc (FCX) - A prominent mining company focused on copper, gold, and molybdenum.

These holdings reflect the fund’s heavy weighting toward large, established companies in the chemicals and mining subsectors.

Sector Allocation

XLB is exclusively focused on the materials sector, with its allocations broken down into specific industries within this category. Based on typical sector breakdowns:

Chemicals: Dominates the portfolio, often comprising over 70% of assets, including industrial gases, specialty chemicals, and coatings.

Metals & Mining: A significant portion, featuring companies like Freeport-McMoRan involved in copper and other metal extraction.

Containers & Packaging: Includes firms producing industrial packaging materials.

Construction Materials: Covers companies supplying materials like cement and aggregates.

Paper & Forest Products: A smaller allocation, representing lumber and paper production.

This concentrated sector focus distinguishes XLB from broader market ETFs, making it a cyclical play tied to economic and industrial activity.

Risk Level

MEDIUM-to-HIGH - due to exclusive focus on materials making it more volatile than diversified funds, as it is sensitive to economic cycles, commodity prices, and industrial demand.

Performance

Since its inception on December 16, 1998, XLB has delivered an annualized return of approximately 7.5%-8%.

Expense Ratio

XLB boasts a competitive Management Expense Ratio (MER) of 0.09%, making it one of the lowest-cost ETFs in its category.

This means that for every $1,000 invested, the annual cost would be $0.90.

Dividend Yield

XLB has an average dividend yield of 2%. Dividends are paid quarterly.

This means that if you invest $1,000 in this ETF, you can expect to receive approximately $20 in dividends over a year, assuming the yield remains constant.

Similar Alternatives

There are several ETFs that provide exposure to the materials sector, similar to XLB. Here are some alternatives:

Vanguard Materials ETF (VAW): Launched on January 26, 2004, VAW seeks to track the MSCI US Investable Market Materials 25/50 Index, offering broader exposure to the U.S. materials sector compared to XLB’s S&P 500 subset.

iShares U.S. Basic Materials ETF (IYM): Launched on June 12, 2000, IYM tracks the Dow Jones U.S. Basic Materials Index, focusing on U.S. companies in the materials sector.

FlexShares Morningstar Global Upstream Natural Resources Index Fund (GUNR): Launched on September 13, 2011, GUNR tracks the Morningstar Global Upstream Natural Resources Index, providing global exposure to companies in materials, energy, and agriculture.

SPDR S&P Global Natural Resources ETF (GNR): Launched on September 13, 2010, GNR tracks the S&P Global Natural Resources Index, targeting large, publicly traded companies in natural resource industries worldwide.

This is a comparison of the XLB ETF and similar alternatives, focusing on their Management Expense Ratios (MER), yields, and annualized performances.

Target Investors

The Materials Select Sector SPDR Fund (XLB) is designed for investors who seek sector-specific exposure to the materials industry. Here are the primary target investors:

Sector-Focused Investors: Investors seeking targeted exposure to the U.S. materials sector, including industries like chemicals, metals and mining, construction materials, and packaging.

Tactical and Cyclical Investors: Those who actively adjust portfolios based on economic cycles or market trends, particularly favoring cyclical sectors.

Dividend and Income Seekers: Investors prioritizing steady income alongside moderate growth, comfortable with sector-specific risks.

Long-Term Growth Investors: Buy-and-hold investors with a positive outlook on the materials sector’s role in industrial and economic development.

Cost-Conscious Passive Investors: Individuals or institutions favoring low-cost, passive investment vehicles over actively managed funds.

Portfolio Diversifiers: Investors aiming to diversify beyond core holdings like the S&P 500 or tech-heavy funds, seeking non-correlated assets.

Institutional and Professional Investors: Hedge funds, financial advisors, or portfolio managers using ETFs for hedging, sector rotation, or client allocations.

Reasons to Invest in XLB

Sector Exposure – XLB provides targeted exposure to the materials sector, which includes industries like chemicals, metals & mining, and construction materials.

Diversification – The ETF holds a basket of materials companies, reducing single-stock risk.

Dividend Income – XLB offers a reasonable dividend yield, making it attractive for income-focused investors.

Low Expense Ratio – With a low management expense ratio (MER), XLB is a cost-effective way to gain sector exposure.

Economic Growth Potential – The materials sector tends to perform well during periods of economic expansion and infrastructure spending.

Exposure to Industry Leaders – Holdings include dominant firms, which are well-positioned in their industries.

Liquidity & Accessibility – XLB is highly liquid, making it easy to buy and sell without significant price impact.

Reasons Not to Invest in XLB

Sector Concentration Risk – XLB is heavily concentrated in the materials sector, making it vulnerable to downturns in commodity prices and global trade.

Cyclical Nature – The materials sector is highly cyclical, meaning it can underperform during economic slowdowns or recessions.

Limited Growth Potential – Compared to technology or healthcare ETFs, XLB may have slower long-term growth.

Limited Geographic Scope - XLB is U.S.-centric, tracking only S&P 500 materials companies, missing out on global opportunities in emerging markets or resource-rich regions.

Interest Rate Sensitivity – Rising interest rates can negatively impact materials companies, especially those with high debt levels.

Commodity Price Volatility – Many holdings in XLB are dependent on commodity prices, which can be unpredictable and volatile.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.