OpenText - A Midcap in the Tech Landscape - FY24

As companies start to reveal their earnings for the fiscal year 2024, here are the results for a stock in my portfolio along with a business valuation.

Welcome to my summary of OpenText’s (OTEX) earnings report for fiscal 2024. For additional context, please refer to my earlier post detailing my valuation methodology.

Year-End Results

OpenText (OTEX) achieved a significant increase in revenues, driven by strong demand for its cloud-based solutions and AI-driven innovations. Earnings per share (EPS) also saw a notable rise, reflecting the company’s efficient cost management and strategic investments. Despite facing challenges in certain markets, OTEX’s commitment to enhancing its product offerings and expanding its global footprint has positioned it well for sustained growth in the coming years.

The Application Modernization and Connectivity (AMC) divestiture for $3.050 billion (CAD) in cash allowed for a reduction in debt lowering OpenText’s net leverage ratio to under 3x. This move is part of OTEX’s strategy to focus on high-growth areas to create better shareholder value.

Revenues saw a 29% increase.

Earnings per share (EPS) increased by 205%, with adjusted EPS up by 27%.

Dividends per share (DPS) increased by 3%.

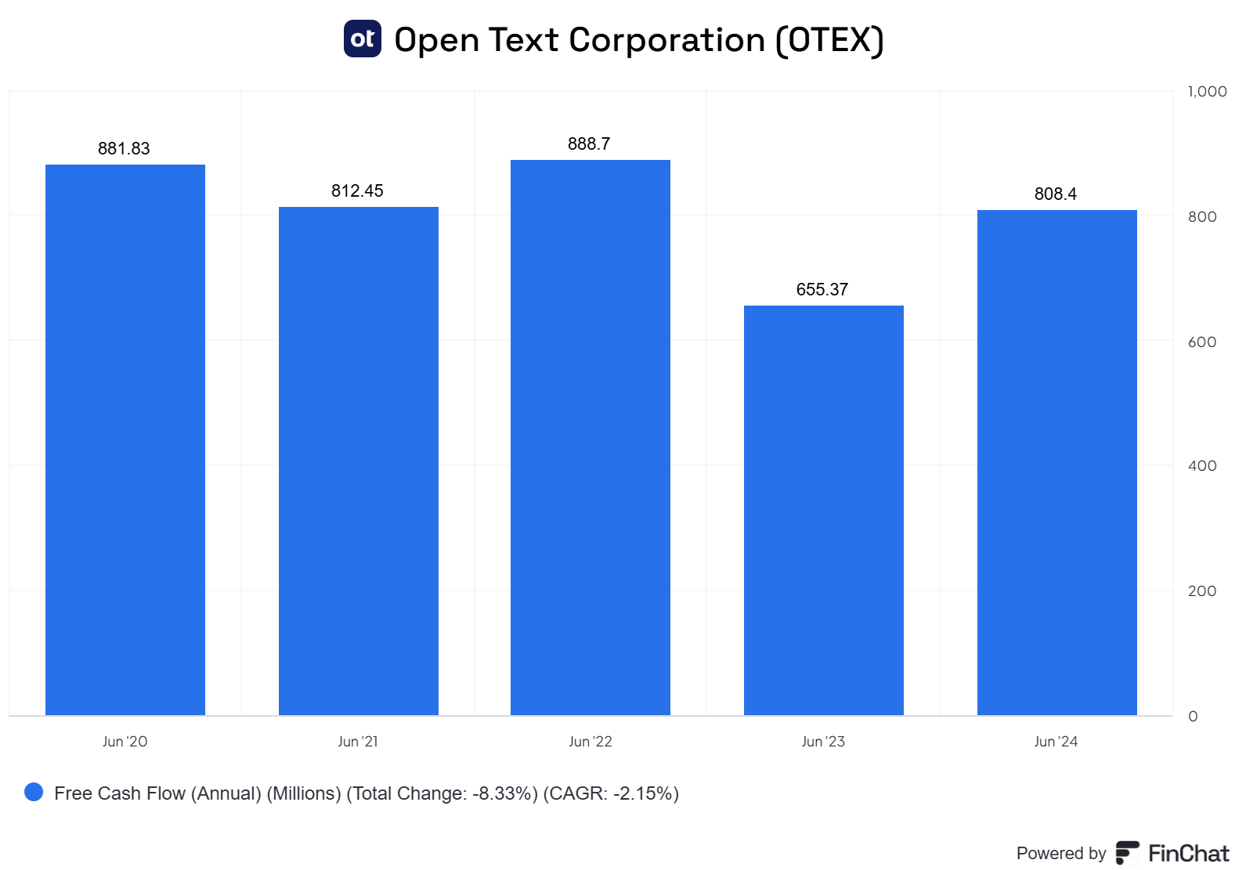

Operating cash flow (OCF) was $968 million, and free cash flow1 (FCF) was $808 million.

