Take Nine - Random Investing Notes

A collection of insightful investment pieces to broaden knowledge and elevate the investing mindset. Includes: China's Surplus, Global Valuations, Long-Term Investing, Trading vs. Investing

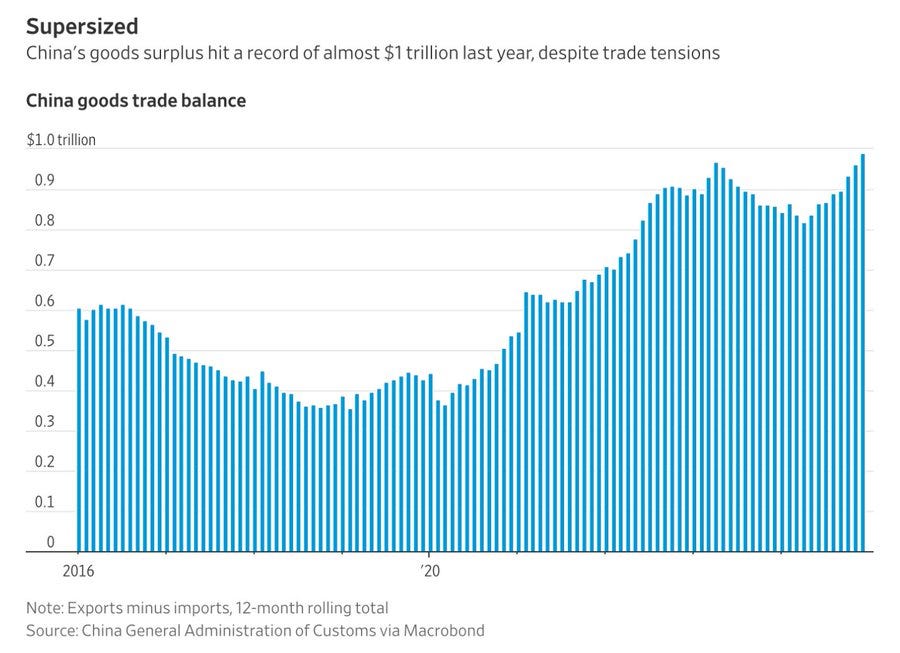

China’s Dominance

Don't be misled by mainstream media emphasizing concerns about China. Negative narratives often become louder when the weaknesses of Western economies are even greater. China has achieved its largest trade surplus ever and, according to statistics, currently accounts for around 27% of global industrial production, up from 24% in 2018. The UN predicts that by 2030, China's share of global industry will rise to 45%.

High-scale manufacturing is unlikely to return to the Western world as long as China continues to ramp up its investment in industrial production. China will remain the lowest-cost producer, with quality continuing to improve.

It's important to remember that the stock market is primarily a barometer for the West, not China. The Chinese place less emphasis on the stock market, which is why Chinese citizens are known to have one of the highest savings rates in the world. To boost productivity, the mindset in the West needs to shift away from speculative assets like meme coins and towards more productive investments. Energy may be the way!

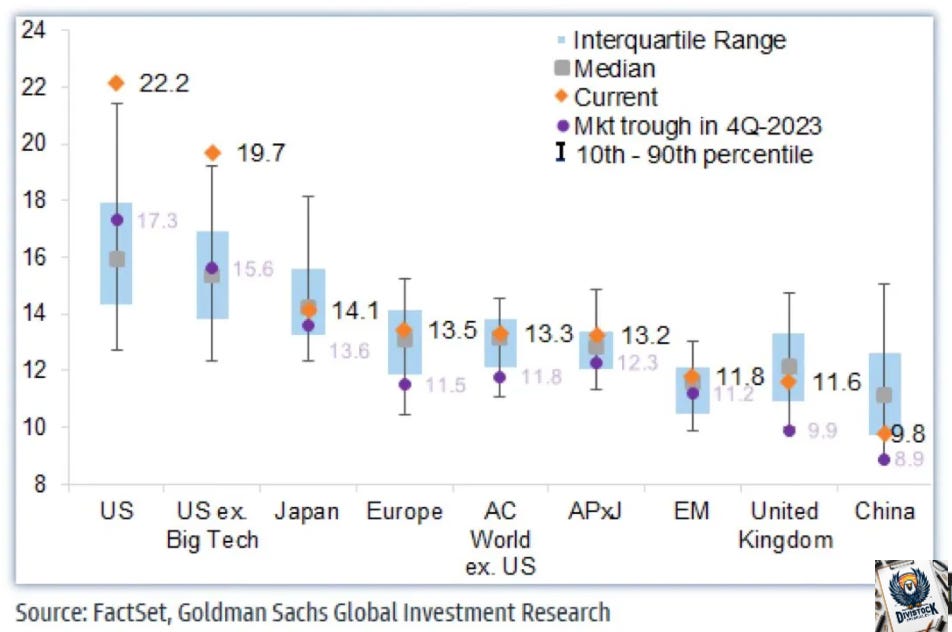

Global Valuations

The graph speaks for itself - extended valuations are not only in the top stocks of the S&P 500, but excluding those big tech names, we also see a premium in other equity valuations in the US. In contrast, other global markets align more closely with their median averages. Consequently, the US is drawing significantly more investment away from other global areas.

