Take 16 - Random Investing Notes

A collection of insightful investment pieces to broaden and elevate the investing mindset. Includes: 1) Limiting Losses, 2) Stop-Loss Orders, and 3) Debt vs. Equity

Limit Your Losses

For an average investor, this chart illustrates the importance of limiting losses early to avoid the steep climb needed to recover from bigger drops. The bigger the loss, the harder it is to get back to even!

The Core Idea: Imagine you invest $100. If that investment drops to $90 (a 10% loss), you might think you only need to gain 10% back to get to $100. But that's not how it works! If you have $90 and it gains 10%, you only have $99 ($90 * 1.10 = $99). You need more than a 10% gain to get back to your original $100. This image illustrates exactly how much more.

Left Side (Red Bars - "% Loss"): This side shows various percentage losses you might experience on an investment. For example, if your investment drops by 5%, 10%, 20%, and so on, down to 80%.

Right Side (Green Bars - "% Gains Needed"): This side shows the corresponding percentage gain required to get your investment back to its original value after sustaining the loss on the left.

Here’s a breakdown:

A small loss of 1% only requires a 1% gain to recover.

A 5% loss needs an 5% gain.

As losses get bigger, the recovery gains increase more sharply. For example:

A 10% loss requires an 11% gain.

A 20% loss needs a 25% gain.

A 50% loss requires a 100% gain (doubling your money).

An 80% loss demands a massive 400% gain.

The ideal range for stop losses (cutting losses) is around -1% to -5%, where recovery is manageable. Beyond a -10% loss, things get difficult, and taking a loss here is still considered manageable but challenging. Larger losses (e.g., -50% or more) make recovery extremely tough, often requiring unrealistic gains.

As an investor, here are some things to consider:

Risk Management: This chart highlights why managing risk and limiting losses is so important. A small loss is a hiccup; a large loss can be devastating to your portfolio and extremely difficult, if not impossible, to recover from.

Stop-Loss Orders: It reinforces the concept of "stop-loss" orders, which are automated instructions to sell an investment if it drops to a certain price, thereby limiting your potential losses.

Realistic Expectations: It sets realistic expectations about investment recovery. Don't underestimate how much you need to gain back after a significant loss.

Emotional Discipline: It encourages emotional discipline. It's easy to "hope" an investment will come back, but this chart shows the mathematical reality of what's required. Sometimes, the best decision is to accept a smaller loss to protect your capital for future, better investments.

Stop-Loss Orders

A stop-loss order is a tool you can use with your broker to automatically sell a stock or other investment if its price drops to a certain level you set in advance. Although it doesn’t guarantee the exact price you set due to market volatility, but it’s a smart way to manage risk as an average investor acting as a safety net to limit your losses if the market moves against you.

How It Works

You decide the price at which you’re willing to sell if the stock falls (e.g., 5% below your purchase price).

You place the stop-loss order with your broker, setting that price as the "stop" level.

If the stock hits that price, the order turns into a market order and sells the stock, helping you avoid bigger losses.

How to Use It

Set a Realistic Level: For example, if you buy a stock at $100, you might set a stop-loss at $95 (a 5% drop) to protect yourself from a big decline.

Place the Order: Use your brokerage account to enter the stop-loss order when you buy the stock or anytime after.

Adjust as Needed: If the stock price rises, you can move the stop-loss up to lock in profits or reduce risk (this is called a trailing stop).

Monitor It: While it’s automatic, keep an eye on market conditions, as fast-moving markets or gaps in price can sometimes lead to selling at a lower price than your stop.

Why It’s Useful

It helps you stick to a plan and avoid emotional decisions during a market drop.

Based on the earlier image, keeping losses small (e.g., 5-10%) makes recovery easier, and a stop-loss can enforce that discipline.

Debt vs. Equity

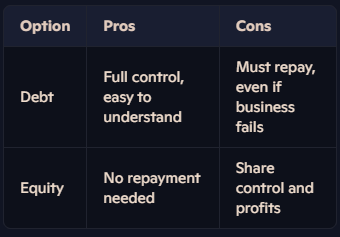

This short outlines the two primary methods of financing a business: debt and equity.

What Is Debt?

Debt means borrowing money with a promise to pay it back—plus a little extra, called interest.

You keep full control of your business.

You must repay the money, even if the business struggles.

It’s like “renting” money—use it now, return it later with a bonus.

Example: You borrow $100,000 at a 10% interest rate to launch your business. Over time, you repay $110,000, covering both the loan and interest. You retain 100% ownership and full control of your business—even after repayment.

What Is Equity?

Equity is when someone gives you money in exchange for part ownership of your business.

No repayment is required.

You share profits and decisions with your new partner.

Equity means your business is now a shared project.

Example: An investor contributes $100,000 in exchange for 10% ownership of your business. You remain the majority owner with 90% of the company, and there’s no obligation to repay the investment. However, the investor now shares in 10% of the profits—and the risk. If the business thrives, they benefit alongside you. If it struggles, they share the downside too.

Past Editions

Includes: 1) Credit Ratings, 2) Pricing Power, & 3) The Renewables Dilemma.

Includes: 1) Stock Checklist, 2) Dividend Strength Data, & 3) Lessons from Warren Buffet and Mark Leonard.

Includes: 1) Power of Dividends, 2) Stocks with China Exposure, 3) Tips to Managing Portfolios, & 4) Accepting Volatility

Includes: 1) Advantage of Dividend Stocks, 2) Recessionary Dividend Performance, 3) Railroad Stocks, & 4) Reducing Risk

Includes: 1) Investment Planning, 2) Returns After First-Rate Cut, 3) Investment Accounts in Canada, &

4) Hyperscalers.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.