ZCN - ETF Overview

A Comprehensive Guide to the BMO S&P/TSX Capped Composite Index ETF (ZCN)

For individuals seeking to learn about analyzing Exchange-Traded Funds (ETFs), I suggest reviewing my earlier post that explains the fundamentals of ETFs and the analysis process.

Analyzing an ETF

An Exchange-Traded Fund (ETF) serves as both an investment product and a collective investment scheme. Let’s break down what this entails:

BMO S&P/TSX Capped Composite Index ETF (ZCN) - Snapshot

Overview

The BMO S&P/TSX Capped Composite Index ETF (ZCN) is an exchange-traded fund launched and managed by BMO Asset Management Inc. It seeks to provide investors with exposure to the broad Canadian equity market by tracking the performance of the S&P/TSX Capped Composite Index, net of expenses. The index comprises the largest and most liquid securities listed on the Toronto Stock Exchange (TSX), selected based on market capitalization, liquidity, and fundamentals, with a 10% cap on individual constituent weightings to promote diversification.

Investment Strategy

ZCN employs a passive investment strategy, aiming to replicate the performance of the S&P/TSX Capped Composite Index through a full replication technique. This involves holding the constituent securities of the index in the same proportions as the index itself. The index, which includes over 200 TSX-listed companies, is market-cap weighted but caps any single stock at 10% to mitigate concentration risk. The fund may occasionally use a sampling methodology to track the index, which rebalances quarterly. By focusing on large-cap companies across all Global Industry Classification Standard (GICS) sectors, ZCN provides broad exposure to the Canadian equity market, emphasizing stability and liquidity.

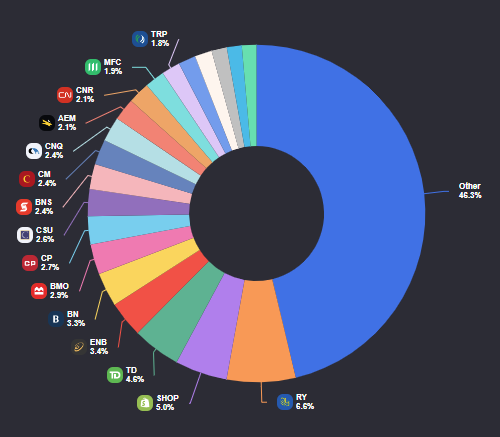

Top Holdings

The following is based on the general composition of the S&P/TSX Capped Composite Index, which ZCN tracks. The index typically includes major Canadian companies across various sectors. Based on typical index composition, the top holdings (as of recent data) likely include:

Royal Bank of Canada (RBC) – Financials

Toronto-Dominion Bank (TD) – Financials

Canadian National Railway (CNR) – Industrials

Enbridge Inc. – Energy

Shopify Inc. – Technology

These holdings reflect the index’s focus on large-cap, liquid Canadian firms, particularly in financials, energy, and industrials.

Sector Allocation

The S&P/TSX Capped Composite Index, which ZCN tracks, provides diversified exposure across all GICS sectors. Typical sector allocations for the index (and thus ZCN) include:

Risk Level

MEDIUM - As it tracks the S&P/TSX Capped Composite Index, it is subject to market risks associated with Canadian equities, including volatility due to economic cycles, commodity price fluctuations (notably in energy and materials), and currency risk for non-Canadian investors. The 10% cap on individual holdings reduces concentration risk compared to uncapped indices, but the fund’s heavy exposure to financials and energy sectors ties its performance to these industries’ performance.

Performance

Since its inception on May 29, 2009, ZCN has delivered an average annual return of 8.70%.

Expense Ratio

The Management Expense Ratio (MER) for ZCN is 0.06%, making it one of the lowest-cost ETFs in its category. This low MER reflects BMO’s efficient management and the passive nature of the fund, which minimizes active trading and operational costs.

This means that for every $1,000 invested, the annual cost would be $0.60.

Dividend Yield

ZCN’s historical average dividend yield is approximately 2.54% (as of July 7, 2025).

This means that if you invest $1,000 in this ETF, you can expect to receive approximately $25 in dividends over a year, assuming the yield remains constant.

Similar Alternatives

Three comparable ETFs that provide exposure to the Canadian equity market are:

iShares Core S&P/TSX Capped Composite Index ETF (XIC): Tracks the same S&P/TSX Capped Composite Index as ZCN, offering broad Canadian market exposure with a focus on large-cap stocks.

Vanguard FTSE Canada All Cap Index ETF (VCN): Tracks the FTSE Canada All Cap Index, which includes large-, mid-, and small-cap Canadian stocks, providing slightly broader exposure than ZCN.

Horizons S&P/TSX 60 Index ETF (HXT): Tracks the S&P/TSX 60 Index, focusing on the 60 largest and most liquid Canadian companies, offering less diversification than ZCN but targeting blue-chip stocks.

Target Investors

ZCN is suitable for:

Long-term investors seeking broad exposure to the Canadian equity market.

Cost-conscious investors prioritizing low fees for passive index tracking.

Diversified portfolio builders looking to allocate to Canadian large-cap stocks.

Dividend-focused investors interested in steady income from Canadian equities.

Beginner investors wanting a simple, low-maintenance investment vehicle.

Retirement savers aiming for stable growth within registered accounts.

Reasons to Invest in ZCN

Broad market exposure: ZCN provides access to a wide range of Canadian companies, capturing the overall performance of the TSX.

Diversification: The fund spans multiple sectors, reducing reliance on any single industry.

Low-cost structure: Its minimal MER makes it an economical choice for long-term investing.

Passive strategy: The index-tracking approach eliminates the need for active stock picking.

Dividend income: Offers consistent dividend payouts from Canada’s top companies.

Liquidity: High trading volume ensures ease of buying and selling shares.

Stability: Focus on large-cap stocks provides relative stability compared to smaller-cap funds.

Reputable management: BMO Asset Management Inc. is a trusted provider with a strong track record.

Reasons Not to Invest in ZCN

Limited growth potential: Large-cap focus may miss higher-growth opportunities in small- or mid-cap stocks.

Sector concentration: Heavy weighting in financials and energy ties performance to these sectors.

No active management: Passive strategy cannot adapt to market changes or outperform the index.

Currency risk: Non-Canadian investors face exposure to CAD fluctuations.

Market dependency: Performance is tied to the Canadian economy, which may underperform global markets.

Dividend variability: Payouts depend on underlying companies, which may cut dividends in downturns.

No international exposure: Lacks diversification outside Canada, limiting global opportunities.

Interest rate sensitivity: Financials-heavy portfolio may be impacted by rising interest rates.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.