The End Goal of Trump's Tariffs

A Leverage Game - Exploring the Economic Impact and Strategic Goals Behind Trump's Tariff Policies

“We will restore the name of the great President William McKinley to Mount McKinley, where it should be and where it belongs. President McKinley made our country very rich through tariffs and through talent.” - Donald J. Trump, January 2025.

Who was President McKinley?

If you've been following Donald Trump's speeches over the past year, you'll notice he frequently references Sir William McKinley, the 25th President of the United States. This emphasis likely stems from McKinley's strong support for tariffs.

William McKinley served as President from 1897 to 1901. A member of the Republican Party, he led the U.S. during a period of significant expansionism. McKinley's presidency was marked by economic prosperity and a focus on foreign policy, but it was tragically cut short when he was assassinated in 1901.

William McKinley was a strong advocate for protective tariffs. Before his presidency, he played a key role in drafting the McKinley Tariff Act of 1890 as a Republican representative in Congress. The McKinley Tariff Act significantly raised tariffs on imported goods, increasing the average duty on imports from 38% to 49.5%. This was designed to protect domestic industries and workers by making foreign products more expensive and less competitive in the U.S. market.

However, this led to higher prices for American consumers and received backlash, causing the Republicans to lose their majority in the House during the 1890 election. In the 1892 presidential election, the Republican candidate was soundly defeated, and the Senate, House, and Presidency all came under Democratic control.

Though tariffs were not eliminated, the rates were reduced until McKinley himself won the presidential bid in 1897. He then enacted the Dingley Tariff Act of 1897 to counteract the lower tariffs imposed by the previous Democratic act. However, his approach to tariffs during this time was more forward-thinking, focusing on reciprocity. He recognized that what was produced beyond domestic consumption needed alternative markets—export markets and lower trade barriers abroad through negotiations. In 1901, just a day before his death, he announced his support for reciprocal trade treaties, marking a considerable shift in his thinking about trade policy.

Fun fact: The Dingley Tariff was the highest protective tariff in the history of the United States. It increased duties by an average of 52% and the cost of living by nearly 25%.Who pays the tariff?

This can get tricky.

U.S. importers pay the bill for tariffs on goods imported into the U.S., but the question of who ultimately pays the tariff cost is more complicated. Here are some examples:

The extra cost of importing a product due to the tariff hike can be fully borne by the importer impacting their bottom line.

The extra cost can be split between the importer itself and the end consumer. This way the importers profits still sink but not as much, while the end consumer is left with less money.

The supplier exporting the product could be forced to lower the price for the difference or lose the importer’s business to an alternative provider, if that is available.

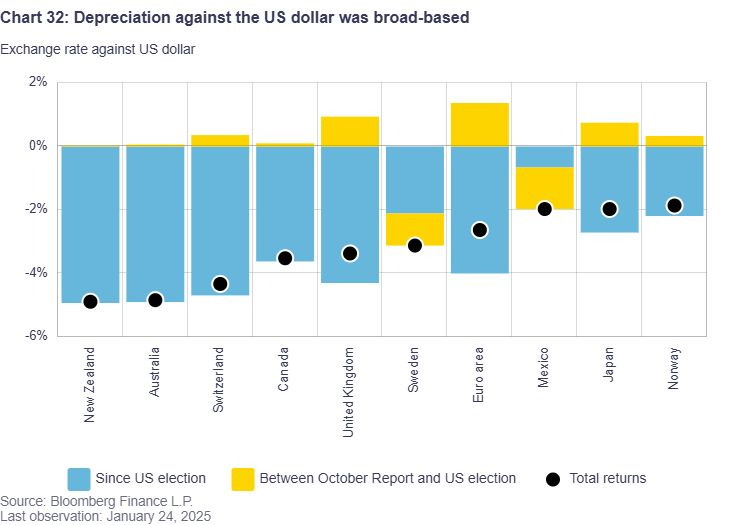

In the end, someone suffers. However, the impact can be mitigated to some extent. For example, if the importing country has a stronger currency, this can help reduce the negative effects. If the US dollar (USD) strengthens or the competing currency depreciates, US importers can offset the hit to their profits through positive currency adjustments. Additionally, lower corporate (business) tax rates can help offset thinner profit margins.

This is why it's so complicated. There are numerous pieces to the puzzle to consider. These complexities can lead to retaliatory tariffs and other trade barriers that dampen economic growth. Every move creates a different impact and needs to be weighed on an ongoing basis.

What about the USMCA?

The United States-Mexico-Canada Agreement (USMCA) is a free trade agreement that replaced the North American Free Trade Agreement (NAFTA) and came into effect on July 1, 2020. The USMCA aims to create a more balanced, reciprocal trade environment that supports high-paying jobs for Americans and grows the North American economy.

Although this promotes free trade, even with the USMCA in place, countries can impose temporary tariffs for various reasons like national security under Section 232 of the U.S. Trade Expansion Act.

Do you see the loophole now?

