Take 10 - Random Investing Notes

A collection of insightful investment pieces to broaden and elevate the investing mindset. Includes: Dividend Growth Strategy, Tariff Threats, Importance of 10-Year Yield, and Portfolio Building.

Dividend Growth Strategy

The strategy of investing in dividend growers is a popular one. But they key term in it all is “growth”. Many of investors that profess to using this strategy tend to only focus on yield and do not analyze the fundamentals behind the dividend itself. Let’s take a look at some misconceptions:

High Yields

A high yield doesn't always equate to high risk, but it can be indicative of a company in distress or one that is unsustainably distributing too much of its earnings as dividends.

Payout Ratios

The payout ratio is the percentage of earnings a company pays out in dividends. Think of it as the dividends per share (DPS) divided by earnings per share (EPS).

A lot of companies have a set target payout ratio they wish to achieve. It is often between 60%-80%. When this ratio gets too high, it’s a good indicator that the dividend is not sustainable, especially if it exceeds 100%.

For companies such as REITs and certain energy stocks (like ENB), they substitute DPS by Funds from Operations (FFO) per unit and Distributable Cash Flows (DCF) per share, respectively.

Yield vs. Growth

The sustainability and growth of dividends are crucial in the long run. When a company consistently increases its dividend each year, it often indicates strong performance and healthy cash flows. Companies that sustainably raise their dividends over time provide more income and better total returns. However, it's important to support these findings with analysis, such as examining the payout ratio.

Bell Canada (BCE) presents a classic example of a high dividend yield that may be at risk of being cut. Despite the attractive yield, income investors should be cautious.

A reminder of the consequences can be seen with Algonquin Power & Utilities Corp (AQN), where an unsustainable dividend payout led to a cut in 2023. Such cuts often result in a significant decline in the stock price.

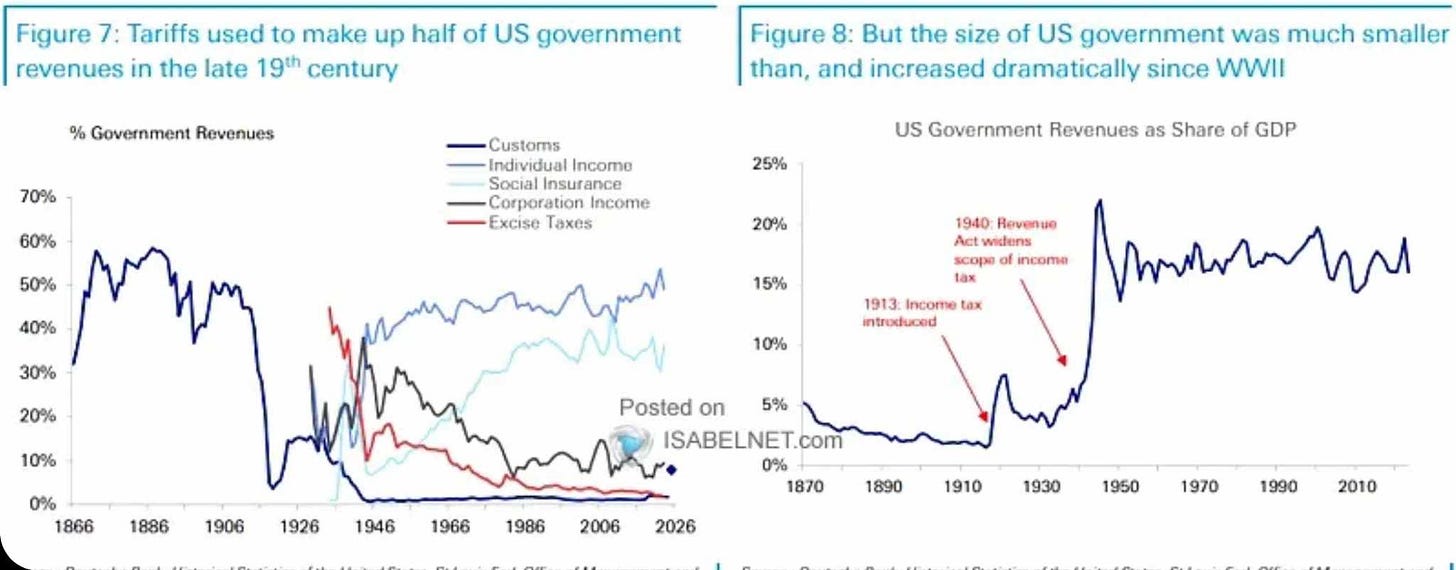

Tariff Threats

In such a closely interconnected global trading environment, tariffs often serve as negotiating tools, a tactic Donald Trump frequently employs. While he does wield considerable leverage, which heightens the threat, he is also acutely aware of the significant repercussions that tariffs can bring - inflation, retaliation, supply chain disruptions, misallocation of resources, economic slowdowns, among others.

