Take 14 - Random Investing Notes

A collection of insightful investment pieces to broaden and elevate the investing mindset. Includes: Stock Checklist, Dividend Strength Data, and Lessons from Warren Buffet and Mark Leonard.

Checklist for Stocks

Many investors lack a reliable method for evaluating stocks when creating a stock watchlist. They often follow the crowd without understanding why a particular stock might be a good choice at that time. This checklist is just one of many tools available to help investors avoid common pitfalls, such as chasing hype, investing in heavily indebted companies, or overpaying stocks. It prioritizes simplicity, safety, and comprehension while advocating for a clear and systematic approach to stock analysis.

Five Straight Years of Profit: Look for consistent net income and free cash flow over the past five years.

Sales and Earnings Growth: Revenue and earnings per share should grow steadily, around 5% or more per year.

No Debt Problem: Debt should not exceed three times yearly free cash flow to ensure financial health.

Return on Capital Above 15%: High ROIC indicates efficient reinvestment and strong shareholder value creation. ROIC has been expanded on in Take Ten.

Fair or Cheap Price: Use metrics like the price-to-free-cash-flow ratio or DCF analysis to ensure reasonable valuation.

Understandability: You should be able to explain the business and its profit model concisely.

Competitive Moat: Assess features like brand strength, customer loyalty, and high switching costs to gauge the company’s ability to fend off competitors. MOATs have been explained in Take One.

Dividend Growth Strength

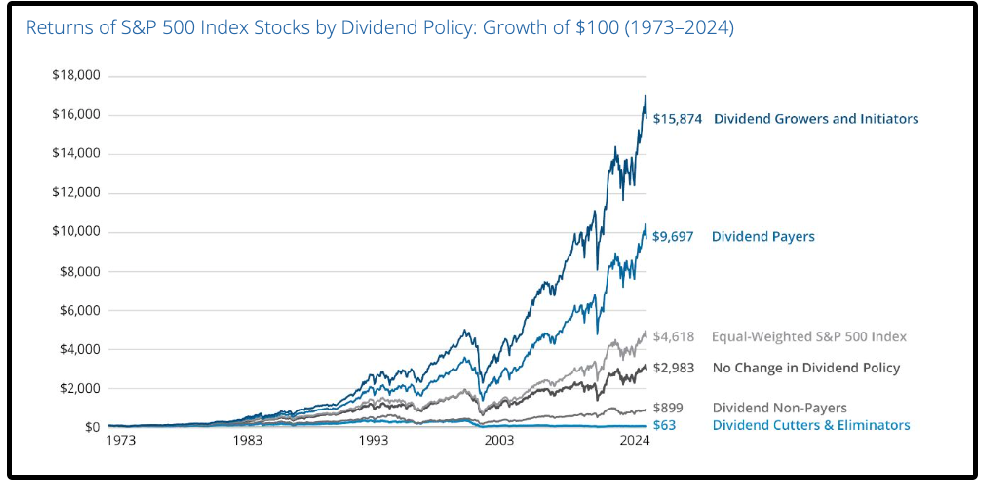

Dividend investing is a proven strategy, delivering steady income, stronger long-term returns, reduced volatility, and stability during market declines. My publications consistently advocate building a portfolio of high-quality dividend-paying stocks to attain financial independence.

Here are some prominent reasons1 as to why:

Dividend Growth Delivers Superior Performance – Companies that grow or initiate dividends have historically provided higher total returns, reflecting strong financial health and strategic management.

Dividend Growth Stocks Are Less Volatile – Dividend-paying stocks tend to have lower volatility, making them a more stable investment choice. Learn about beta in Take Two.

Power of Compounding Dividends – Reinvesting dividends, much like reallocating extra income from raises or savings, greatly enhances investment returns. For example, a $10,000 investment in the S&P 500 in 1960 would have grown to approximately $6.4 million by 2025 with dividends reinvested, compared to just $982,000 without reinvestment.

