Take 13 - Random Investing Notes

A collection of insightful investment pieces to broaden and elevate the investing mindset. Includes: Power of Dividends, Stocks with China Exposure, Tips to Managing Portfolios, & Accepting Volatility

The Power of Dividends

The hidden power of dividends is real. Here are some points to strengthen your view on dividend payers:

Opportunity in Market Crashes: While most people panic during market crashes, savvy investors see it as an opportunity. Volatility is not the enemy.

Dividends Stay Steady: Even when stock prices drop significantly, dividends often remain intact. For instance, despite Canadian Tire’s (CTC.A) falling stock price, its dividend has increased every year.

Increased Yield During Downturns: When stock prices fall but dividends remain the same, the yield (dividends as a percentage of stock price) increases. Buying stocks during downturns can result in higher yields.

Dividends Are Resilient: Companies prioritize maintaining dividends, even during tough times, as cutting dividends signals trouble. For example, Fortis (FTS) has raised its dividend for 50+ consecutive years.

The Power of Growing Dividends: Warren Buffett’s investment in Coca-Cola demonstrates how growing dividends over time lead to significant returns. His yield on the original investment is now over 60% annually.

Portfolio Resilience: Dividend-focused investments provide stability and cash flow even in volatile markets.

Advice for Investors: Investing in companies with a long history of paying and increasing dividends offers peace of mind and potential higher yields during market crashes.

Embrace dividends as a strategy to capitalize on market volatility and build long-term wealth. However, avoid relying solely on dividend-paying stocks for your investments, as there are potential risks and warning signs highlighted in Take 10.

How to Manage One’s Portfolio

The overarching advice is to focus on discipline, patience, and compounding for long-term investment success. Here are some main considerations to take into account when building and managing your investment portfolio:

Buy Great Companies: Focus on businesses with competitive advantages, trustworthy management, healthy balance sheets, high profitability, smart capital allocation, and growth opportunities.

Don't Overpay: A great business can be a bad investment if purchased at an inflated price. Price does matter!

Quality Stock Selection:

Use a Buy-Hold-Sell list to identify reasonably priced companies.

Research only those companies you understand, find interesting, and can evaluate long-term. Don’t follow the herd.

Look for financial health (low debt, high margins, consistent growth) and reasonable valuation.

Position Sizing: Invest 3-6% per company, scaling based on confidence and company quality as long as it continues meeting your investment thesis.

Diversification: Own 15-20 companies to balance market and company-specific risks. Refer back to my topic on Diversification in Take 7.

Selling Strategies:

Sell only for good reasons, like a competitive edge lost, management changes, or the stock becoming excessively expensive.

Avoid selling due to short-term price movements or macroeconomic concerns.

Long-Term Focus: Let quality companies compound growth; avoid excessive trading.

Stocks with Significant China Exposure

The potential effects of retaliatory tariffs between the U.S. and China on companies with substantial operations or revenue from China are profound. Here are some U.S. companies with significant exposure to the Chinese market amidst escalating trade tensions:

Nike: 15% of sales come from China, the second-largest production center after Vietnam.

Apple: 16% of revenue originates in China, with most iPhones assembled there.

