Take Five - Random Investing Notes

A collection of insightful investment pieces to broaden knowledge and elevate the investing mindset. Includes: Trade Balances, Deflation from China, Global Reserve Currency, 2024 US Election Aftermath

Trade Balances

Attention will be centered on the world's two leading economies in trade - the US and China.

US

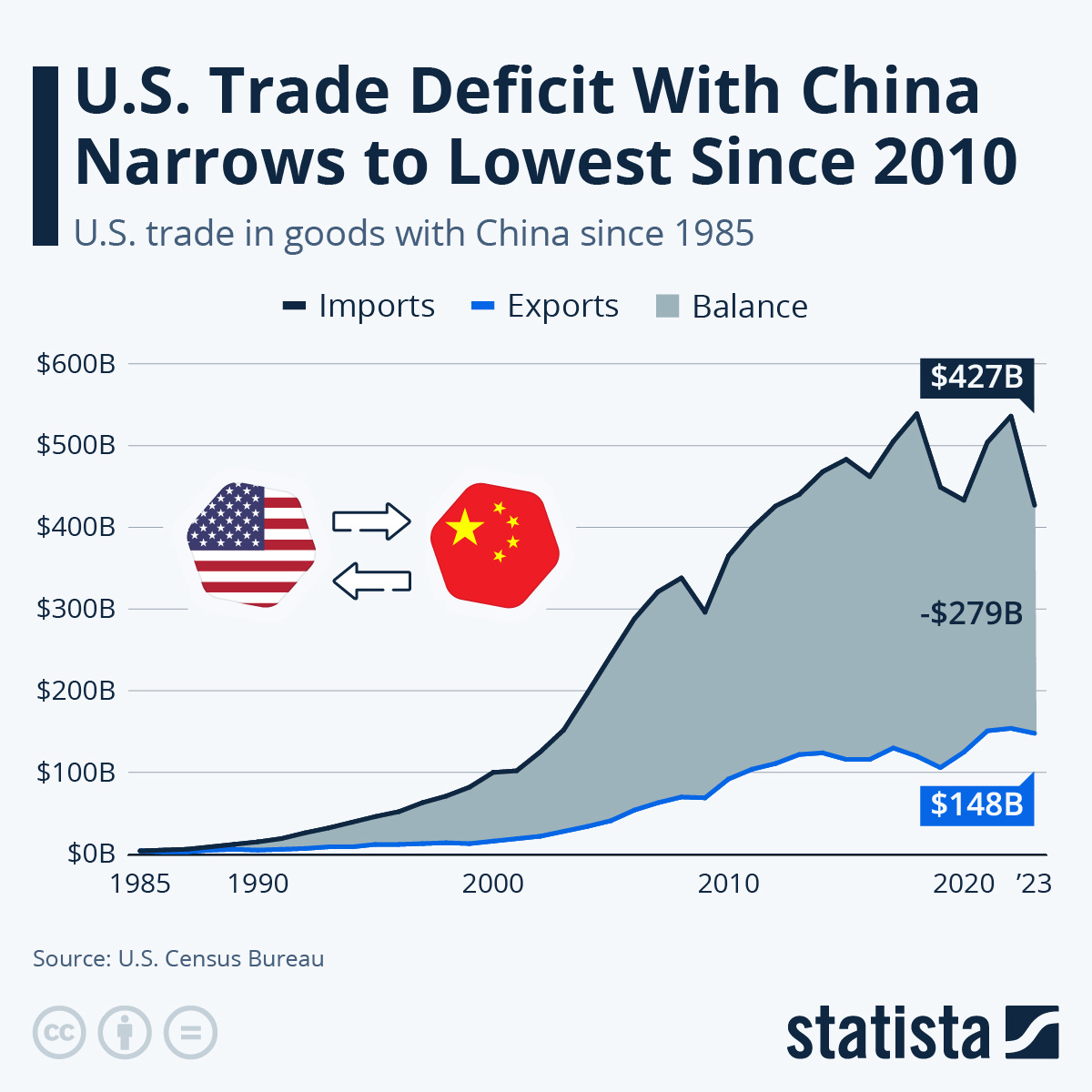

The U.S. trade deficit has been increasing since 2009, peaking in 2022. As of October 2024, the United States had an overall trade deficit of $73.8 billion. This is a 15% increase from the previous year.

The US has been importing more than it exports, leading to a trade deficit. This means they buy more goods from other countries than they sell to them.

