Running deficits have been a common theme for many governments globally, particularly the United States (US), with seemingly no plan to repay the debt. As we move through 2025, we should be prepared to embrace volatility. Let's examine the challenges the major powerhouse, the US government, faces this year.

Since the 2008 Great Financial Crisis (GFC), the US government has continuously run deficits without achieving a surplus. When budget revenues, such as taxes, are insufficient to cover expenses, a deficit occurs, necessitating borrowing to bridge the gap.

How does the government then fund itself?

They need to sell Treasury securities.

Treasury bills (T-bills) and Treasury bonds (T-bonds) are both government-issued debt securities, but they differ in terms of maturity and interest payments:

T-bills: These are short-term investments that mature in one year or less. They are sold at a discount and redeemed at face value upon maturity. T-bills do not pay periodic interest but instead offer a return based on the discount.

T-bonds: These are long-term investments with maturities ranging from 20 to 30 years. T-bonds pay semi-annual interest and return the face value at maturity.

In order to sell these securities, there needs to be demand for them.

Who are the buyers?

The top three holders of US debt are:

Foreign entities

US Mutual Funds

The Federal Reserve (the FED)

US Debt Landscape in 2025

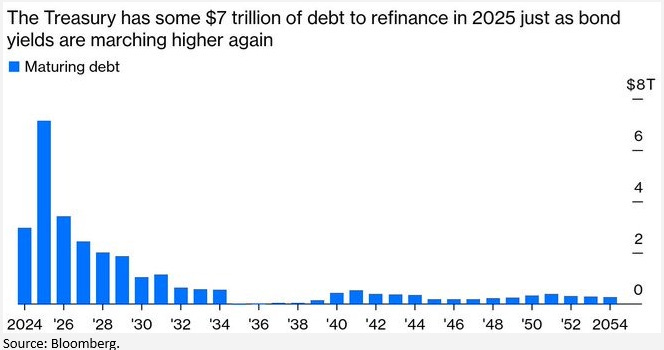

The US government is facing significant challenges heading into 2025. With approximately $3 trillion in treasury bills maturing and needing to be refinanced, and an additional $2 trillion in debt required to fund its deficit, the US will need to find buyers for around $5 trillion.

Japan, the largest foreign holder of US debt, is also experiencing economic difficulties.

Similarly, Europe, which has significantly increased its US debt holdings in recent years, may not be eager to purchase more. China, the second-largest holder of US debt, has been steadily reducing its share since 2020. Demand is waning.

This is a significant reason why yields have been increasing. Buyers now demand a greater risk premium on US debt due to the substantial debt burden, sticky inflation, and the potential risk of an economic recession. The Federal Reserve's quantitative tightening (QT) since 2022 hasn't alleviated this issue.

It's important to note that the Federal Reserve has a more pronounced influence on short-term rates, which impacts the rates at which the US government borrows. However, the Fed has less control over long-term rates, which affect everyone else's borrowing costs from mortgage rates to car loans. Long-term rates are more dictated by inflation expectations, economic growth projections, and global market conditions. This dynamic is evident in the markets today, potentially leading to reduced spending and a slower economy as borrowing becomes more expensive.

During Janet Yellen’s time as Treasury Secretary, the Treasury focused heavily on using short-term Treasury bills (T-bills) to fund deficits. This approach was influenced by historically low interest rates and the immediate fiscal needs brought on by the pandemic. However, Scott Bessent, the incoming Treasury Secretary, has expressed concerns about this strategy. While Yellen’s method provided near-term flexibility and kept borrowing costs low, Bessent considers it risky due to the constant need for refinancing and the unpredictable nature of short-term markets. He is advocating for a strategic pivot towards issuing long-term debt, which he believes will offer greater stability and reduce refinancing risks.

Path Forward

Inflation or Recession?

The US likely won’t be able to avoid both outcomes, but one will precede the other.

If demand for US Treasury securities falls short, the Fed would have no option but to step in as a buyer, reengaging in its quantitative easing (QE) program through money printing. Additionally, to alleviate future debt payment burdens, the Federal Reserve may be compelled to cut rates more aggressively than expected. However, this would likely lead to increased inflation, furthering their strategy of inflating away the debt until an inevitable recession occurs.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.