But a word of caution: any reset could hurt, though in the short term, this dominance will likely continue. Interactive Brokers, a well-known brokerage firm, just reported in their latest quarterly earnings that they have witnessed the highest level of margin in their accounts. We are literally living on borrowed time.

Margin refers to the practice of borrowing money from a broker to purchase securities. It allows investors to buy more stock than they could with just their available cash.

The Long Game of Investing

Investing isn't about quick wins; it's about holding great businesses over time. Here are some easy-to-follow strategies to keep you on track:

Think Like an Owner: Treat your investments as pieces of a business. Try to understand what the company does, how it makes money, and why it’s better than its competitors.

Stay Calm During Ups and Downs: Stock prices go up and down all the time. Good companies usually bounce back and grow. If the stock price drops but the company is still strong, it might be a good chance to buy more shares at a lower price.

Tune Out the Noise: Don’t get distracted by the constant news and short-term market predictions. Some of the best companies focus on long-term growth rather than short-term results.

But it is also important to figure out where you fit on the investing spectrum. Every investor has their own style and comfort level with risk. Adjusting your stock choices to match your preferences can boost your confidence.

Conservative Investors: Look for lower valuation metrics, like a low price-to-earnings (P/E) ratio or a low price-to-free cash flow (P/FCF) and prioritize companies with minimal debt. When you avoid debt, you reduce risks. Conservative investors want safety first and sustainable results.

Growth-Oriented Investors: Consider paying higher valuations for companies with exceptional growth rates and competitive advantages. Aggressive investors accept that higher returns often come with higher risk. They will go into new markets and focus on revenue growth.

Trading vs. Investing

See previous article on "Trading vs. Investing". At a high level, here are the key differences between trading and investing:

Trading vs. Investing

There are many posts on the internet that offer a range of insights from both a technical perspective as well as a fundamental view. Although they can co-mingle in certain instances, you usually fit into one of the two labels: trader or investor. It would be quite onerous for one to engage in both (unless one is a business for you and the other can be d…

Approach: Traders focus on short-term gains by actively buying and selling to capitalize on price fluctuations, while investors take a long-term approach, often buying and holding assets.

Risk Levels: Trading involves higher risk due to the need for constant engagement and quick decision-making. Investors, on the other hand, generally face lower risk as they focus on the long-term financial health of companies.

Time Commitment: Traders need to be highly committed and actively engaged in the market, often on a daily basis. Investors can afford to be more patient and less involved in day-to-day market movements.

Technical vs. Fundamental Analysis: Traders rely more on technical indicators to make decisions, while investors prioritize market and company fundamentals.

Market Trends: Traders target both rising and falling markets to maximize returns, whereas investors are more concerned with the overall long-term growth of their investments.

Past Editions

Includes: 1) 2024 US Market Review, 2) Concentration Risk, 3) Retail Sales Trajectory, & 4) Earnings vs. S&P500

Includes: 1) S&P 500 Valuation, 2) Canada’s Weak Economy, 3) Investment Vehicles in Canada, & 4) Diversification

Includes: 1) Yield Curve Inversion, 2) Tech Bubbles, 3) Gold vs. Treasuries, and 4) VIX.

Includes: 1) Trade Balances, 2) Deflation from China, 3) Global Reserve Currency, and 4) 2024 US Election Aftermath.

Includes: 1) S&P 500 Historical Growth, 2) Risk Terminology, 3) WFH Case, and 4) CRE Debt Crisis.

Includes: 1) Purchasing Power, 2) Global Liquidity, 3) Currency Debasement, 4) Hurdle Rate, and 5) Liquidity Cycles.

Includes: 1) Tough Industries to Invest In, 2) First Rule of Compounding, 3) CDN Focused Portfolios, and 4) Beta.

Includes: 1) MOATs, 2) Portfolio Recession Crashes, 3) Capital Allocation, and 4) CDN vs US Dividend Growers.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!

Please refer to the details of the referral program below.

Invite your friends to read DiviStock Chronicles

Thank you for reading DiviStock Chronicles — your support allows me to keep doing this work. Join our referral program!