For the US, strong domestic demand (people buying a lot within the country) and low savings rates (people saving less money) have contributed to their trade deficit.

China

China's trade surplus has been increasing consistently since 1995. In the third quarter of 2024, China's current account surplus increased from $55 billion in the second quarter to $148 billion.

China has been exporting more than it imports, leading to a trade surplus. This means they sell more goods to other countries than they buy from them.

For China, weak domestic demand (people not buying much within the country) and high savings rates (people saving more money) have contributed to their trade surplus.

China's large trade surplus means they have a big influence on global trade.

China’s Deflationary Impact Globally

Recently, Chinese banks have shown a preference for investing in the industrial sector over the real estate sector. This shift has contributed to China's emergence as a major force in industrial products. For instance, the 2018 United States ban on high-end semiconductor sales to China spurred the country to fast-track the development of its semiconductor industry, aiming for self-reliance across different industrial sectors.

As a result, China's success in making and exporting goods cheaply has helped keep global prices low. This is called deflation.

Global Reaction

In reaction to China's industrial ascent, the United States and the European Union have adopted protectionist measures such as tariffs and sanctions, shifting away from free trade principles.

This shift signifies a reduced openness to free trade and an increased emphasis on safeguarding domestic economies, which can result in higher prices and inflation. To alter this trajectory, it would be necessary to identify a supplier with Western ideologies comparable to China's scale, or for the United States to undertake a transformation of its industrial/manufacturing sector to restore jobs and enhance global competitiveness. But this may be a step backwards. Nevertheless, this subject is complex, encompassing various viewpoints, and what has been discussed only scratches the surface.

Global Reserve Currency

Global Dominance: Since the conclusion of World War II, the U.S. dollar (USD or the dollar) has served as the world's primary reserve currency. It is the currency most commonly utilized for international trade and financial transactions.

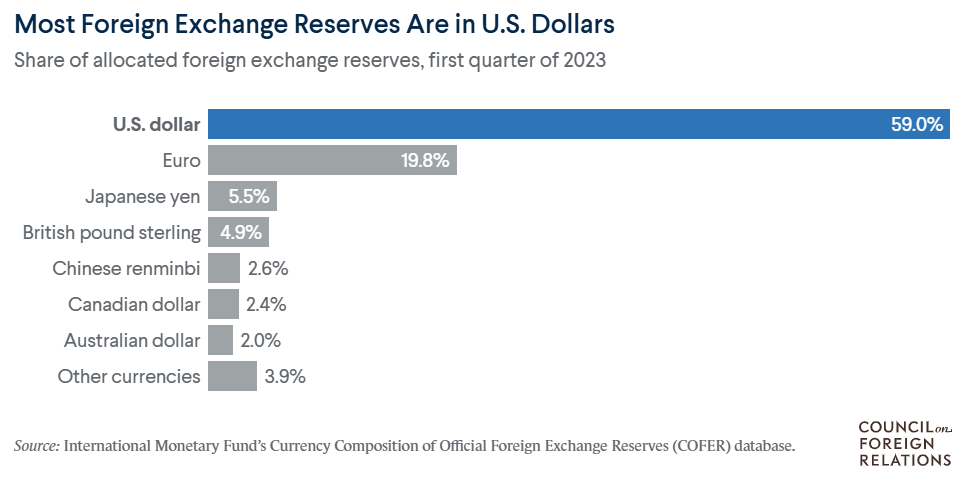

Reserve Currency: A reserve currency is a foreign currency held by a central bank or treasury as part of a nation's official foreign exchange reserves. The USD constitutes 59 percent of the world's foreign exchange reserves, down from 70 percent in the 2000s.

Economic Influence: The dollar's centrality to the global economy allows the United States to borrow money at a lower cost and extend the reach of U.S. financial sanctions.

Economists emphasize the unique role of the U.S. economy in supplying liquidity to the global market and stimulating worldwide demand, positioning the U.S. trade deficit as pivotal for global economic equilibrium. The dollar's status as the primary global reserve currency and main medium for international transactions compels numerous countries to maintain dollar reserves, thus generating substantial demand for U.S. financial assets. Consequently, the U.S. incurs minimal costs for its foreign borrowing, enabling it to fund its considerable consumption inexpensively, which in turn propels global demand.

While some economists caution that a shift towards a U.S. trade surplus might diminish global growth and trigger more economic volatility among trading partners, others argue that the intense international demand for U.S. assets strains the economy and hinders the attainment of full employment.

