In this series on exchange-traded funds (ETFs), I will examine each of the Select Sector SPDR (Standard & Poor’s Depositary Receipts) Funds. Managed by State Street Global Advisors (SSGA), this family of ETFs allows investors to tailor their exposure to specific segments of the S&P 500 Index. Each fund represents a different sector of the index, as illustrated below, and is designed to track the performance of that sector.

For individuals seeking to learn about analyzing Exchange-Traded Funds (ETFs), I suggest reviewing my earlier post that explains the fundamentals of ETFs and the analysis process.

Analyzing an ETF

An Exchange-Traded Fund (ETF) serves as both an investment product and a collective investment scheme. Let’s break down what this entails:

Industrial Select Sector SPDR Fund (XLI) - Snapshot

Overview

The Industrial Select Sector SPDR Fund (XLI) is an exchange-traded fund (ETF) that tracks the performance of the Industrial Select Sector Index, a market cap-weighted index comprising industrial-sector stocks drawn from the S&P 500. XLI provides investors with targeted exposure to the U.S. industrial sector, which includes industries such as aerospace and defense, industrial conglomerates, machinery, transportation, and construction. The fund is designed to replicate the price and yield performance of its underlying index and is a popular choice for investors seeking to capitalize on industrial innovation and economic growth.

Investment Strategy

XLI employs a passive investment strategy, aiming to replicate the performance of the Industrial Select Sector Index by investing at least 95% of its total assets in the securities comprising the index. The fund uses a replication strategy, holding substantially all the securities in the index in approximately the same proportions. XLI is non-diversified, focusing exclusively on industrial companies as defined by the Global Industry Classification Standard (GICS). The fund is positioned to benefit from state funding programs, industrial innovation, and economic cycles, particularly in sectors like aerospace, defense, and manufacturing, which are sensitive to government spending and monetary policy shifts.

Top Holdings

These holdings reflect XLI’s emphasis on large-cap industrial firms with significant market presence.

The top holdings, which account for a significant portion of the portfolio, are:

GE Aerospace (GE): A leading aerospace and defense company.

Caterpillar Inc. (CAT): A global manufacturer of construction and mining equipment.

Uber Technologies, Inc. (UBER): A global technology company that provides ride-sharing, food delivery, and freight transportation services through its mobile app platform.

RTX Corp (RTX): A major player in aerospace and defense, including missile systems and aviation.

Honeywell International Inc. (HON): A diversified industrial conglomerate with focus on aerospace and automation.

Union Pacific Corp (UNP): A leading railroad transportation company.

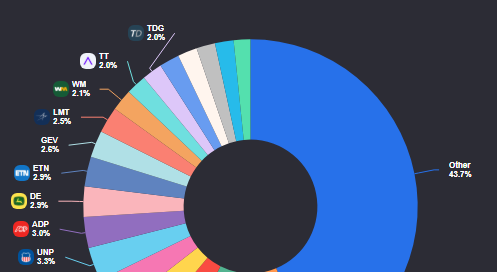

Sector Allocation

XLI is entirely allocated to the industrial sector but within this sector, it spans various sub-industries. Based on recent data, the fund’s primary allocations include:

Aerospace and Defense: A significant portion, driven by companies benefiting from increased defense spending and commercial aviation demand.

Machinery: Includes firms tied to construction and infrastructure.

Transportation: Encompasses railroads and logistics firms.

Industrial Conglomerates: Companies with diversified industrial operations.

Construction and Engineering: Exposure to infrastructure development.

The fund’s focus on aerospace and defense has grown in recent years, reflecting shifts in state funding and global demand.

Risk Level

MEDIUM-to-HIGH - due to its sector-specific focus and cyclical nature as it is sensitive to economic cycles, government policy changes, and supply chain disruptions. XLI may exhibit greater price fluctuations, particularly during economic downturns.

Performance

Since its inception on December 16, 1998, XLI has delivered solid long-term performance. Historical annualized returns are approximately 8%-10%.

Expense Ratio

XLI is known for its cost efficiency, with a Management Expense Ratio (MER) of 0.08%, making it one of the lowest-cost ETFs in its category.

This means that for every $1,000 invested, the annual cost would be $0.80.

Dividend Yield

XLI has an average dividend yield of 1%-2%. Dividends are paid quarterly.

This means that if you invest $1,000 in this ETF, you can expect to receive approximately $10 to $20 in dividends over a year, assuming the yield remains constant.

Similar Alternatives

Below is a summary of similar alternatives to the XLI ETF, focusing on ETFs that provide exposure to the consumer discretionary sector or related areas:

Vanguard Industrials ETF (VIS): Tracks the MSCI US Investable Market Industrials 25/50 Index, providing broad exposure to the U.S. industrial sector across large-, mid-, and small-cap companies.

