Part 4: Benchmarking Investment Returns - Finding Relevant Indices

A four-part series that illuminates the purpose and limitations of benchmarking, incorporating a personal perspective on my investment portfolio.

If you haven't read my earlier posts in this series, I recommend that you do. Comprehending the context is essential to fully understand the message I wish to communicate.

In Part 3, I analyzed the returns of my personal portfolio since its start against the renowned S&P 500 index. Although the S&P 500 may not reflect everyone's individual objectives, it provided a clear benchmark for understanding effective comparisons.

Part 3: My Personal Touch to Benchmarking

The inspiration for this series comes from my benchmarking analysis. During my post-secondary years, I followed the conventional path of investing in mutual funds, which seemed like a logical choice at the time. Nowadays, while I still hold those mutual funds, I've been gradually reducing my stake in them for various reasons (which I won't detail here) …

In this last part of the series, I will explore additional relevant indices to use as benchmarks for assessing my investment performance.

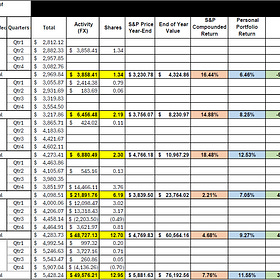

However, before we delve into that, it's important to make a fair comparison. As a Canadian investor, it's appropriate to compare my returns with the S&P/TSX Composite Index, which reflects the Canadian stock market. Although the S&P 500 often surpasses the S&P/TSX Composite Index, it's proper to evaluate both. I have applied the same benchmarking approach outlined in Part 3. The results are displayed in the accompanying image.

In my quest to find other indices that align with my investment style, I discovered XAW to be a strong candidate for my initial benchmark comparison. It aligns closely with my targeted sector allocation, with the primary discrepancy being an almost exact inverse between healthcare and utilities. XEQT was another contender, offering similar sector weightings, though not as closely aligned with XAW. Searching for a dividend growth-focused index proved more difficult, but ZDY emerged as the nearest match. Finally, I considered combining various sector-specific ETFs, such as XLE, XLF, XLK, etc., to mirror my desired sector allocation percentages.

In summary, my performance has improved significantly over the years due to increased dedication and knowledge, resulting in my current outperformance compared to the mentioned benchmarks. Although past performance does not predict future results, the key takeaway is to always conduct thorough research before investing. For those aiming to create their own stock portfolio, education is crucial. Beginners should start with index funds before delving into individual stock selection. While index funds are suitable for everyone, picking individual stocks is not for everyone.

Analyzing an ETF

An Exchange-Traded Fund (ETF) serves as both an investment product and a collective investment scheme. Let’s break down what this entails:

This series aimed to demystify benchmarking and empower you to make more informed investment decisions. Rather than obsessing over beating indices, focus on your personal financial goals. Tailor your strategy accordingly. Happy investing!

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.