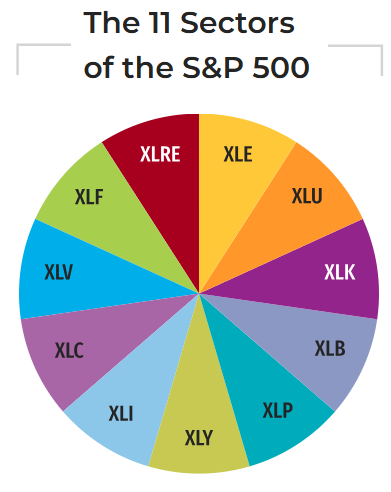

In this series on exchange-traded funds (ETFs), I will examine each of the Select Sector SPDR (Standard & Poor’s Depositary Receipts) Funds. Managed by State Street Global Advisors (SSGA), this family of ETFs allows investors to tailor their exposure to specific segments of the S&P 500 Index. Each fund represents a different sector of the index, as illustrated below, and is designed to track the performance of that sector.

For individuals seeking to learn about analyzing Exchange-Traded Funds (ETFs), I suggest reviewing my earlier post that explains the fundamentals of ETFs and the analysis process.

Analyzing an ETF

An Exchange-Traded Fund (ETF) serves as both an investment product and a collective investment scheme. Let’s break down what this entails:

Technology Select Sector SPDR Fund (XLK) - Snapshot

Overview

The Technology Select Sector SPDR Fund (XLK) is an exchange-traded fund (ETF) that tracks the performance of the S&P Technology Select Sector Index. It primarily focuses on technology companies within the S&P 500, offering exposure to industries such as software, semiconductors, IT services, and more.

Investment Strategy

XLK employs a passive, replication strategy to track the Technology Select Sector Index. This means the fund invests in substantially all the securities in the index, in approximately the same proportions, aiming to mirror its performance. Under normal market conditions, at least 95% of its total assets are invested in the index’s constituents. The fund is non-diversified, focusing solely on technology-related companies within the S&P 500, which excludes smaller-cap firms and results in a tilt toward large, established players. This approach minimizes active management and aims for low tracking error relative to the index.

Top Holdings

As of the latest data, XLK’s portfolio is heavily concentrated in a few mega-cap technology companies:

Common top holdings include:

Apple Inc. (AAPL): A global leader in consumer electronics, known for iPhones, Macs, and services like the App Store, driving innovation and brand loyalty.

Microsoft Corp. (MSFT): A tech titan specializing in software (Windows, Office), cloud computing (Azure), and AI, with a growing presence in enterprise solutions.

NVIDIA Corp. (NVDA): A powerhouse in semiconductors, dominating the GPU market for gaming, AI, and data centers with cutting-edge chip designs.

Broadcom Inc. (AVGO): A semiconductor and software firm, providing critical components for networking, wireless, and enterprise storage solutions.

Adobe Inc. (ADBE): A leader in creative and digital experience software, offering tools like Photoshop and Acrobat, with a strong subscription-based model.

These top five holdings typically account for over 50% of the fund’s assets, with the top 10 constituting about 60-65%. The portfolio includes 73 securities in total, reflecting a concentrated exposure to industry leaders.

Sector Allocation

XLK primarily invests in the technology sector, but its holdings span sub-industries within the S&P 500’s technology classification. The approximate sector breakdown is:

Technology (Hardware, Software, Semiconductors): 85-90%

Communication Services (e.g., telecom-related tech firms): 5-10%

Other (e.g., financial payment processors like Visa or Mastercard, occasionally included): 0-5%

Risk Level

MEDIUM-to-HIGH - due to its sector-specific focus and concentration in a handful of stocks. Its exclusion of smaller, less-stable firms reduces volatility compared to broader tech benchmarks, but it remains sensitive to tech-sector downturns, geopolitical events, and macroeconomic factors like interest rate changes. Historical maximum drawdowns, such as the 82.05% drop during the dot-com bust (recovered over 3,622 trading sessions), highlight its vulnerability to severe market corrections.

Performance

Since its inception on December 16, 1998, XLK has delivered strong long-term performance. As of March 30, 2025, its annualized return since inception is approximately 9-10%.

Performance reflects the tech sector’s growth, driven by companies like Apple, Microsoft, and NVIDIA, but it is not immune to periods of underperformance, such as in 2022.

Expense Ratio

XLK boasts a low management expense ratio (MER) of 0.09%, making it one of the most cost-efficient ETFs in its category.