Fidelity MSCI Industrials Index ETF (FIDU): Tracks the MSCI USA IMI Industrials Index, focusing on U.S. industrial companies across all market capitalizations.

First Trust Industrials/Producer Durables AlphaDEX ETF (FXR): Tracks the StrataQuant Industrials Index, which uses a proprietary methodology to select industrial and producer durable stocks based on fundamental factors.

iShares U.S. Aerospace & Defense ETF (ITA): Tracks the Dow Jones U.S. Select Aerospace & Defense Index, focusing specifically on aerospace and defense companies.

This is a comparison of the XLI ETF and similar alternatives, focusing on their Management Expense Ratios (MER), yields, and annualized performances.

Target Investors

The Industrial Select Sector SPDR Fund (XLI) is designed for investors seeking exposure to the U.S. industrial sector. Here are the key types of investors who may find XLI appealing:

Sector-Specific Investors: Those who want targeted exposure to industrial companies without investing in the broader market.

Growth-Oriented Investors: Investors looking for capital appreciation from industrial innovation, infrastructure spending, and economic cycles.

Passive Investors: XLI follows a passive investment strategy, tracking the Industrial Select Sector Index rather than actively selecting stocks.

Economic Cycle Traders: Investors who time market cycles may use XLI to capitalize on periods of strong industrial growth.

Institutional Investors: Large funds and institutions may use XLI for sector rotation strategies or as part of a diversified portfolio.

Dividend Investors (Moderate Yield Seekers): While XLI offers quarterly dividends, its yield is moderate compared to high-dividend sectors like utilities or consumer staples.

Reasons to Invest in XLI

Exposure to a Key Economic Sector: XLI provides targeted exposure to the U.S. industrial sector, which includes critical industries like aerospace and defense, machinery, transportation, and industrial conglomerates (e.g., GE Aerospace, Caterpillar, RTX). These industries are integral to economic growth, infrastructure development, and national security, making XLI a way to capitalize on industrial innovation and economic expansion.

Low Management Expense Ratio (MER): XLI is one of the most cost-efficient industrial ETFs, minimizing expense drag on returns. This makes it attractive for long-term investors seeking to maximize net performance.

Solid Historical Performance: Since its inception, XLI has delivered a strong annualized return. Its focus on large-cap, fundamentally strong companies provides stable, long-term growth potential.

Attractive Dividend Yield: XLI offers a modest but steady income stream.

High Liquidity and Trading Flexibility: XLI is highly liquid, with narrow bid-ask spreads and significant trading volume, making it suitable for both active traders and long-term investors.

Diversification Within the Industrial Sector: XLI offers diversification across industrial sub-industries (e.g., aerospace, machinery, transportation), reducing single-stock risk compared to individual industrial investments. Its large-cap focus adds stability.

Alignment with Macroeconomic Trends: XLI is well-positioned to benefit from macroeconomic tailwinds, such as U.S. infrastructure spending, defense budget increases, and industrial automation. Its sensitivity to economic cycles makes it a tactical play during recovery or expansion phases.

Reasons Not to Invest in XLI

Sector Concentration Risk: XLI is a non-diversified fund, with 100% allocation to the industrial sector, making it vulnerable to sector-specific downturns. Economic recessions, reduced industrial production, or policy shifts (e.g., budget cuts) could negatively impact performance.

Cyclical Nature and Economic Sensitivity: The industrial sector is highly cyclical, with performance tied to economic cycles, interest rates, and industrial activity. During economic downturns or rising interest rate environments, XLI may underperform compared to defensive sectors like utilities or consumer staples.

Geopolitical and Policy Risks: XLI’s holdings, particularly in aerospace and defense, are exposed to geopolitical risks (e.g., trade disputes, wars) and policy changes (e.g., tariffs, defense budget cuts). These factors can introduce volatility and uncertainty.

Limited Dividend Yield for Income Seekers: While XLI’s dividend yield is competitive for a sector ETF, it’s modest compared to high-yield sectors like utilities or dividend-focused ETFs.

Not a Core Portfolio Holding: XLI’s sector-specific focus makes it a satellite holding rather than a core portfolio component.

U.S.-Centric Exposure: XLI is entirely focused on U.S. industrial companies, lacking exposure to global industrials. Investors seeking international diversification may prefer ETFs like the iShares Global Industrials ETF (EXI), which includes firms from Europe and Asia.

Opportunity Cost of Specialization: By investing in XLI, investors may miss opportunities in other sectors or asset classes with higher growth potential or lower risk.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.