De-dollarization: Several countries are actively exploring methods to engage in trade using non-dollar currencies, a trend referred to as de-dollarization. This includes other options such as BRICS, the Eurozone, and the realm of cryptocurrencies, among others1.

However, few serious contenders have emerged to replace the dollar as the leading reserve currency.

The Threat: Aggressive U.S. sanctions and U.S. financial instability.

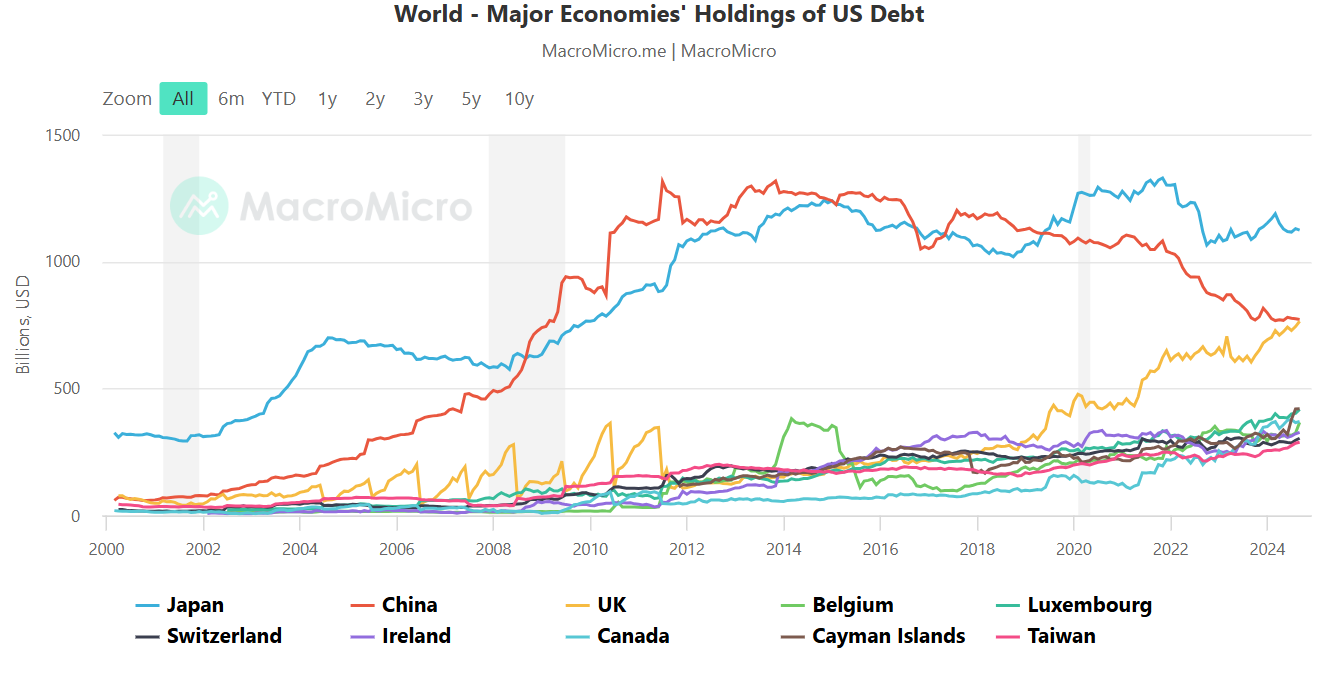

Sanctions, like those imposed on Russia following its invasion of Ukraine, were feasible due to Russia's investments in U.S. debt. The effectiveness of sanctions diminishes as a country's reliance on U.S. reserves decreases.

Consider this - In the wake of Russia's invasion of Ukraine, a growing number of nations, including allies of the U.S. like India, are seeking methods to trade with Russia that bypass the dollar. Concurrently, the Chinese renminbi has emerged as the most frequently traded currency in Russia.

An economic recession in the U.S. can pose serious troubles. A U.S. default on their debt would have global repercussions, diminishing the dollar's appeal as a global currency.

Reality Check: Due to the U.S.'s capacity to issue its own currency, its status as the world's strongest economy, the USD's dominance in international transactions, and the lack of an immediate suitable alternative for the dollar as a reserve currency, de-dollarization remains a distant prospect.

However, there is an ever-more-present risk to this happening over the very long-term.

China was once the largest foreign holder of U.S. debt until trade tensions began in 2019. It is the only trend line on the chart below that has decreased its foreign currency reserves in USD.

