Take Four - Random Investing Notes

A collection of insightful investment pieces to broaden knowledge and elevate the investing mindset. Includes: S&P 500 Historical Growth, Risk Terminology, WFH Case, CRE Debt Crisis.

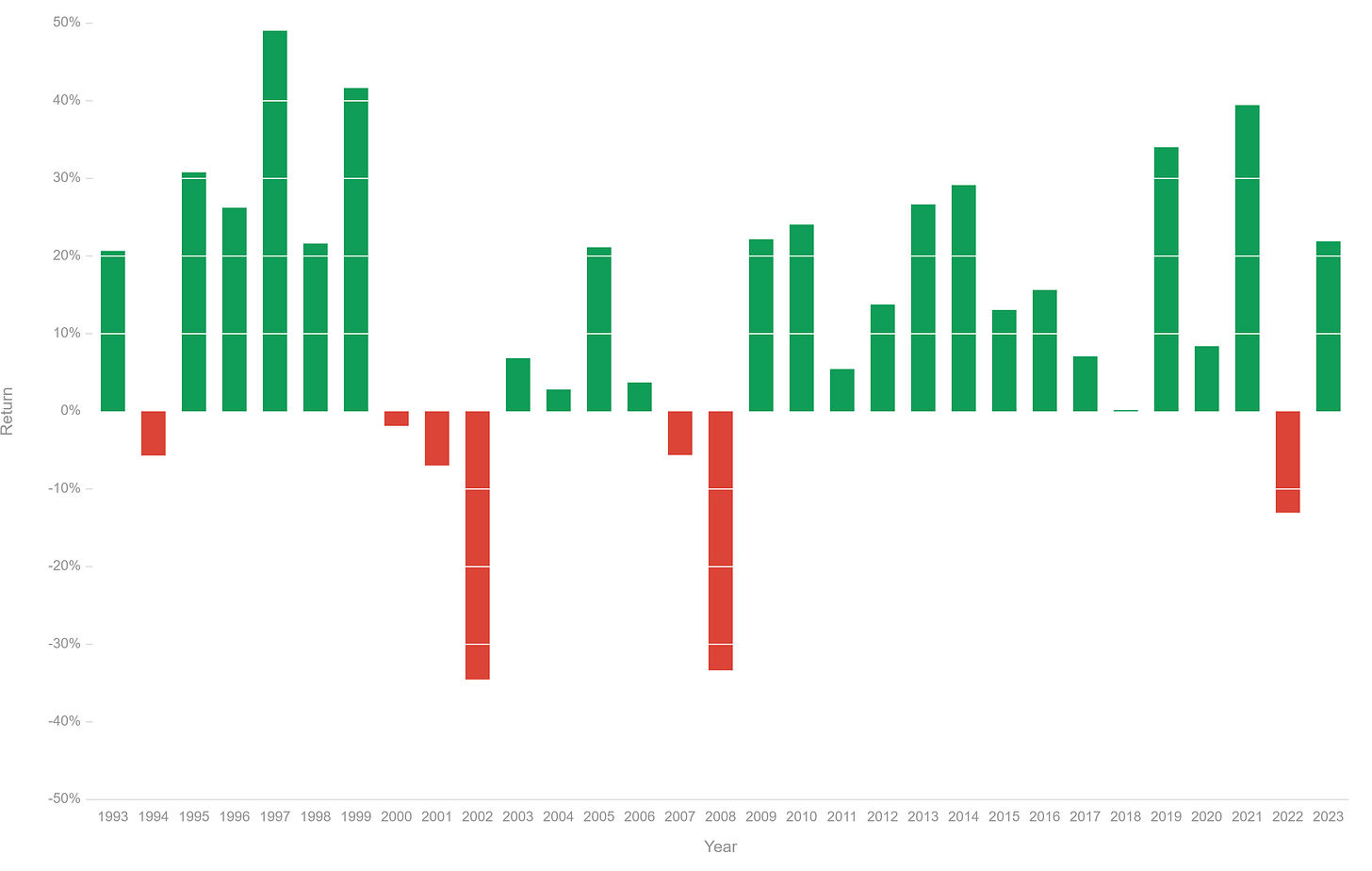

What is the Historical Average Growth of the S&P 500?

Around 10%.

Does that mean it grows exactly around 10% every year?

Not at all.

Does that mean it averages between 8% and 12% per year?

Not at all.

Instead, in most cases, it either massively overperforms or underperforms. To term Howard Marks, there are ‘excesses’ and ‘corrections’.

See the data below and link those coined terms to each year. Then you will understand how the market has averaged such a normal percentage.

Risk Aversion

Risk aversion is often a crucial consideration for investors, though it is sometimes neglected. It doesn't necessarily mean a fear of risk leading to lower returns; instead, it represents a thoughtful and prudent approach to investments to achieve a comfortable balance. A risk-averse investor might still pursue higher returns, but will complement their cautious outlook by conducting extensive due diligence, maintaining skepticism, making conservative projections, and applying a safety margin. These are just some of the methods aid in managing—not avoiding—risk, by accepting a level of risk that is tolerable for one's investment comfort zone. Ultimately, you are avoiding the risk you do not desire!