Fentanyl and illegal migration are ‘valid reasons’ under the agreement to impose tariffs. This is how Trump has no hesitancy in applying tariffs on Canadian and Mexican goods up to 25%, or more in the future.

The question is, what reason will he use to impose tariffs on Europe?

Trump’s Intentions

No one knows for certain, but it's likely a negotiation tactic to ensure the United States maintains its global recognition as a dominant power. He may be helping reduce the impact on US businesses through lower tax rates to attract investment back into the US, but the short-term implementation will still be challenging. However, with the USD currently strong while other global currencies are struggling, the ability to mitigate these challenges is prevalent and could be effective without causing significant harm to the country in the short term. Moreover, the early work through the Department of Government Efficiency (DOGE), led by Elon Musk, will assist in the very short term by marginally reducing the deficit, thus lowering the need for additional financing to combat this pain.

However, prolonged unreasonable tariffs in an intertwined trading world can lead to higher living costs, reciprocal tariffs, loss of political party control, and declining popularity, among other consequences. If those countries being targeted somehow reduce their economic and financial dependence on the US, this can spell trouble for Trump. So, will Trump win or lose?

Is There a Secondary Play at Hand?

I have written before of how the 3-month/10-year treasury inversion is a great indicator of economic pain, or recessionary environments1. We are at a critical stage of this trend - look at where the line is crossing. If history repeats itself, the recessionary confirmation comes next.

Perhaps Trump is just forcing the issue. He could benefit from crashing the economy, as it would give him a full four years to restore it to a high pedestal. This strategy would also allow him to quickly blame the Biden administration and deflect any negative perceptions from his own. The Republicans would be well-positioned for the midterms in two years and the next presidential election in four years amid a booming economy. Trump has also insisted that interest rates need to drop further. This could be one way to force the hand.

Short-term pain for long-term gain is what Trump is preaching.

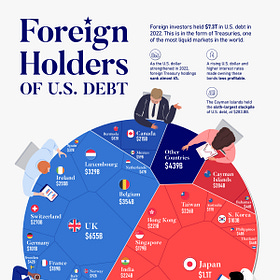

Now, there is a great deal of risk involved, and this is just a theory. However, I have discussed the major issues the US government is facing as we approach 2025. Around $7 trillion in maturing debt will need to be refinanced by the US Treasury. Because the Treasury will have to borrow at significantly higher rates than when these obligations were issued, this enormous refinance will result in a significant increase in the cost of debt. The US budget deficit, which is already at dangerous levels, will be mechanically made worse by this. Obviously, lower borrowing rates will be beneficial. So, is Trump attempting to use magic to achieve his short-term goals?

Inflating Away the Debt

Running deficits have been a common theme for many governments globally, particularly the United States (US), with seemingly no plan to repay the debt. As we move through 2025, we should be prepared to embrace volatility. Let's examine the challenges the major powerhouse, the US government, faces this year.

Opinion

This is all a leverage game, and right now, the US holds most of the leverage. Many more countries rely on the US than the US relies on them. The strength of the USD relative to other currencies around the world is staggering at the moment. Short-term momentum is on Trump's side, so benefits can be gained rather quickly if other countries' reactions falter.

Secondly, what does Trump have to lose? He survived assassination attempts and became President for a second time despite the world berating him and trying to lock him up. Perhaps this is a new Trump who doesn’t care and is out for vengeance. Why do you think all the tech conglomerates have been aligning with him after years of opposition? Being in a position of power changes things.

Thirdly, Trump loves the stock market - the gauge of the US economy. Currently, the US stock market is at all-time highs. A short-term correction shouldn’t bother Trump too much considering other economies around the world are weak. Short-term pain is acceptable, but if it persists in the medium term, Trump will undoubtedly become more subtle and rethink his tariff approach. Escalating trade wars can lead to long-term pain so just keep this in mind. In fact, Trump wants to keep the USD as the world reserve currency. Therefore, trade needs to happen.

And lastly, where are these countries going to turn to? Both Canada and Mexico are significantly dependent on the U.S. market for their exports. For instance, over 80% of Mexico's exports go to the U.S., and Canada sends over 60% of its exports to the U.S. This dependency means that tariffs will severely affect their economies, giving the U.S. a strategic advantage in negotiations or when enforcing trade policies. Refer to trade statistics below.

Trump did not like where the world was headed. He is now using his powers to steer it back in the right direction, with the US leading the way in a respected manner. His rhetoric in the media is also part of his strategy—he will continue saying outrageous things to add more pressure. Read his book entitled, “The Art of the Deal”, you will learn pretty quickly how he structures his negotiations.

Finally, I want to reiterate—the US can afford short-term pain but cannot sustain it in the long-term. However, the key to this play is that their other trading partners CANNOT afford short-term pain and will likely crumble in the long-term. The US holds the negotiation leverage. Period.

Trade Balance Statistics (2023)

For a more in-depth look at this situation, read the following publication by the Bank of Canada (BoC):

Evaluating the potential impacts of US tariffs - BoC

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.