In a globalized economy, tariffs are evidently more harmful compared to an early-stage industrialized world. Consequently, the costs to industries far outweigh the benefits. Returning to a pre-globalization era, reminiscent of the early 1900s, is implausible. As a society, our trajectory is forward, not backward.

However, there is a silver lining to enforcing tariffs. The new U.S. Treasury Secretary, Scott Bessent, articulates his points clearly and precisely. He isn't wrong; if tariffs are targeted at the right sources, they can be a valuable tool to have in reserve.

The Importance of the 10-Year Yield

In most economies worldwide, the 10-year government bond yield holds significant importance for everyday citizens.

Why?

Because it often has the greatest impact on interest rates across the borrowing spectrum due to its status as an ideal benchmark rate. This influence extends to mortgages, auto loans, credit card debt, business and government financing, and other forms of long-term capital formation.

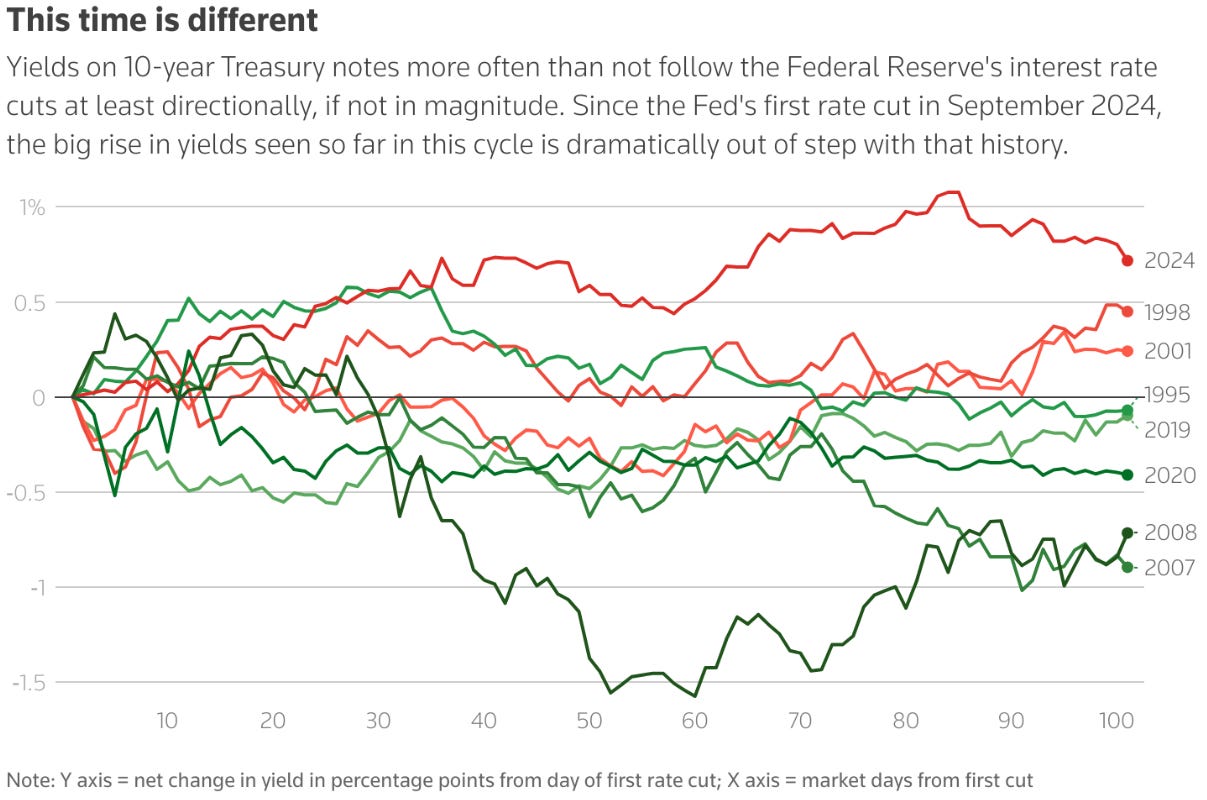

Treasury Secretary Scott Bessent and President Trump emphasize the significance of long-term Treasury bond yields over the Federal Reserve's short-term interest rates. While historical data suggests that yields often follow the Fed’s interest rate direction, more factors come into play on the long end of the yield curve. I have previously explained this in one of my articles. Recently, we observed that when the Fed began cutting rates, the long-term yield actually rose in the opposite direction. The Trump administration aims to prevent the 10-year yield from exceeding 5%, as such a scenario could undermine Trump’s economic plans and negatively impact the economy, including the equities market.

