Quantitative Tightening - Simplified

The Mechanics and Implications of Quantitative Tightening for Beginners

What is Quantitative Easing?

Quantitative tightening (QT) is a monetary policy tool used by central banks to decrease the money supply in the economy. Think of it as the reverse of quantitative easing (QE).

While QE involves the central bank buying financial assets like government bonds to inject money into the economy, QT involves selling those assets or allowing them to mature without reinvesting, effectively pulling money out of circulation. In simple terms, this is how it works:

Central Bank Decision: The central bank decides to reduce the money supply.

Selling Bonds: The central bank sells government bonds it holds.

Maturing Bonds: Alternatively, the central bank allows bonds to mature without reinvesting the proceeds.

Reduced Money Supply: These actions reduce the amount of money circulating in the economy.

Higher Interest Rates: With less money available, interest rates tend to rise. Why? In order to sell these bonds, you need buyers. Buyers will warrant a higher yield.

Reduced Liquidity: There is less liquidity in the financial system, which can slow down economic activity. Why? Borrowing becomes more expensive and demand subsides.

The aim of QT is to control inflation and stabilize the economy by diminishing surplus liquidity. Essentially, QT acts as a roadblock for the economy, making loans more difficult and costly to obtain, thereby deterring excessive spending and investment.

Risks

Quantitative tightening (QT) comes with several risks:

Market Volatility: Reducing liquidity in financial markets can lead to higher volatility, making prices more unpredictable.

In 2018, during the Federal Reserve's phase of QT, the S&P 500 saw notable fluctuations, indicative of investor uncertainty and a reassessment of risk.

Economic Slowdown: By making borrowing more expensive, QT can slow down economic activity, potentially leading to a recession.

The Federal Reserve's 2022 actions to reduce its balance sheet and raise interest rates played a role in the global economic deceleration, which was further intensified by supply chain issues and geopolitical conflicts.

Investor Sentiment: Selling off assets can create a bearish sentiment among investors, negatively impacting stock and bond prices.

The reduction of the Federal Reserve's balance sheet in late 2018 was acknowledged as a contributing factor to the significant downturn in risk assets, which resulted in the S&P 500 falling nearly 20% from its peak.

Higher Borrowing Costs: As the central bank sells assets, interest rates rise, increasing borrowing costs for consumers and businesses.

In January 2008, the borrowing costs for investment-grade firms rose above two percentage points for the first time in five years, resulting in an extended decline in commercial and industrial lending.

Global Impact: QT in major economies can have ripple effects globally, affecting international trade and investment.

The QT measures implemented by the European Central Bank in 2023 resulted in increased long-term interest rates and a flatter yield curve, which impacted economic activities throughout the eurozone.

When should QT stop?

Quantitative tightening (QT) should stop based on several criteria:

Inflation Control: When inflation is under control, meaning it's within the central bank's target range.

Economic Stability: Once the economy shows signs of stability without overheating or contracting sharply.

Ample Reserves: This refers to a scenario in which the central bank holds a significant surplus of excess reserves within the banking system. It indicates that banks possess more reserves than are needed for immediate financial stability, which allows them to fulfill their reserve requirements and have extra capital available for lending or other financial operations.

Economic Conditions: If the economy slows down significantly, central banks might pause or reverse QT to stimulate the economy. In other words, turn to QE.

Market Feedback: Monitoring market reactions and financial conditions can also influence the decision to stop QT.

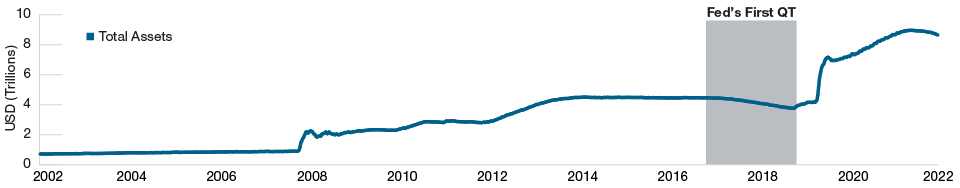

By 2018, the U.S. economy had largely bounced back from the Great Recession. The Federal Reserve aimed to normalize monetary policy to avert an overheated economy. Amidst economic growth and low unemployment, rising inflation became a concern. Quantitative Tightening (QT) served as a mechanism to control inflation. The Fed's balance sheet had swelled due to Quantitative Easing (QE) policies implemented during and after the financial crisis. QT provided a means to shrink the balance sheet gradually, which fell from approximately $4.5 trillion in 2017 to about $3.8 trillion by the end of 2019. The outcomes were mixed; while inflation remained under control, the strategy contributed to heightened market volatility, with notable swings in stock prices and bond yields, reflecting economic uncertainty.

Summation

Quantitative tightening (QT) as a formal policy tool was first used by the Federal Reserve in October 2017. This was the first time a major central bank implemented QT to reduce the size of its balance sheet after a period of quantitative easing (QE) following the global financial crisis.

The effectiveness of QT is a matter of debate. QT aims to control inflation, stabilize the economy, normalize monetary policy, and manage financial risks by reducing the money supply and central bank balance sheet. However, some argue that QT can exacerbate a liquidity crunch as banks need to maintain a minimum level of reserves to meet regulatory requirement so they can fulfill withdrawal requests and other obligations. At the same time, these minimum levels can change depending on economic conditions.

So in the end, this is all a enormous game of Monopoly!

Final Question

If the quantitative tightening (QT) is ‘deemed’ the current official stance of the Federal Reserve at this time (see chart below), then how has the stock market continued its massive climb in such a short period of time? Where is the liquidity coming from? Either the current economic data may not be accurately reflecting the actual situation, or the Federal Reserve might be manipulating the narrative, or it could be a combination of both.

For a greater look into QT, specifically for 2025, the video below is an excellent addition to your learning journey:

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.