Part 2: Benchmarking to the S&P 500

A four-part series that illuminates the purpose and limitations of benchmarking, incorporating a personal perspective on my investment portfolio.

In my previous post, I delved into benchmarking and its significance. As individual investors, or DIYers, we often measure our performance against prominent market indices, such as the S&P 500, a commonly-used benchmark. In Canada, the S&P/TSX Composite can also serve as a secondary reference point. However, it's essential to recognize that these are traditional benchmarks.

Next Steps

Let's explore further. Individual investors may not closely align with established benchmarks, unlike fund managers or institutional investors who often have a pressing need to surpass them. For these professionals, bonuses and career advancement are frequently tied to their performance metrics. In contrast, our investment goals and strategies can significantly differ from theirs.

The S&P 500 has been a formidable presence in the market. A 2019 S&P Global report1 revealed that an overwhelming 89% of large-cap US funds did not surpass the S&P 500 index over a decade, highlighting the need for individual investors to be cautious when using it as a benchmark.

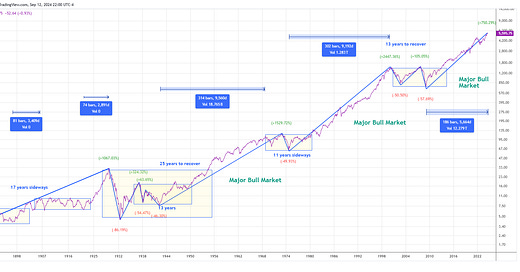

Yet, it's important to remember that the index's performance has not always been positive. It's common to hear claims about the S&P 500's returns, with projections of 10-12% annualized gains based on recent trends. But a closer examination, considering the historical data, reveals periods, often spanning decades, with minimal returns. Indeed, the market does not always ascend; it can experience extended phases of stagnation. I delve into this topic more extensively in my 'Random Investing Notes' series.

A recurrence of this pattern may be on the horizon. Nonetheless, adopting a long-term perspective suggests an overall upward trajectory for the market, requiring patience and time. Keep this in mind.

“History Doesn't Repeat Itself, but It Often Rhymes” – Mark Twain.

Benchmarks do have their significance; when utilized correctly, they provide valuable context, as discussed in my previous post. However, the paramount consideration is ensuring that they align with your personal goals and foster the growth of your cash flow. Ideally, this cash flow should be compounding. If it is not, it may indicate one of two things: either suboptimal investment decisions have been made, or, in a more extreme scenario, it could signify a broader economic downturn.