In this series on exchange-traded funds (ETFs), I will examine each of the Select Sector SPDR (Standard & Poor’s Depositary Receipts) Funds. Managed by State Street Global Advisors (SSGA), this family of ETFs allows investors to tailor their exposure to specific segments of the S&P 500 Index. Each fund represents a different sector of the index, as illustrated below, and is designed to track the performance of that sector.

For individuals seeking to learn about analyzing Exchange-Traded Funds (ETFs), I suggest reviewing my earlier post that explains the fundamentals of ETFs and the analysis process.

Analyzing an ETF

An Exchange-Traded Fund (ETF) serves as both an investment product and a collective investment scheme. Let’s break down what this entails:

Financial Select Sector SPDR Fund (XLF) - Snapshot

Overview

The Financial Select Sector SPDR Fund (XLF) is an exchange-traded fund (ETF) that seeks to provide investment results that correspond generally to the price and yield performance of the Financial Select Sector Index, a subset of the S&P 500 Index. XLF offers investors exposure to large U.S. financial companies, including banks, insurance firms, capital markets, and consumer finance entities. XLF is a popular choice for investors seeking targeted exposure to the U.S. financial sector, known for its cyclical nature and sensitivity to economic conditions, interest rates, and regulatory changes.

Investment Strategy

XLF employs a passive, replication strategy, investing at least 95% of its total assets in the securities comprising the Financial Select Sector Index. The index includes companies classified as financials under the Global Industry Classification Standard (GICS), covering industries such as diversified financial services, insurance, banks, capital markets, mortgage real estate investment trusts (REITs), and consumer finance. The fund is cap-weighted, meaning larger companies like Berkshire Hathaway and JPMorgan Chase have a greater influence on performance. This strategy provides efficient, low-cost exposure to the financial sector, appealing to investors looking to capitalize on economic cycles or hedge sector-specific risks.

Top Holdings

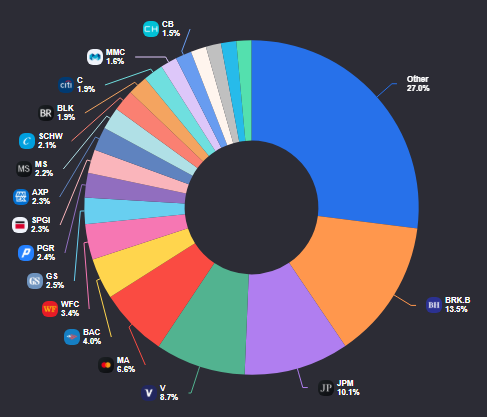

XLF’s top holdings represent major players in diversified financial services, banking, and payment processing, reflecting the fund’s focus on large-cap, blue-chip financial firms:

The top holdings, which account for a significant portion of the portfolio, are:

Berkshire Hathaway Inc. (BRK.B): A diversified holding company with investments in insurance, railroads, utilities, and consumer goods, known for its stable cash flows and Warren Buffett’s leadership.

JPMorgan Chase & Co. (JPM): A leading global bank offering commercial and investment banking, asset management, and consumer financial services, with a strong balance sheet.

Visa Inc. (V): A global payments technology company facilitating electronic transactions, benefiting from the shift to digital payments.

Mastercard Inc. (MA): A global payment network processing card transactions, competing closely with Visa in the digital payments space.

Bank of America Corp. (BAC): A major U.S. bank providing retail and commercial banking, wealth management, and investment services, with broad market exposure.

Sector Allocation

XLF is exclusively allocated to the financial sector, as defined by GICS. The breakdown of industries within the fund includes:

Diversified Financial Services: Offers a range of financial products and services across multiple industries.

Banks: Encompasses large commercial banks focused on lending, deposits, and corporate banking.

Capital Markets: Covers investment banks and brokerages providing advisory, trading, and asset management services.

Consumer Finance: Includes payment processors as well as credit providers, driven by consumer spending trends.

Insurance: Comprises property, casualty, and life insurers benefiting from premium growth and investment income.

Mortgage REITs: Includes firms which invest in mortgage-backed securities, sensitive to interest rate changes.

This allocation excludes real estate, which was spun off into the XLRE ETF in September 2016, reducing XLF’s diversification by removing ~20% of its prior real estate exposure.

Risk Level

MEDIUM - due to heavy concentration in financial companies like banks, insurance firms, and capital markets, its performance is sensitive to interest rate changes, economic cycles, and financial regulations.