Risk is the Name of the Game

Risk required is the level of risk an investor must assume to meet their investment objectives.

Longer time horizon or Maximized Returns → Higher level of risk.

Shorter time horizon or Moderate to Low Returns → Lower level of risk.

Risk capacity refers to an investor's ability to withstand risk, taking into account factors beyond their investment objectives.

Do you have surplus savings to allow your investments to compound independently?

Are you employed in a stable, well-paying occupation that allows you to cover your expenses with your income?

Risk tolerance refers to an investor's capacity to endure financial losses without resorting to decisions driven by panic.

Low tolerance → Taking less risk for safer, more liquid investments.

High tolerance → Assuming higher risk in more volatile investments.

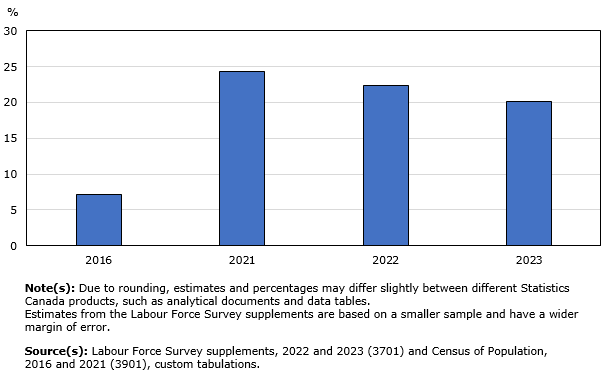

The Case of Working from Home (WFH)

Around 20.1% of employees in Canada typically work from home, compared to 12.7% of employees in the United States who mainly work from home. The majority of these individuals are employed in the finance, insurance, and IT sectors.

Why do they choose WFH?

Because they can, without any loss to productivity.

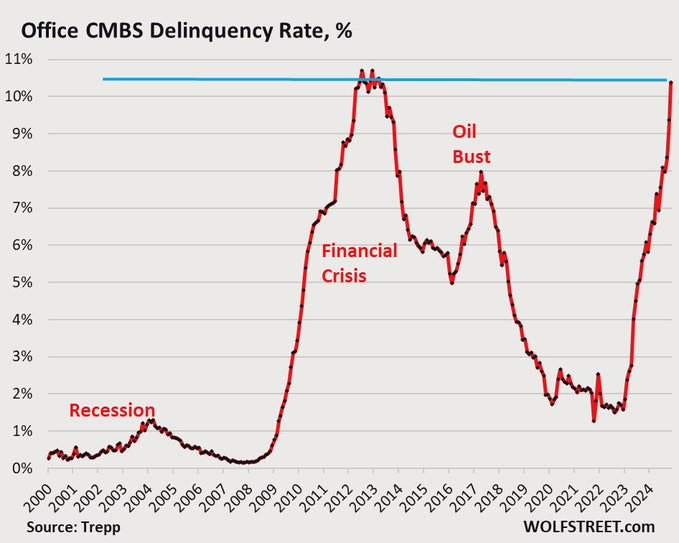

The primary reason (in my opinion) companies are urging employees to return to the office is financial; they wish to avoid the costs associated with renting or leasing partially unoccupied properties. For building owners, high vacancy rates can lead to a significant devaluation of their properties. If they fail to generate sufficient income, they may default on their loans (as is happening).

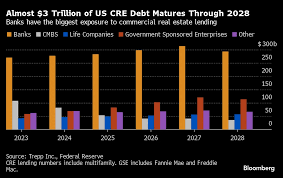

And if you haven't noticed, a significant debt crisis in commercial real estate (CRE) is looming in the next few years. Banks with a high proportion of CRE loans could be severely affected.

Here’s some cases for WFH policies:

More productive matches between job and worker are achieved if you don’t have a strict schedule in an office benefitting all parties.

Sitting in a car and commuting long distances is not productive for anyone.

These flexible WFH arrangements have led to improved morale and better work-life balance.

Companies may face the loss of top talent if they implement these mandates. For example, in the IT sector, there are competitors ready to provide work-from-home options.

My take is simple - experienced individuals are well-aware of their responsibilities and can operate autonomously, often finding they are more productive when WFH. Conversely, those who are new to their careers gain valuable experience from the teamwork, networking, and training available at a physical workplace. It is beneficial for them to be present at least a few days a week, preferably simultaneously, to foster interaction. It’s a win-win for all those involved in my view. But only certain sectors can benefit from it, obviously.

Past Editions

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!

Please refer to the details of the referral program below.

Invite your friends to read DiviStock Chronicles

Thank you for reading DiviStock Chronicles — your support allows me to keep doing this work. Join our referral program!