Microsoft - Strong Earnings, but Correction Needed - FY24

As companies start to reveal their earnings for the fiscal year 2024, here are the results for a stock in my portfolio along with a business valuation.

Welcome to my summary of Microsoft’s (MSFT) earnings report for fiscal 2024. For additional context, please refer to my earlier post detailing my valuation methodology.

Year-End Results

Despite the overall strong performance, slower-than-expected growth in the cloud segment caused some concern among investors. Considering that the cloud represents the largest revenue stream for Microsoft, a deceleration in this sector would significantly impact the stock. This might also indicate that analysts' projections are overly optimistic. Given the high current valuation, a market correction could be beneficial to stabilize the situation as was seen in the after-hours market on the day MSFT’s earnings were released. Nonetheless, given the company's overall robust growth and the ongoing demand, Microsoft is likely to continue its upward trajectory, bolstered by increased capital expenditures to enhance its capacity.

Revenues saw a 16% increase.

Earnings per share (EPS) increased by 22%, with adjusted EPS up by 20%.

Dividends per share (DPS) increased by 10%.

Operating cash flow (OCF) was $118.5 billion, and free cash flow1 (FCF) was $74 billion.

The payout ratio stood at 25%.

The long-term debt to equity ratio was 0.22.

The average share price growth was 27% over 5 years, 18% over 3 years, and 41% over the last year.

The count of outstanding shares remained significantly unchanged.

Investor Presentation Highlights

A leader in everything that is artificial intelligence (AI). The company offers leading insights into AI adoption, from cloud infrastructure and capital expenditure to applications.

Azure AI quarterly revenue keeps increasing. However, scale is needed to continue rapid growth.

Lower consumption in Europe may indicate underlying issues.

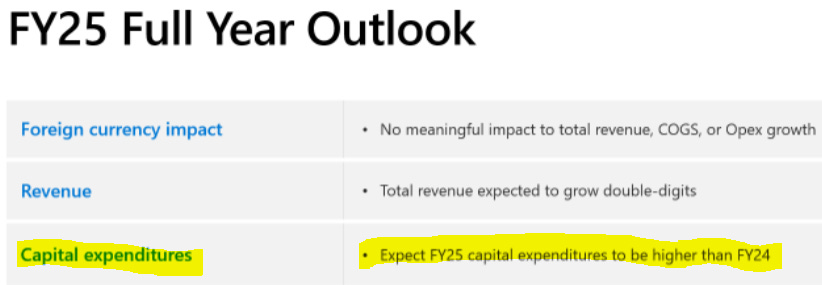

Regarding capital expenditure, half of the current spending is allocated to acquiring land, leases, and construction of the data centers. The remaining half is predominantly invested in GPUs and AI accelerators for these data centers.

Copilot continues to be a hit with customers as it grew 60% from Q3, while OpenAI is a leader in the app space.

Key note to MSFT’s outlook presentation to investors is the need to intensify capital expenditures to meet demand for its products, specifically Azure. Given the substantial cash flows being generated and the prospect of falling interest rates in the near term, this should pose no issue for the company.

My Own Valuation

Microsoft's valuation reflects high expectations of perfection. Any shortfall could significantly affect the stock price negatively. The market anticipates much from companies in the AI sector, and given Microsoft's size, the repercussions are amplified. Should the anticipated demand for AI not materialize, the existing infrastructure could potentially be repurposed to bolster larger-scale cloud computing networks. However, the relentless competition from companies like Google and Amazon does not simplify matters.

The AI revolution is poised for continued expansion, and with it, capital expenditures are expected to rise. The critical question to consider is whether the excitement surrounding this growth is both tangible and sustainable for future generations. Having experienced a tech bubble in the past, one wonders if this situation presents a different scenario.

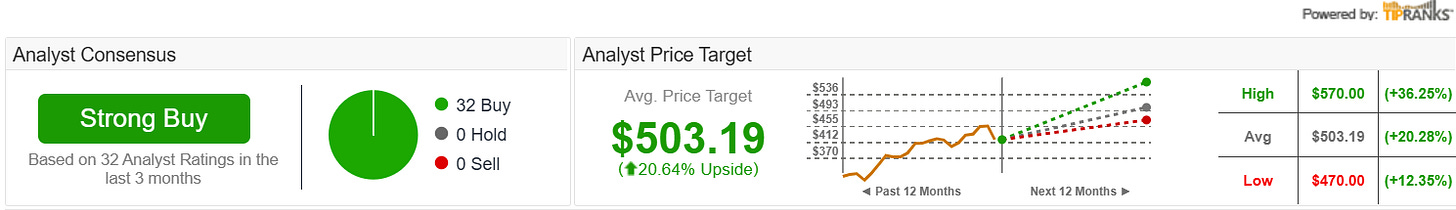

Currently, MSFT warrants its premium valuation going forward, which is why it has reached the implied share price already during the course of this year. The consensus among analysts remains high as well. Adjusting the long-term growth rate and exit multiple to more conservative figures, MSFT's valuation would stand between $380-$400 currently. While the potential for growth is undeniable, the associated risks cannot be overlooked.