The focus is three-pronged at minimum: becoming energy dominant to lower energy prices, promoting deregulation and tax cuts to reduce costs and increase productivity, and finding ways to cut government spending, notably through the Department of Government Efficiency (DOGE).

However, inflation remains the biggest obstacle. This is why Trump is targeting the US economy rather than pushing the Fed to lower rates in the short term. If the Fed were to continue lowering interest rates, inflation would undoubtedly surge quickly. This is also why tariffs do not seem to be Trump's ultimate goal—instead, they are being used to give the US a competitive advantage in the short term. Tariffs will force most trading partners to comply with Trump's policies, knowing that maintaining tariffs long-term would harm the US economy. A weaker US dollar (USD) would also help bring long-term yields down, but tariffs often weaken competing currencies, thereby strengthening the USD, which doesn't help this approach. Read between the lines on the tariff situation.

The End Goal of Trump's Tariffs

“We will restore the name of the great President William McKinley to Mount McKinley, where it should be and where it belongs. President McKinley made our country very rich through tariffs and through talent.” - Donald J. Trump, January 2025.

Will it succeed? This endeavor requires a delicate balancing act, something that might be impossible to achieve without an economic reset. It's unfortunate to admit.

Building a Resilient Stock Portfolio

Building a robust and resilient stock portfolio involves thoughtful and strategic selection of high-quality companies. Here’s a quick guide offering some insight to this activity:

Identify High-Quality Companies: Focus on companies with strong Return on Invested Capital (ROIC), Earnings Per Share (EPS) growth, and revenue growth over the past decade.

Efficiency (ROIC): Look for companies with at least 10% ROIC; higher is better. Avoid inefficient or cyclical businesses.

Return on Invested Capital (ROIC) is a financial performance metric that measures how efficiently a company is using its invested capital to generate profits. It is calculated by dividing the company's after-tax operating income (NOPAT) by its total invested capital. A higher ROIC indicates that the company is generating more profit per dollar of invested capital, which is generally a sign of a strong and efficient business. Investors often look for companies with high and consistent ROIC because it suggests that the company can sustain growth and provide good returns on investment.

EPS Growth: Companies should have consistent EPS growth of at least 10% annually over the past decade.

Revenue Growth: Aim for companies with at least 5% annual revenue growth over the past decade. Sustainable growth is better than volatile growth.

Valuation Metrics: Assess valuations using price-to-earnings (P/E) ratio or price-to-free cash flow (P/FCF) ratio. A P/E or P/FCF below 20 is often reasonable.

Investor Style: Adjust stock selection based on your investment style and risk tolerance. Conservative investors prioritize lower valuations and minimal debt, while growth-oriented investors may accept higher valuations for exceptional growth rates.

Narrow Down Your List: Focus on companies within your circle of competence and those you have confidence in holding for the long term.

Evaluate Companies: Conduct deep analysis of the company's business model, financial metrics, and capital allocation practices.

Long-Term Investing: View investments as stakes in businesses, ride out market volatility, and ignore short-term noise from Wall Street and other analysts.

Past Editions

Includes: 1) China's Surplus, 2) Global Valuations, 3) Long-Term Investing, & 4) Trading vs. Investing

Includes: 1) 2024 US Market Review, 2) Concentration Risk, 3) Retail Sales Trajectory, & 4) Earnings vs. S&P500

Includes: 1) S&P 500 Valuation, 2) Canada’s Weak Economy, 3) Investment Vehicles in Canada, & 4) Diversification

Includes: 1) Yield Curve Inversion, 2) Tech Bubbles, 3) Gold vs. Treasuries, and 4) VIX.

Includes: 1) Trade Balances, 2) Deflation from China, 3) Global Reserve Currency, and 4) 2024 US Election Aftermath.

Includes: 1) S&P 500 Historical Growth, 2) Risk Terminology, 3) WFH Case, and 4) CRE Debt Crisis.

Includes: 1) Purchasing Power, 2) Global Liquidity, 3) Currency Debasement, 4) Hurdle Rate, and 5) Liquidity Cycles.

Includes: 1) Tough Industries to Invest In, 2) First Rule of Compounding, 3) CDN Focused Portfolios, and 4) Beta.

Includes: 1) MOATs, 2) Portfolio Recession Crashes, 3) Capital Allocation, and 4) CDN vs US Dividend Growers.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!

Please refer to the details of the referral program below.

Invite your friends to read DiviStock Chronicles

Thank you for reading DiviStock Chronicles — your support allows me to keep doing this work. Join our referral program!