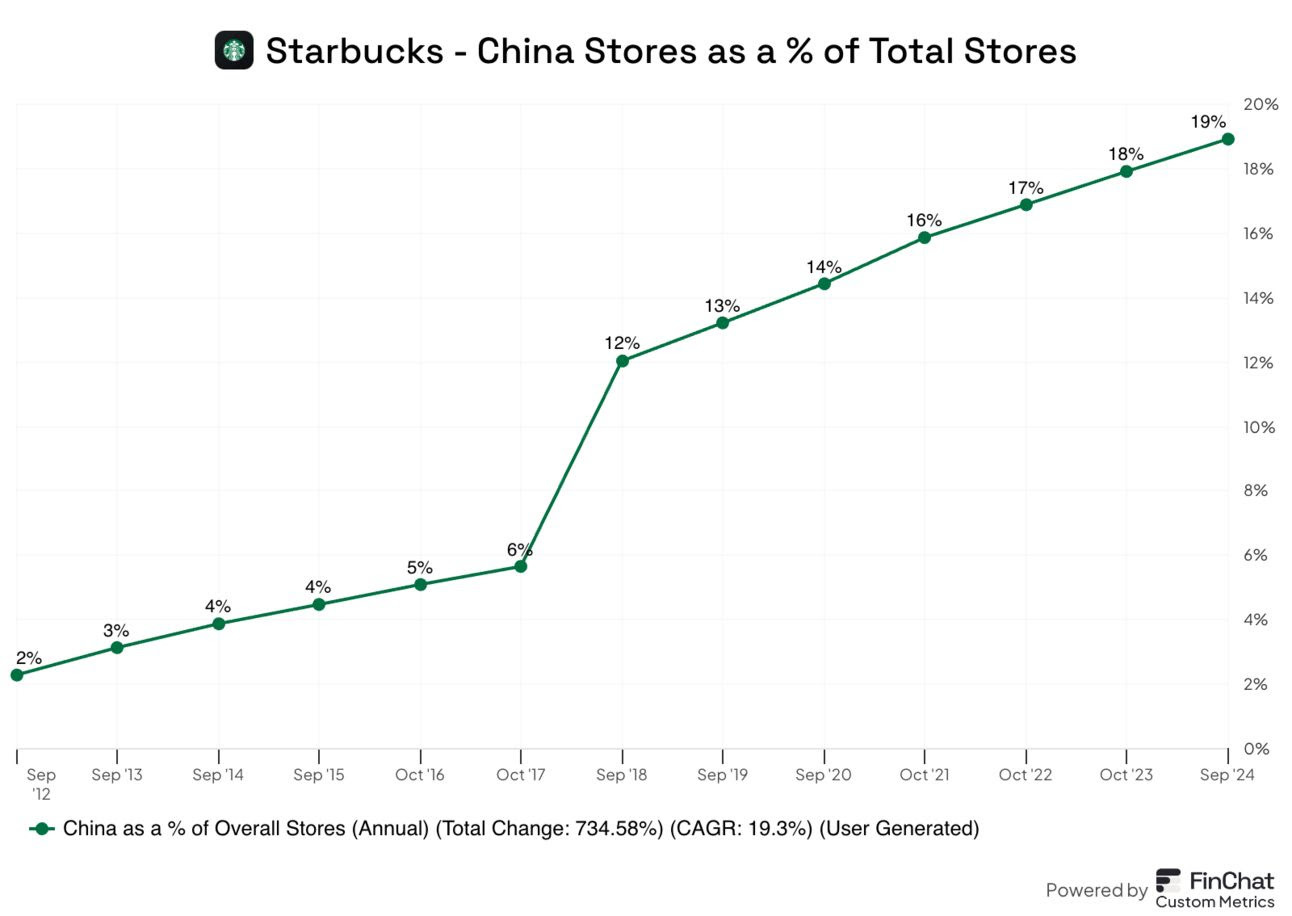

Starbucks: Less than 10% of revenue comes from China, but the country has 19% of its stores.

Intel: China is its largest market, accounting for 29% of sales.

Tesla: China represents 21% of revenue, with over 50% of EV production occurring at its Shanghai factory.

