Part 3: My Personal Touch to Benchmarking

A four-part series that illuminates the purpose and limitations of benchmarking, incorporating a personal perspective on my investment portfolio.

The inspiration for this series comes from my benchmarking analysis. During my post-secondary years, I followed the conventional path of investing in mutual funds, which seemed like a logical choice at the time. Nowadays, while I still hold those mutual funds, I've been gradually reducing my stake in them for various reasons (which I won't detail here) and focusing on growing my do-it-yourself (DIY) portfolio using those resources. I'm sharing my insights here for educational purposes.

My DIY Journey in Short

My true investment journey began when I decided to expand my knowledge beyond the basics. Back in 2019, I decided to dive deeper into the world of investing, which led me to become a DIY investor. Initially, my contributions were modest, but they really began to take off in 2022. I'll circle back to this point shortly.

Strategy and Foundation:

I concentrate on strong dividend growers, seeking quality companies with a track record of consistent but growing dividend payments.

They are supplemented by several index funds.

My sector allocation is specific yet flexible, allowing me to adapt to market conditions.

This strategy forms the bedrock of my investment style, shaping my decisions for the years ahead.

Investing is a journey where knowing your destination is essential. My time horizon stretches well into the future, and this is only the beginning. While my approach may evolve, my objective remains steadfast: to navigate the ever-changing investment landscape with intention and adaptability.

Benchmarking Target

In this post, we'll focus on the central theme of benchmarking against the S&P 500. My previous post emphasized that this index might not be the ideal benchmark for a personal investment portfolio. However, the goal of this post is to demonstrate how to benchmark more accurately using this index as a point of reference.

Part 2: Benchmarking to the S&P 500

In my previous post, I delved into benchmarking and its significance. As individual investors, or DIYers, we often measure our performance against prominent market indices, such as the S&P 500, a commonly-used benchmark. In Canada, the S&P/TSX Composite can also serve as a secondary reference point. However, it's essential to recognize that these are tr…

Many investors rely solely on annual returns or returns over specific periods to compare their portfolio's performance. This method is valid if you invested all your capital at the start of the period without making additional contributions. However, most investors add to their portfolios throughout the year, whether weekly, quarterly, or monthly. Therefore, for a more accurate comparison, benchmarking should reflect the scenario where you invested in the alternative over the same period or as closely as possible.

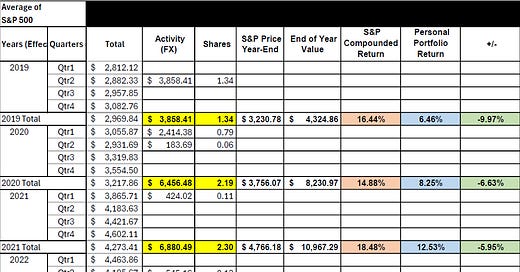

The example in the image illustrates the calculation of the S&P 500's quarterly averages from the start of my investment in 2019 to the end of 2024. The 'activity' column shows my actual contributions for each quarter. Instead of lump-sum investing, I spread my contributions evenly over time. I calculate the hypothetical number of shares I could have bought by dividing my contributions by the index's quarterly average. Then, I multiply the index's year-end value by the hypothetical shares to estimate my total holdings. This process is repeated cumulatively each year. The cumulative return is determined using the Compounded Annual Growth Rate (CAGR) formula to account for return volatility and is then compared to my actual portfolio return (exchange fees have been excluded from this analysis, as they would not significantly alter the results).

Remember when I mentioned starting my investment journey in 2019, but only truly dedicating myself in 2022? That marked the turning point when I began to challenge the S&P 500 benchmark through my outlined benchmarking process. During the years I was not fully invested—or rather, not fully attentive—the S&P 500 significantly outpaced my performance. However, once I realigned my priorities, my portfolio began to approach the S&P 500's cumulative return, as per the earlier mentioned benchmarking exercise. This progress stems from establishing clear objectives, broadening my knowledge, sticking to my strategy, and investing decisively.

Furthermore, my cumulative returns have excelled when applying the same benchmarking method against other indices.

In the final installment of this series, I'll explore my personal cumulative returns alongside comparisons to pertinent indices and sector funds. Subscribe to keep an eye out for it!

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.