This means that for every $1,000 invested, the annual cost would be $0.90.

Dividend Yield

XLK offers a modest compared to broader market ETFs, reflecting the tech sector’s focus on growth over income, with an average dividend yield typically ranging between 0.6% and 0.7%. Dividends are paid quarterly.

This means that if you invest $1,000 in this ETF, you can expect to receive approximately $6 to $7 in dividends over a year, assuming the yield remains constant.

Similar Alternatives

Here are some similar alternatives to the Technology Select Sector SPDR Fund (XLK) ETF, each offering exposure to the technology sector:

Vanguard Information Technology ETF (VGT): Tracks the MSCI US Investable Market Information Technology 25/50 Index, providing broader exposure to U.S. tech companies, including small- and mid-cap firms alongside large-caps.

iShares U.S. Technology ETF (IYW): Follows the Dow Jones U.S. Technology Index, focusing on U.S. tech firms across software, hardware, and internet services.

Fidelity MSCI Information Technology Index ETF (FTEC): Tracks the same MSCI US IMI Information Technology 25/50 Index as VGT, offering a nearly identical portfolio with over 300 holdings.

Invesco QQQ Trust (QQQ): Tracks the Nasdaq-100 Index, which is tech-heavy (about 50-60% tech) but also includes non-tech sectors like consumer discretionary.

These alternatives differ in scope (broad tech vs. sub-sectors), diversification (number of holdings), and costs. VGT and FTEC are closest to XLK’s broad tech focus with lower fees, while QQQ adds growth diversity.

This is a comparison of the XLK ETF and similar alternatives, focusing on their Management Expense Ratios (MER), yields, and annualized performances.

Target Investors

The Technology Select Sector SPDR Fund (XLK) ETF appeals to a specific range of investors based on its structure, focus, and risk-return profile. Here are the primary target investors:

Long-Term Growth Investors: Individuals or institutions seeking capital appreciation over time, drawn to XLK’s exposure to leading U.S. tech companies. Ideal for those with a horizon of 5+ years.

Sector-Focused Investors: Those bullish on the technology sector specifically, wanting concentrated exposure to large-cap tech without diversifying across other industries. XLK suits investors who believe tech will continue to outperform broader markets.

Cost-Conscious Investors: With a low expense ratio, XLK is attractive to cost-conscious investors seeking long-term growth.

Passive Index Investors: Fans of passive investing who prefer ETFs tracking established indices (Technology Select Sector Index) over active management. XLK fits those who trust market-weighted performance of tech giants.

Retirement and Portfolio Allocators: Investors using XLK as a core holding within a diversified portfolio, allocating 10-20% to tech for growth while balancing with other sectors or asset classes.

Tactical Traders: Short-term traders or tactical allocators leveraging XLK’s high liquidity and tight spreads to capitalize on tech sector momentum or hedge other positions.

Tech Enthusiasts with Moderate Risk Tolerance: Investors comfortable with moderate-to-high risk tied to sector concentration and volatility, but who prefer stability of large-caps over riskier small-cap or thematic tech funds.

Reasons to Invest in XLK

Exposure to Leading Tech Companies: XLK provides access to some of the largest and most innovative technology companies, such as Apple, Microsoft, and NVIDIA.

Growth Potential: The technology sector has historically delivered strong growth, and XLK allows investors to capitalize on this trend.

Diversification Within Tech: While focused on technology, XLK offers diversification across sub-industries like software, semiconductors, and IT services.

Cost-Effective: With a low expense ratio, XLK is an affordable way to gain exposure to the tech sector.

Liquidity: As one of the largest ETFs, XLK offers high liquidity, making it easy to buy and sell shares.

Dividend Income: Though modest, XLK provides a dividend yield, adding a layer of income to its growth potential.

Reasons Not to Invest in XLK

Sector Concentration Risk: XLK is heavily concentrated in the technology sector, making it vulnerable to sector-specific downturns.

Volatility: The tech sector is known for its high volatility, which may not suit risk-averse investors.

Limited Diversification: While diversified within tech, XLK lacks exposure to other sectors, which could impact portfolio balance.

Economic Sensitivity: Technology companies are often sensitive to economic cycles, interest rate changes, and regulatory shifts.

Overweight in Top Holdings: A significant portion of XLK is allocated to a few top companies, which could amplify risks if these companies underperform.

Overvaluation Concerns: Tech stocks, especially those in XLK, are often viewed as overvalued during bull markets, presenting a risk of correction.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.