Performance

Since its inception on December 16, 1998, XLF’s annualized performance is approximately 5%–6% as of April 30, 2025.

Expense Ratio

XLF is known for its cost efficiency, with a Management Expense Ratio (MER) of 0.08%, making it one of the lowest-cost ETFs in its category.

This means that for every $1,000 invested, the annual cost would be $0.80.

Dividend Yield

XLF has an average dividend yield of 1.5%-2%. Dividends are paid quarterly.

This means that if you invest $1,000 in this ETF, you can expect to receive approximately $15 to $20 in dividends over a year, assuming the yield remains constant.

Similar Alternatives

Below is a detailed analysis of alternatives to XLF, focusing on their key characteristics, organized to align with the comprehensive summary provided for this ETF:

Vanguard Financials ETF (VFH): Tracks the MSCI US Investable Market Financials 25/50 Index, offering exposure to a broader range of financial companies, including small- and mid-cap firms, compared to XLF’s large-cap focus.

iShares U.S. Financials ETF (IYF): Tracks the Dow Jones U.S. Financials Index, covering banks, insurance, capital markets, and other financial services.

Invesco KBW Bank ETF (KBWB): Tracks the KBW Nasdaq Bank Index, focusing specifically on U.S. banks and thrifts, excluding broader financial services like insurance or payment processors.

SPDR S&P Regional Banking ETF (KRE): Tracks the S&P Regional Banks Select Industry Index, targeting regional U.S. banks, which are more sensitive to local economic conditions and interest rates.

This is a comparison of the XLF ETF and similar alternatives, focusing on their Management Expense Ratios (MER), yields, and annualized performances.

Target Investors

The Financial Select Sector SPDR Fund (XLF) is designed for investors who want targeted exposure to the U.S. financial sector. Here are the key groups that typically invest in XLF:

Sector-Focused Investors – Those looking to gain precise exposure to financial companies, including banks, insurance firms, and capital markets.

Institutional Investors & Financial Advisors – Hedge funds, pension funds, and financial advisors may use XLF to diversify portfolios or overweight financials based on market outlook.

Dividend & Income Investors – XLF offers regular dividend payouts, making it suitable for those seeking passive income while maintaining exposure to a growth-oriented sector.

Tactical & Strategic Investors – Investors who adjust their portfolio allocation based on market trends may use XLF to increase exposure to financials when the sector is expected to outperform.

Passive Investors – Since XLF follows a passive investment strategy, it is ideal for investors who prefer low-cost, index-based investing rather than actively managing individual financial stocks

Reasons to Invest in XLF

Low-Cost Exposure: XLF’s management expense ratio (MER) is among the lowest for financial sector ETFs, minimizing cost drag and enhancing long-term returns.

Exposure to Blue-Chip Financials: XLF holds major firms like Berkshire Hathaway, JPMorgan Chase, and Visa, providing access to stable, market-leading companies with strong balance sheets and global reach.

Cyclical Growth Potential: The financial sector benefits from economic expansion, rising interest rates, and increased lending activity.

Dividend Income: XLF offers a modest income stream for investors seeking both growth and income.

High Liquidity: As a widely traded ETF, XLF is highly liquid, enabling easy trading with tight bid-ask spreads and flexibility for strategies like stop orders or short selling.

Tactical Portfolio Allocation: XLF allows investors to overweight the financial sector for tactical bets on economic recovery or to hedge other portfolio exposures, complementing diversified funds.

Reasons Not to Invest in XLF

Sector Concentration Risk: XLF’s exclusive focus on financials makes it vulnerable to sector-specific downturns, such as those caused by recessions or regulatory changes.

Interest Rate Sensitivity: Financial firms, especially banks, are sensitive to interest rate fluctuations. Unexpected rate cuts or prolonged low rates could compress lending margins, negatively impacting XLF’s performance.

Economic Cycle Dependence: XLF’s cyclical nature ties its performance to economic conditions.

Moderate Volatility: XLF exhibits moderate volatility, posing risks for risk-averse investors compared to more diversified or stable income-focused ETFs.

Limited Dividend Yield: XLF’s yield is lower than alternatives, making it less attractive for income-focused investors seeking higher payouts.

Geopolitical and Regulatory Risks: Global events (e.g., wars, trade tensions) or increased regulatory scrutiny on banks and financial firms could adversely affect XLF’s holdings, adding uncertainty.

Opportunity Cost: Investing in XLF forgoes broader market exposure that may offer similar returns with less sector-specific risk.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.