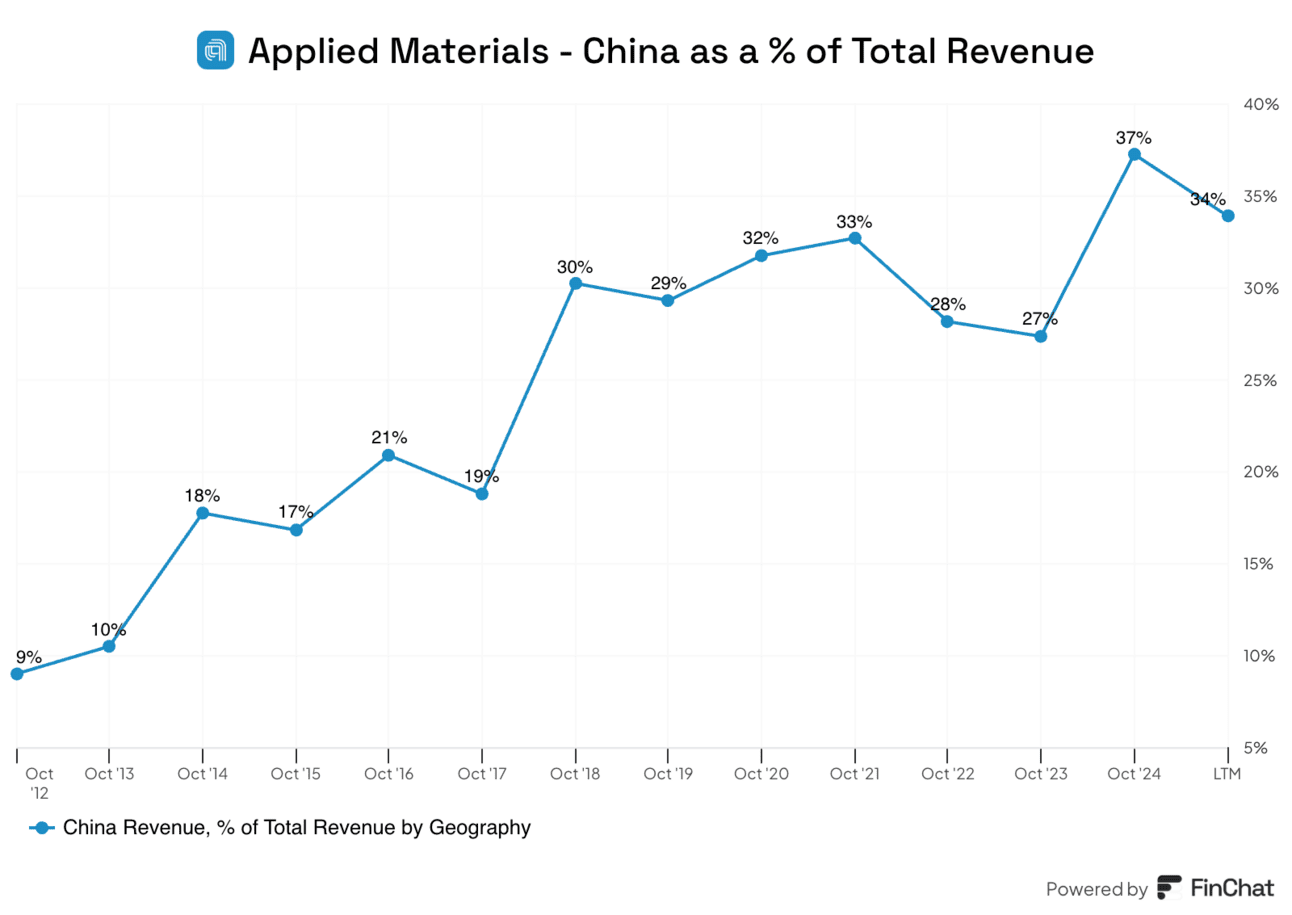

Applied Materials: 34% of sales are in China, the largest market for this semiconductor equipment supplier.

Accepting Volatility

The equity market thrives on volatility—it’s an essential ingredient for generating meaningful returns. Safe investments, like guaranteed investment certificates (GICs), offer stability by eliminating volatility, ensuring a predictable but modest return. However, for those seeking higher gains, volatility is a necessary factor. Rather than fearing market fluctuations, investors should embrace them as opportunities for long-term wealth creation. Here are some key considerations:

Market Volatility: The market has seen dramatic swings, making short-term news seem more significant than it really is. While institutions focus on quarterly performance, individual investors can take advantage of long-term opportunities.

Volatility as a Price for Long-Term Returns: Accepting that stock market volatility is normal and necessary for achieving higher returns compared to safer investments like savings accounts.

Uncertainty Creates Opportunities: Howard Marks, an American investor and well-known author, argues that periods of uncertainty often present the best buying opportunities, as asset prices reflect investor fear rather than actual value.

Welcoming Lower Prices: Warren Buffett, an American investor, businessman, and philanthropist, advises long-term investors to embrace lower stock prices as opportunities rather than risks. Investing during downturns can yield significant rewards.

Managing Emotions: Peter Lynch, an American investor, mutual fund manager, and author, highlights the importance of emotional discipline in investing. Unlike fund managers who face pressure from clients, individual investors have the advantage of making decisions without external influence.

Great investors view downturns as chances to invest in undervalued assets. Over time, markets stabilize, and stock prices reflect the true value of strong companies. Happy investing!

Past Editions

Includes: 1) Advantage of Dividend Stocks, 2) Recessionary Dividend Performance, 3) Railroad Stocks, & 4) Reducing Risk

Includes: 1) Investment Planning, 2) Returns After First-Rate Cut, 3) Investment Accounts in Canada, &

4) Hyperscalers.

Includes: 1) Dividend Growth Strategy, 2) Tariff Threats, 3) Importance of 10-Year Yield, & 4) Portfolio Building.

Includes: 1) China's Surplus, 2) Global Valuations, 3) Long-Term Investing, & 4) Trading vs. Investing

Includes: 1) 2024 US Market Review, 2) Concentration Risk, 3) Retail Sales Trajectory, & 4) Earnings vs. S&P500

Includes: 1) S&P 500 Valuation, 2) Canada’s Weak Economy, 3) Investment Vehicles in Canada, & 4) Diversification

Includes: 1) Yield Curve Inversion, 2) Tech Bubbles, 3) Gold vs. Treasuries, and 4) VIX.

Includes: 1) Trade Balances, 2) Deflation from China, 3) Global Reserve Currency, and 4) 2024 US Election Aftermath.

Includes: 1) S&P 500 Historical Growth, 2) Risk Terminology, 3) WFH Case, and 4) CRE Debt Crisis.

Includes: 1) Purchasing Power, 2) Global Liquidity, 3) Currency Debasement, 4) Hurdle Rate, and 5) Liquidity Cycles.

Includes: 1) Tough Industries to Invest In, 2) First Rule of Compounding, 3) CDN Focused Portfolios, and 4) Beta.

Includes: 1) MOATs, 2) Portfolio Recession Crashes, 3) Capital Allocation, and 4) CDN vs US Dividend Growers.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.