2025 Volatility - Strength of the USD

2025 Market Turbulence: The Ripple Effects of a Strong USD on Global Economies

From an investment perspective, 2025 seems to be filled with uncertainties. With a new President set to be inaugurated at the helm of the United States, and a mission to enact policies within the first two years of his presidency with full control over the Senate and the House, we might need to brace for volatility.

From a broader perspective, I would like to focus on the U.S. Dollar (USD), represented by the DXY in stock symbols, and how it might impact global markets.

USD vs. 10-YR Yield

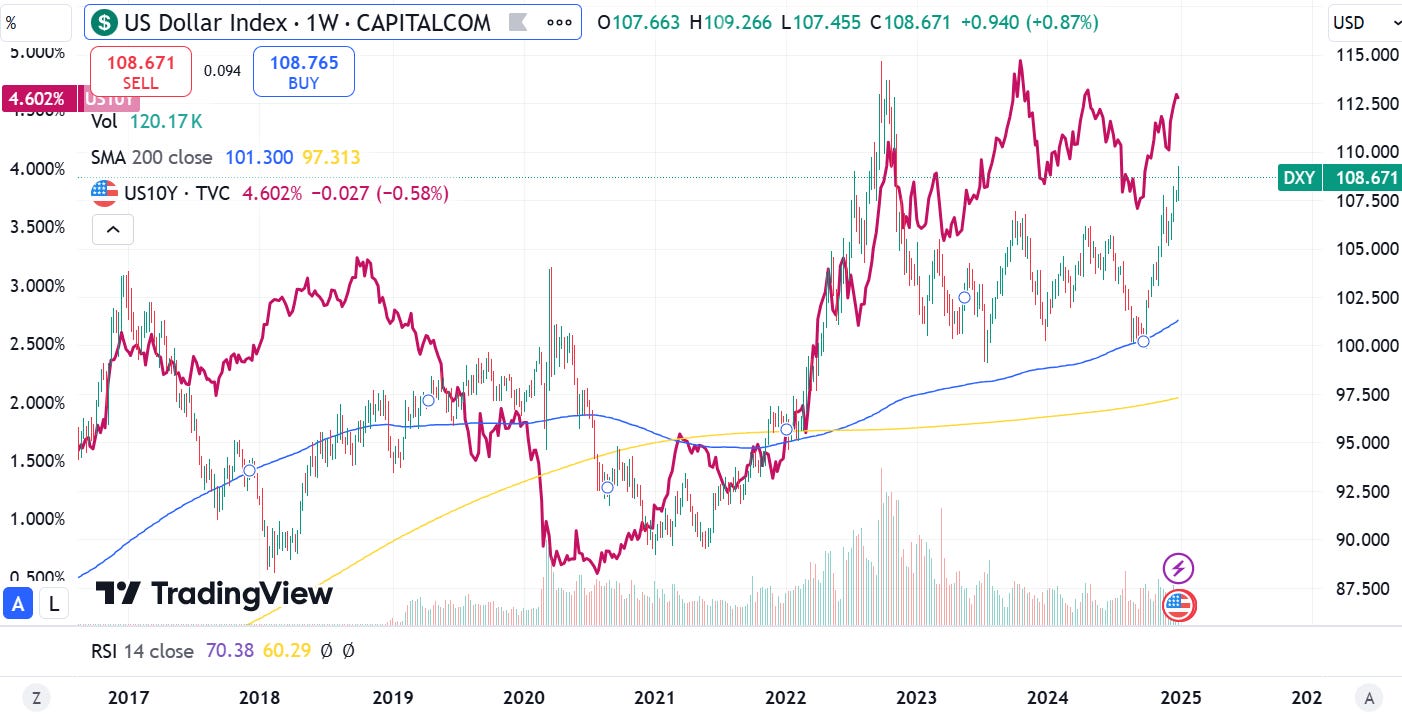

The USD concluded 2024 on a strong upward trend, continuing to climb from its October lows. This rise occurred alongside the increasing yields of the US 10-year Treasury (UST - shown in burgundy below).

The US 10-year Treasury yield and the US Dollar (USD) generally have a positive correlation for some of the reasons below:

Increased Demand for US Assets: When the 10-year Treasury yield rises, it typically indicates higher interest rates in the US. This makes US assets, including Treasury bonds and the USD, more attractive to global investors.

Higher Yields = Higher Demand for US Assets: Higher yields on US Treasuries make them more competitive compared to bonds issued in other countries.

Increased Demand for USD: As investors seek to purchase US Treasuries, they need to acquire USD to do so, increasing demand for the currency.

Monetary Policy Expectations: Rising 10-year yields often reflect expectations of tighter monetary policy from the Federal Reserve (the US central bank). This can include:

Future Interest Rate Hikes: Rising yields can signal that the Fed is likely to raise interest rates in the future to combat inflation.

Reduced Fed Balance Sheet: Higher yields can also indicate that the Fed may reduce its balance sheet (quantitative tightening - QT), which can strengthen the dollar.

Several events unfolded towards the end of the year. Despite interest rate cuts, the Federal Reserve's (FED) tone shifted due to concerns about reinflation. The cycle of rate cuts in 2025 was followed by fewer cuts in the forward guidance. Some banks are even claiming there will be no cuts in 2025. Moreover, the Fed continues reducing its balance sheet via QT. As a result, yields have been rising, along with the DXY. Expect the 10-year UST yield to reach 5% this year.

