In this series on exchange-traded funds (ETFs), I will examine each of the Select Sector SPDR (Standard & Poor’s Depositary Receipts) Funds. Managed by State Street Global Advisors (SSGA), this family of ETFs allows investors to tailor their exposure to specific segments of the S&P 500 Index. Each fund represents a different sector of the index, as illustrated below, and is designed to track the performance of that sector.

For individuals seeking to learn about analyzing Exchange-Traded Funds (ETFs), I suggest reviewing my earlier post that explains the fundamentals of ETFs and the analysis process.

Analyzing an ETF

An Exchange-Traded Fund (ETF) serves as both an investment product and a collective investment scheme. Let’s break down what this entails:

Financial Select Sector SPDR Fund (XLF) - Snapshot

Overview

The Financial Select Sector SPDR Fund (XLF) is an exchange-traded fund (ETF) that tracks the Financial Select Sector Index, which includes financial stocks from the S&P 500. It was launched on December 16, 1998, and is issued by State Street.

Investment Strategy

XLF aims to provide exposure to the financial sector by investing in a diversified portfolio of financial service firms, insurance companies, banks, capital markets, consumer finance, and thrift companies. The fund is passively managed and seeks to replicate the performance of the Financial Select Sector Index.

Top Holdings

As of the latest data, the top holdings of XLF include:

The top five holdings, which account for a significant portion of the fund’s assets, are:

Berkshire Hathaway Inc. (BRK.B) - A diversified holding company with substantial financial services exposure.

JPMorgan Chase & Co. (JPM) - One of the largest U.S. banks, offering a wide range of financial services.

Visa Inc. (V) - A global leader in payment processing and credit card networks.

Mastercard Inc. (MA) - Another dominant player in the payment processing industry.

Bank of America Corp. (BAC) - A major U.S. bank with extensive retail and investment banking operations.

These top holdings typically represent around 30-40% of the portfolio, reflecting the market-cap-weighted structure of the index.

Sector Allocation

XLF is exclusively focused on the financial sector. Within this sector, its allocation spans several sub-industries:

Banks: Major U.S. banking institutions (e.g., JPMorgan Chase, Bank of America).

Financial Services: Payment processors and investment firms (e.g., Visa, Mastercard).

Insurance: Property, casualty, and life insurance companies.

Capital Markets: Brokerages and asset management firms.

Mortgage REITs: Real estate investment trusts focused on mortgage financing.

Consumer Finance: Companies providing loans and credit services.

Risk Level

MEDIUM - subject to sector risk and non-diversification risk, which can result in greater price fluctuations compared to the overall market. The fund's beta is 1.05, indicating that it is slightly more volatile than the broader market

Performance

Since its inception, XLF has delivered an annualized performance of 6.01%. The fund has experienced various market cycles, with notable returns in recent years.

Key performance highlights include:

Early Years: Strong growth in the early 2000s was followed by significant declines during the 2008 financial crisis.

Post-Crisis Recovery: Steady gains as the sector recovered, with notable strength in the 2010s.

Recent Trends: As of early 2025, XLF has benefited from rising interest rates and economic optimism.

Expense Ratio

The management expense ratio (MER) for XLF is 0.08%. This low expense ratio makes it one of the least expensive ETFs in the financial sector.

This means that for every $1,000 invested, the annual cost would be $0.80.

Dividend Yield

XLF pays quarterly dividends, with an annualized dividend yield typically ranging between 1.5% and 2.0%.

This means that if you invest $1,000 in this ETF, you can expect to receive approximately $15 to $20 in dividends over a year, assuming the yield remains constant.

Similar Alternatives

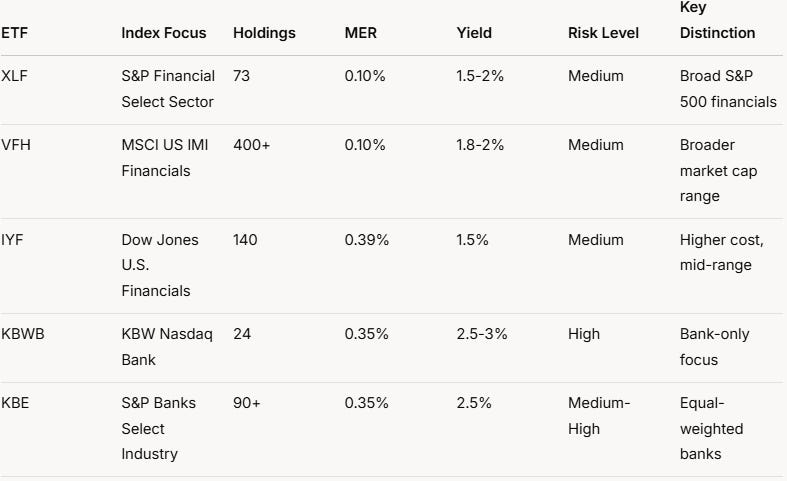

Here are some ETFs that are similar to the Financial Select Sector SPDR Fund (XLF):

Vanguard Financials ETF (VFH): This ETF seeks to track the performance of the MSCI US Investable Market Financials 25/50 Index. It offers broad exposure to the financial sector, including banks, insurance companies, and other financial services firms. VFH has a low expense ratio and is a popular choice among investors.

iShares U.S. Financials ETF (IYF): This ETF aims to track the investment results of an index composed of U.S. equities in the financial sector. It includes a wide range of financial companies, from large banks to smaller financial services firms. IYF is known for its diversified holdings and relatively low expense ratio.

