For individuals seeking to learn about analyzing Exchange-Traded Funds (ETFs), I suggest reviewing my earlier post that explains the fundamentals of ETFs and the analysis process.

KraneShares CSI China Internet ETF (KWEB) - Snapshot

Overview

The KraneShares CSI China Internet ETF (KWEB)1 is an exchange-traded fund that provides investors with targeted exposure to Chinese internet and internet-related companies listed outside of mainland China.

Launched on July 31, 2013, KWEB tracks the CSI Overseas China Internet Index, which focuses on companies operating in sectors such as e-commerce, social media, online entertainment, and cloud computing. With a focus on China's rapidly growing digital economy, KWEB offers access to industry giants and innovative firms driving technological advancements in the world's most populous nation.

Investment Strategy

KWEB employs a passive investment strategy, aiming to replicate the performance of the CSI Overseas China Internet Index using a representative sampling technique. The fund invests at least 80% of its net assets in securities that mirror the economic characteristics of the index, which includes publicly traded Chinese companies listed on exchanges such as the Hong Kong Stock Exchange, NASDAQ, or New York Stock Exchange.

The index is free-float market capitalization weighted with a 10% capping methodology at semi-annual rebalancing to ensure diversification. KWEB focuses on capturing the growth potential of China's internet sector, encompassing firms in software, IT services, and internet-related technologies, while avoiding excessive concentration in any single holding.

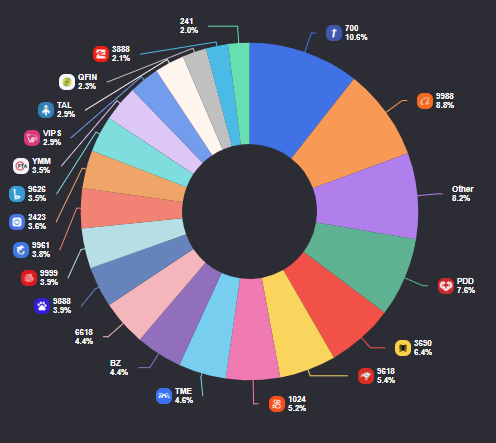

Top Holdings

KWEB’s holdings represent significant players in China's digital economy, reflecting KWEB's focus on internet-driven businesses. Some include:

Alibaba Group Holding Ltd (HKSE:09988) - E-commerce and cloud computing giant.

Tencent Holdings Ltd (HKSE:00700) - Leader in social media, gaming, and digital services.

PDD Holdings Inc (PDD) - Operator of the Pinduoduo e-commerce platform.

Meituan (HKSE:03690) - Provider of food delivery and local services.

Kanzhun Ltd (BZ) - Online recruitment and job search platform.

Sector Allocation

KWEB’s portfolio is highly concentrated in China’s internet and technology sectors, offering targeted exposure with limited diversification beyond these industries. The fund’s sector allocation breaks down as follows:

Consumer Discretionary: Includes e-commerce platforms and online retail services.

Communication Services: Covers social media, digital entertainment, and related services.

Information Technology: Focuses on software development, cloud computing, and IT services.

Risk Level

HIGH – due to its concentrated exposure to Chinese internet companies and the associated geopolitical, regulatory, and market risks. The fund is non-diversified, meaning it has significant exposure to a limited number of sectors and holdings. Volatility is elevated due to factors such as Chinese government regulations, U.S.-China trade tensions, and currency fluctuations.

Performance

Since its inception on July 31, 2013, KWEB has delivered an annualized return of approximately 4.65% as of June 30, 2025, including dividends. This performance reflects the volatility of the Chinese internet sector, with periods of strong growth offset by regulatory crackdowns and market downturns. Past performance is not indicative of future results, and investors should consider the fund's historical volatility.

Expense Ratio

KWEB's management expense ratio (MER) is 0.70% per annum, which is competitive within the China-focused ETF category.

This means that for every $1,000 invested, the annual cost would be $7.

Dividend Yield

KWEB distributes dividends annually, but its yield tends to be relatively modest due to its focus on growth-oriented Chinese internet and technology companies. While the fund does not consistently offer high income, historical data suggests its distribution yield has typically ranged between 0.5% and 2.0% annually.

This means that for every $1,000 invested, you can expect to receive approximately $5 to $20 in dividends over a year, assuming the yield remains constant.

Similar Alternatives

For investors seeking exposure to Chinese equities or technology-focused funds, the following ETFs are comparable alternatives to KWEB:

iShares MSCI China ETF (MCHI) - Tracks the MSCI China Index, providing broad exposure to Chinese companies across various sectors, including internet and technology.

KraneShares MSCI All China Index ETF (KALL) - Tracks the MSCI China All Shares Index, offering diversified exposure to Chinese companies, including those listed in mainland China.

Invesco China Technology ETF (CQQQ) - Focuses on Chinese technology companies, including internet and software firms, tracking the FTSE China Incl A 25% Technology Capped Index.

Target Investors

Growth-oriented investors seeking exposure to China's rapidly expanding internet and technology sectors.

High-risk-tolerant investors comfortable with volatility and geopolitical uncertainties.

Thematic investors focused on digital transformation, e-commerce, and online services in emerging markets.

Diversified portfolio holders looking to allocate a portion of their portfolio to high-growth, high-risk assets.

Reason to Invest…

Exposure to China's digital economy: KWEB provides direct access to leading internet companies driving China's technological growth.

Growth potential: The fund captures the rapid adoption of internet-based services in a populous market.

Diversified internet focus: Includes a range of sub-sectors like e-commerce, social media, and cloud computing.

Established companies: Holds major players like Alibaba and Tencent with strong market positions.

Passive management: Low-cost, transparent strategy tracking a well-defined index.

Global listing advantage: Invests in companies listed on major exchanges, reducing some mainland China-specific risks.

Emerging market exposure: Offers a way to diversify portfolios with exposure to a key emerging market.

Long-term thematic trend: Aligns with the global shift toward digitalization and online services.

Reason Not to Invest…

High volatility: The fund is subject to significant price swings due to market and regulatory factors.

Geopolitical risks: U.S.-China trade tensions and policy changes can impact performance.

Regulatory uncertainty: Chinese government crackdowns on tech firms can lead to sudden losses.

Concentration risk: Heavy focus on internet and tech sectors limits diversification.

Currency risk: Exposure to Hong Kong dollar and other currencies may affect returns.

Non-diversified fund: Limited holdings increase the impact of poor-performing stocks.

Emerging market challenges: China's economic slowdown and political risks may hinder growth.

Complex market dynamics: Understanding China's internet sector requires specialized knowledge.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.