Additionally, the strategy to inject more liquidity into the market ahead of the 2024 election was abandoned after Trump's win. The Treasury's reliance on short-term debt has resulted in a 2025 maturity wall with over $3.6 trillion in bills alone due in Q1 of 2025. The rest of the public debt maturities to be refinanced amount to just over $8 billion, or 20-30% of the total US government debt. While Janet Yellen favored short-term borrowing, the incoming Treasury Secretary, Scott Bessent, aims to shift from this short-term debt strategy to long-term securities. Liquidity is about to be tested. For a more detailed perspective, see the Substack below.

Impact of a Strong USD

A stronger US dollar can also reduce global liquidity through several mechanisms:

Increased Borrowing Costs:

When the dollar strengthens, it often coincides with rising US interest rates.

This makes it more expensive for borrowers outside the US to obtain dollar-denominated loans, as they must pay higher interest rates to hedge against exchange rate fluctuations.

This can reduce borrowing and investment activity globally.

Since the Fed began cutting interest rates in September 2024, mortgage rates have not followed suit. The chart of the 30-year fixed-rate mortgage average in the US actually shows an increase despite these rate cuts.

Reduced Demand for Riskier Assets:

A strong dollar often signals a flight to safety, as investors seek the perceived security of US assets.

This can lead to a decrease in demand for riskier assets like emerging market bonds and equities, reducing liquidity in those markets.

There has been a huge divergence between the market cap of the US compared to other regions in the world.

Debt Repayment Pressures:

Many emerging market countries and corporations have dollar-denominated debt.

A stronger dollar increases the real value of this debt, making it more difficult to repay.

This can lead to financial distress and potentially reduce liquidity in these economies.

Additionally, a stronger dollar can make US goods more expensive for foreign buyers, potentially reducing demand for US exports. If their currency devalues compared to the USD, it can lead to even greater financial distress, and INFLATION. Refer to the currency devaluation charts below for further illustration.

Liquidity at the Fed

As previously mentioned, the Fed has been engaged in QT. However, this has not spurred any drawback in the market. How might this be?

Through mechanisms employed to ensure liquidity and stability in the banking system such as: Bank Term Funding Program (BTFP), Reverse Repo Facility (RRP), and Treasury General Account (TGA).

Bank Term Funding Program (BTFP): This was an emergency lending program created by the Federal Reserve in March 2023 to provide liquidity to U.S. depository institutions. It offered loans of up to one year to eligible institutions pledging high-quality collateral.Reverse Repo Facility (RRP): This facility allows eligible financial institutions to lend money to the Federal Reserve overnight in exchange for Treasury securities. It helps control short-term interest rates and provides a floor for the federal funds rate.Treasury General Account (TGA): This is the U.S. government's general checking account held at the Federal Reserve. It receives tax payments and proceeds from the auction of Treasury securities and disburses government payments.What similarities do you notice among all three?

Most of the funds have been depleted as of the start of 2025, leaving approximately $765 billion in the Treasury General Account (TGA) and $208 billion in the Reverse Repo Facility (RRP). This situation has resulted in significant liquidity challenges for the incoming president, Donald Trump. Markets have been feeling the strain already in the first few weeks of 2025.

Trump’s Position on the USD

Trump’s stance is that he would like to see a weaker dollar. In fact, under his first term, he managed to do that relatively quickly within his first year in charge. We then saw the Fed begin increasing rates which led to an appreciation in the USD, to which Trump was not pleased.

So, it's clear that Trump favors a lower USD, but there are numerous hurdles to navigate. First and foremost, there's Trump's plan and rhetoric.

USD hegemony - His support to keep the USD as the global reserve currency. The strength of the USD is unparallel to any other global currency.

Imposing Tariffs - If Trump actually uses them rather than as a threat, there is fear that inflation will remain elevated leading to higher rates for longer.

Tax Cuts - Foreign capital will be attracted to the US if better investment opportunities arise. Savings in one area can translate into earnings in another.

All these point to maintaining a strong USD, or at least stronger than other global currencies. Only time will tell, but the Fed may need to intervene, or Trump’s policies might compel them to lower interest rates more rapidly and/or inflate away the debt through increased printing (QE). Check out my previous post for more details on why this might happen.

In my opinion, the USD will need to weaken to avoid a catastrophic year.

Inflating Away the Debt

Running deficits have been a common theme for many governments globally, particularly the United States (US), with seemingly no plan to repay the debt. As we move through 2025, we should be prepared to embrace volatility. Let's examine the challenges the major powerhouse, the US government, faces this year.

Predictions

The Federal Reserve will end its QT cycle and begin a new phase of QE.

The 10-year UST yield will reach 5%, but efforts to stabilize and lower the long-term rate will likely occur as QE (or some form of yield curve control mechanism) is implemented.

The Federal Reserve will cut rates more significantly than anticipated, as the burden of refinancing U.S. debt at high rates becomes untenable (the opposite of what should happen, crazy, I know).

The USD will fall, but other global currencies will struggle to appreciate, leaving GOLD to hit a new all-time high.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.