The payout ratio improved to 58%.

The long-term debt to equity ratio was 1.56.

The average share price growth was +1% over 5 years, -5% over 3 years, and +9% over the last year.

The count of outstanding shares slightly decreased.

Investor Presentation Highlights

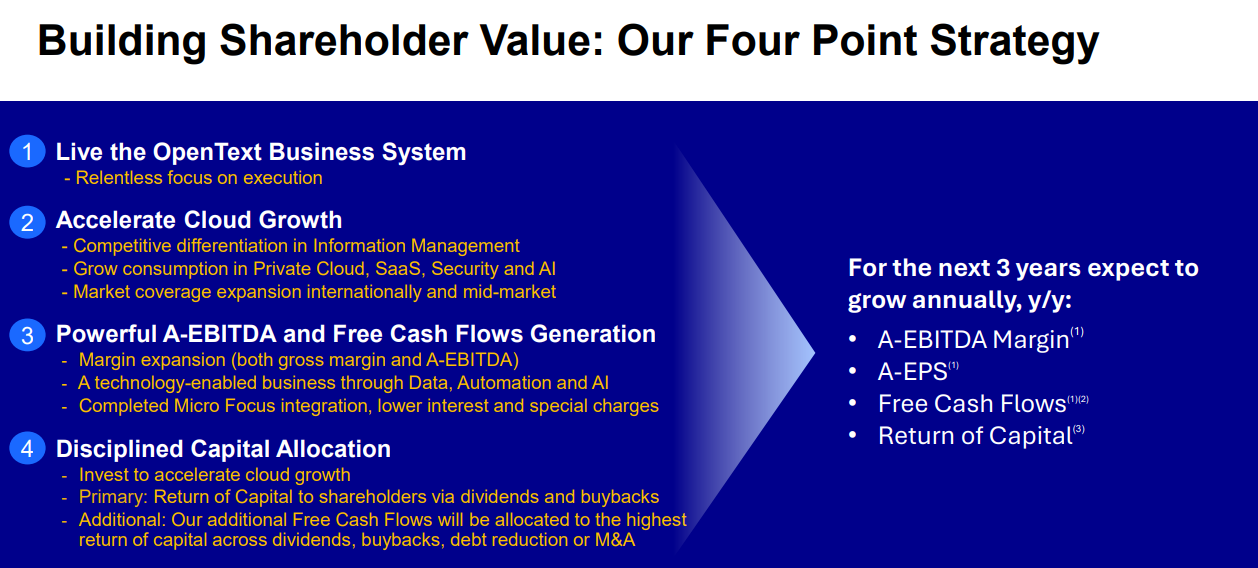

Strategic Focus. The company is transforming for growth in cloud, security, and AI, with significant investments in these areas.

OpenText is integrating AI and security into its cloud offerings, with products like Titanium X and various AI-driven solutions to enhance customer productivity and value.

A diversified company in information management.

Facilitates automation and integration of data sets across various platforms becoming a trusted leader in this area.

Building shareholder value through return of capital to shareholders via dividends and buybacks.

A key focus to accelerate cloud growth and boost free cash flows now that Micro Focus integration is complete.

Biggest share buyback announced ($300M US). For the first time, the value is expected to surpass that of dividends, signaling confidence in the company's growth.

Mergers and acquisitions also in sight on smaller to medium cloud companies.

My Own Valuation

OTEX represents a speculative play for me, occupying a small yet high-potential segment of my portfolio. The company's steady innovation and expansion of market share render it an attractive investment. It is trading at a reasonable price, though it operates in a highly competitive market. Nevertheless, the company's solid recurring revenue and its commitment to reducing debt to acceptable levels are commendable. With this investment, patience is essential.

Mid-cap Canadian companies, often overlooked by analysts, tend to have scarce ratings. Nevertheless, these ratings align closely with my analysis. The pattern of increasing revenues, rising adjusted earnings, and growing dividends is consistent with my investment thesis.