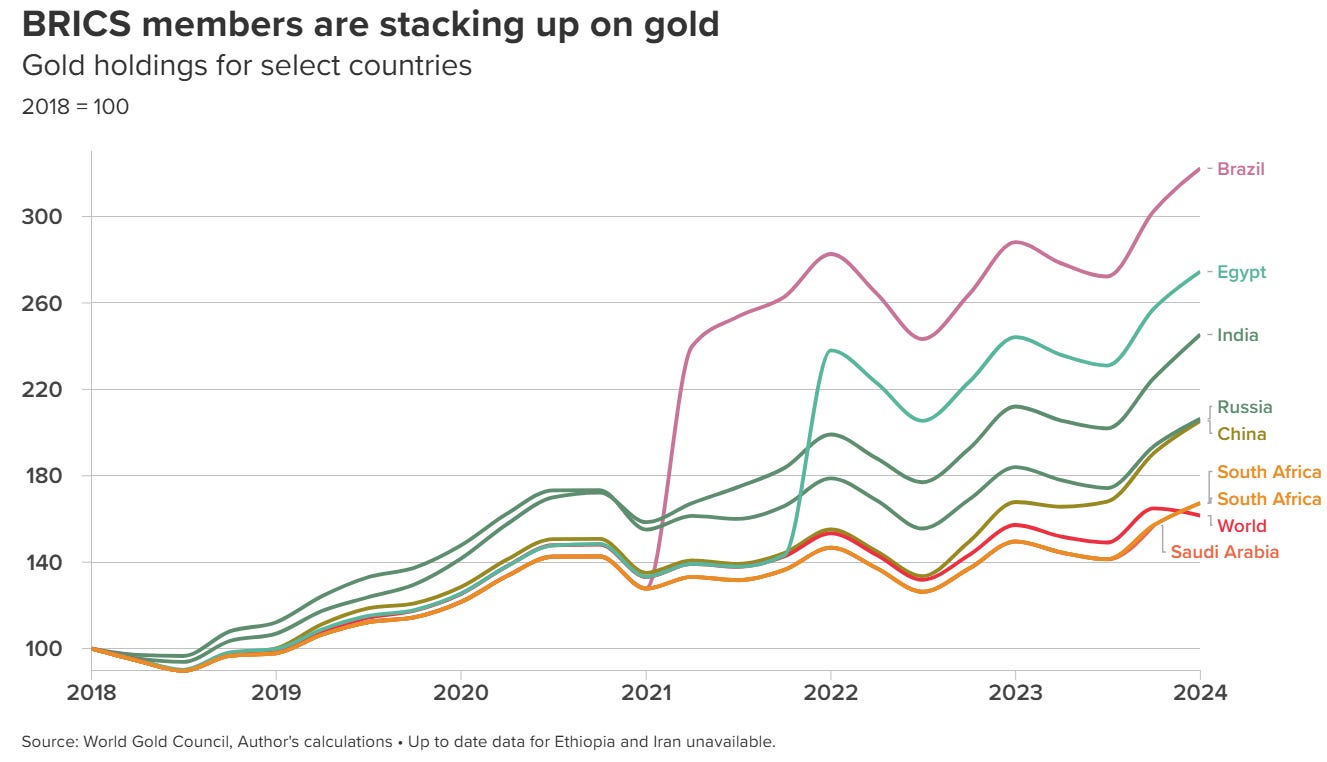

Consequently, China has bolstered its gold reserves over these past five years. The primary motivation for this is to reduce reliance on the dollar and, in an extreme scenario, to diminish vulnerability to U.S. sanctions.

The trend of increasing gold reserves is also prevalent among other BRICS nations. Emerging markets have been instrumental in the recent surge of gold acquisitions. Since 2018, BRICS members have augmented their gold holdings more rapidly than the rest of the world, even with gold prices at historical highs.

Conclusion: The USD's status as the global reserve currency is unlikely to disappear within my lifetime. Although the challenges may increase over time, the dollar remains the most trusted currency. As I have consistently maintained, the greatest threat to the dollar is the state of the U.S. economy and its national debt.