SPDR S&P Bank ETF (KBE): This ETF focuses specifically on the banking sector, tracking the performance of the S&P Banks Select Industry Index. It includes a mix of large, mid, and small-cap banks, providing targeted exposure to the banking industry.

Invesco KBW Bank ETF (KBWB): This ETF seeks to track the investment results of the KBW Nasdaq Bank Index. It includes a diverse range of U.S. banking stocks and is designed to provide exposure to the banking sector's performance

These ETFs provide various options for investors seeking exposure to the financial sector, each with its own unique investment strategy and focus.

This is a comparison of the XLF ETF and similar alternatives, focusing on their Management Expense Ratios (MER), yields, and annualized performances.

Target Investors

The Financial Select Sector SPDR Fund (XLF) is designed for a variety of investors who are looking to gain exposure to the financial sector. Here are some of the target investors for XLF:

Sector-Specific Investors: Those who want to focus their investments on the financial sector, including banks, insurance companies, and other financial services firms.

Diversified Portfolio Seekers: Investors looking to diversify their portfolios by adding a sector-specific ETF that provides broad exposure to the financial industry.

Long-Term Investors: Individuals who are interested in long-term growth and are willing to hold the ETF for an extended period to benefit from the potential appreciation of financial stocks.

Cost-Conscious Investors: Those who prefer low-cost investment options, as XLF has a low management expense ratio (MER) of 0.08%, making it an attractive choice for cost-conscious investors.

Income-Oriented Investors: Investors seeking regular income through dividends, as XLF has an average dividend yield of 1.44% and pays dividends quarterly.

Institutional Investors: Large institutional investors, such as pension funds and mutual funds, that want to gain exposure to the financial sector without having to pick individual stocks.

Market Participants Seeking Liquidity: Investors who value liquidity and ease of trading, as XLF is one of the largest and most actively traded ETFs in the financial sector.

These target investors are drawn to XLF for its diversified exposure to the financial sector, low costs, and potential for long-term growth and income.

Reasons to Invest in XLF

Diversified Exposure: XLF provides broad exposure to the financial sector, including banks, insurance companies, and other financial services firms. This diversification helps mitigate the risk associated with individual stocks.

Low Expense Ratio: XLF has a low management expense ratio (MER), making it a cost-effective option for investors seeking exposure to the financial sector.

Dividend Yield: XLF offers an average dividend yield of 1.44%, providing investors with regular income through quarterly dividend payments.

Liquidity: XLF is one of the largest and most actively traded ETFs in the financial sector, ensuring high liquidity and ease of trading.

Long-Term Growth Potential: The financial sector has shown strong growth potential, and XLF has delivered a decent annualized performance since its inception.

Economic Recovery Potential: If the economy strengthens or stabilizes post-recession fears, the financial sector often leads recovery efforts due to its role in lending and capital markets. XLF could capitalize on such trends.

Institutional Backing: The fund is issued by State Street, a well-established financial services company with a strong reputation. This institutional backing can provide additional confidence to investors.

Benchmark Tracking: XLF tracks the Financial Select Sector Index, which includes leading financial companies from the S&P 500. This alignment with a well-known benchmark can make it easier for investors to understand the fund's performance relative to the broader market.

Reasons Not to Invest in XLF

Sector Concentration Risk: XLF primarily focuses on the financial sector, which means its performance is heavily dependent on the financial industry's performance. A downturn in the financial sector could negatively impact the value of XLF.

Interest Rate Sensitivity: The financial sector is sensitive to changes in interest rates. Fluctuations in interest rates can significantly impact the profitability of financial institutions, affecting XLF's performance.

Market Volatility: The financial sector can be sensitive to economic and geopolitical events, regulatory changes, and shifts in investor sentiment. This can lead to higher levels of volatility and potential investment losses.

Regulatory and Legislative Changes: Changes in regulations and legislation can impact the financial sector's profitability and operations. Stricter lending standards or increased capital requirements could affect the performance of financial institutions held within XLF.

Non-Diversification Risk: While XLF provides diversified exposure within the financial sector, it lacks diversification across other sectors. Investors seeking broader market exposure may need to consider additional investments in other sectors.

Limited Exposure to Emerging Trends: XLF primarily invests in established financial institutions. As a result, it may have limited exposure to emerging trends and innovative companies in the financial sector, such as fintech startups.

Competition from Other Sectors: The financial sector may face competition from other sectors that offer higher growth potential or different risk/return profiles. Investors seeking broader market exposure might prefer a more diversified ETF.

Currency Risk: For international investors, fluctuations in currency exchange rates can impact the returns of XLF. While this risk may be minimal for U.S.-based investors, it is a factor to consider for those investing from abroad.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.