Lessons from The Oracle of Omaha

Warren Buffett, often called the "Oracle of Omaha," is one of the most successful investors in history. Born on August 30, 1930, in Omaha, Nebraska, he showed an early interest in business and investing, buying his first stock at age 11. Buffett studied under Benjamin Graham, the father of value investing, at Columbia University, which shaped his investment philosophy.

He took control of Berkshire Hathaway in 1965, transforming it from a struggling textile company into a powerhouse holding company with investments in diverse industries. Known for his frugality despite immense wealth, Buffett has pledged to donate 99% of his fortune to philanthropic causes. His investment strategies emphasize patience, simplicity, and long-term value.

Here are some principles for building wealth stemming from Warren Buffett’s teachings and investment history:

The Power of Compounding: Wealth grows significantly over time, especially with long-term investments.

Avoid Borrowing for Investment: Borrowing increases risks and potential losses.

Invest in Simple, Understandable Businesses: Boring, straightforward companies often lead to stable returns.

Prioritize Strong Management: Companies with insider ownership and aligned incentives tend to perform better.

Focus on Quality Stocks: Healthy financials and consistent growth are key for long-term success.

Stay Disciplined: Stick to your strategy, even during market underperformance.

Embrace Volatility: Use market downturns as opportunities to buy valuable stocks at lower prices.

Reinvestment Opportunities Matter: Invest in companies that reinvest their earnings to grow organically.

Concentrate on Best Ideas: Avoid excessive diversification and focus on high-potential investments.

Pricing Power is Essential: Look for companies that can pass on costs to customers without compromising margins.

Lessons from a Capital Allocator

Mark Leonard is the founder and President of Constellation Software Inc. (CSU), a Canadian technology company specializing in acquiring, managing, and building vertical market software businesses.

Under his leadership, CSU has grown into a $95 billion empire through over 600 acquisitions, achieving 34% annualized returns. His acquisition strategy, often likened to Warren Buffett’s, focuses on niche software companies. Leonard’s net worth is approximately $4.65 billion, making him the 741st richest person globally and 23rd in Canada.

Here are some lessons that can be taken from his resounding successes at CSU:

Think Like an Owner – Inspired by Warren Buffett, Mark Leonard acquires companies intending to own them forever.

Maintain High Autonomy – Leonard ensures acquired companies keep autonomy, avoiding direct operational control.

Look for Distressed Sellers – The best deals often come during economic downturns when sellers need liquidity. In other words, be greedy when others are fearful.

Prioritize Return on Invested Capital (ROIC) – A high and stable ROIC is a key indicator of a company’s competitive advantage.

Consider Size in Growth – Larger companies find it harder to sustain high growth rates compared to smaller ones. Consider where companies are in their growth cycle.

Culture Over Strategy – A strong corporate culture drives long-term success more than strategy alone.

Focus on Capital Allocation – Effective capital allocation is the most critical skill for management.

Favour Founder-Led Businesses – Companies run by founders often have leaders deeply invested in long-term success. Insider ownership can be key most of the time.

Prioritize Intrinsic Value Over Stock Price Fluctuations – Stock prices will follow intrinsic value in the long run. Ignore short-term volatility.

Look for Reinvestment Opportunities – Businesses with high margins and low capital intensity can reinvest profits effectively.

Hold Cash Strategically – Leonard only acquires companies when there are economically sound opportunities. Cash provides the oxygen.

Past Editions

Includes: 1) Power of Dividends, 2) Stocks with China Exposure, 3) Tips to Managing Portfolios, & 4) Accepting Volatility

Includes: 1) Advantage of Dividend Stocks, 2) Recessionary Dividend Performance, 3) Railroad Stocks, & 4) Reducing Risk

Includes: 1) Investment Planning, 2) Returns After First-Rate Cut, 3) Investment Accounts in Canada, &

4) Hyperscalers.

Includes: 1) Dividend Growth Strategy, 2) Tariff Threats, 3) Importance of 10-Year Yield, & 4) Portfolio Building.

Includes: 1) China's Surplus, 2) Global Valuations, 3) Long-Term Investing, & 4) Trading vs. Investing

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.