U.S. Election

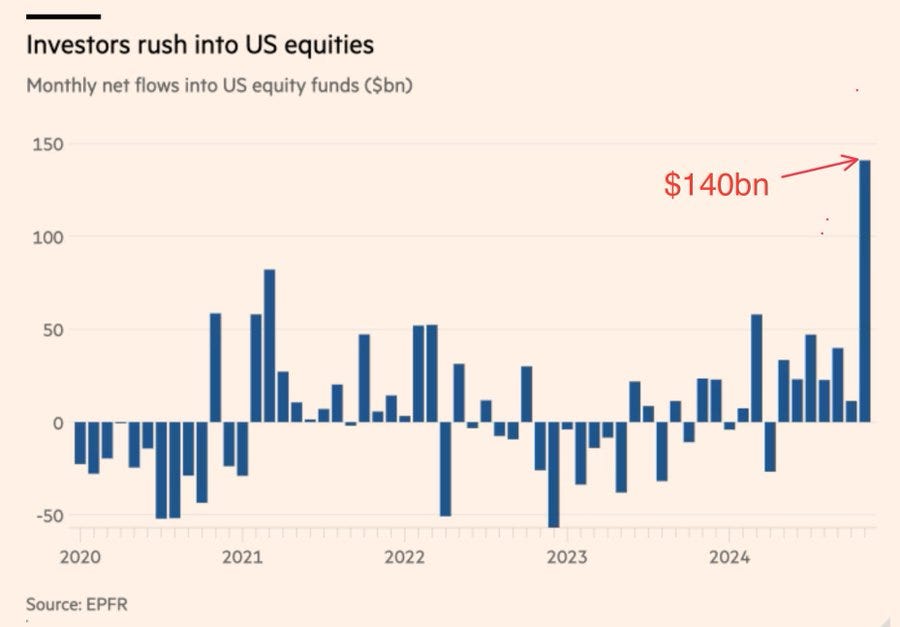

In my previous edition, I had made reference to how the global money supply influences the trajectory of the major markets, specifically the S&P 500 (SPX).

If we take a look at the most recent trend of the overall estimated global liquidity (black line) and compare it to the SPX chart, there is quite the inverse relationship as of late. While the money supply has decreased, the SPX has risen. This is a bit counter intuitive.

Not even the results of the U.S. elections or the threats of President-elect, Donald J. Trump, have seemed to spook the markets. Why could this be?

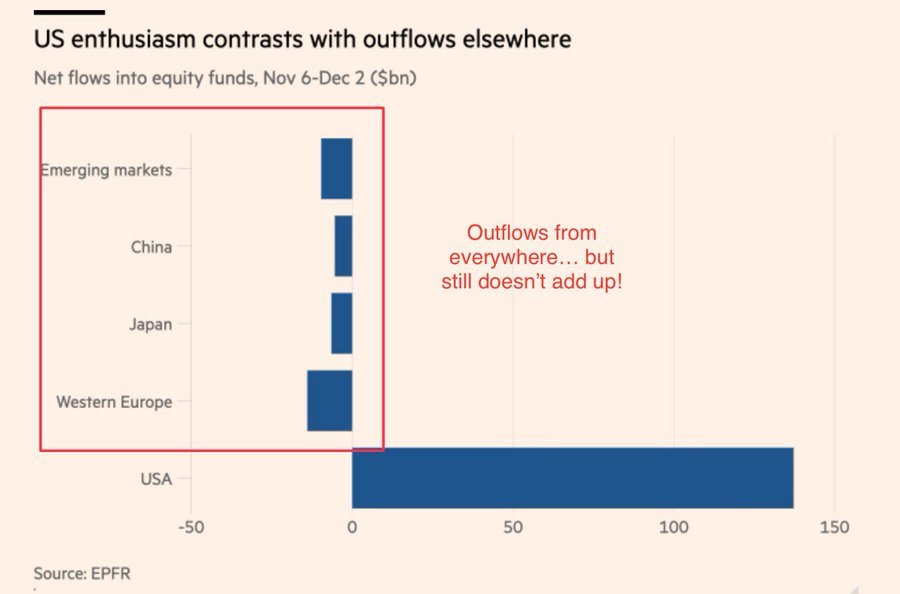

Well, as expertly laid out by Wasteland Capital on X, it evidently is not from outflows from other markets (see above). Can we pinpoint this to just being cash on the sidelines coming into the market? Retail investors tend to buy in at the top when they fear missing out on greater returns. This may be true, but there are clearly there are other factors at play, and perhaps some behind the scenes actions from the Federal Reserve. Read into the following article, THE FED’S HIDDEN QE, to understand the behind-the-scenes actions. I would also encourage you to follow JustDario on X.

Past Editions

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!

Please refer to the details of the referral program below.

Invite your friends to read DiviStock Chronicles

Thank you for reading DiviStock Chronicles — your support allows me to keep doing this work. Join our referral program!