Take Seven - Random Investing Notes

A collection of insightful investment pieces to broaden knowledge and elevate the investing mindset. Includes: S&P 500 Valuation, Canada’s Weak Economy, Investment Vehicles in Canada, Diversification

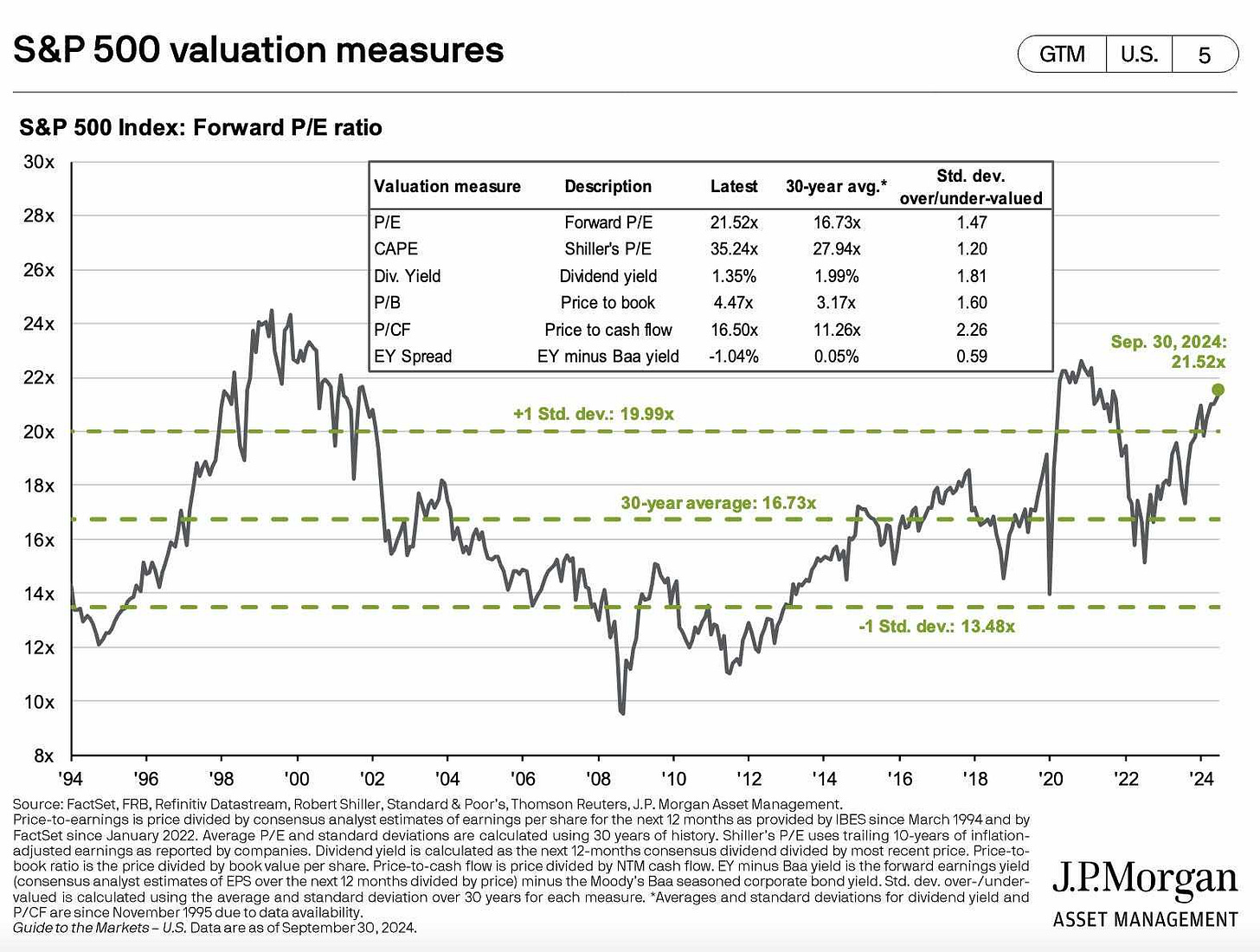

S&P 500 Valuation

The last time we encountered such high valuations across many of the metrics shown in the image below, it was during the Tech Bubble of the 2000s, which subsequently led to a significant stock market crash.

The technology bubble of the 2000s and the current technology market share certain similarities, but they also possess significant differences. Here's a breakdown:

Similarities:

High Valuations: Both periods saw tech companies with extremely high valuations. In the 2000s, many internet-based startups had sky-high valuations without solid business models.

Speculative Investments: There was a lot of speculative trading in both periods. In the 2000s, it was dot-com companies; today, it's companies like Nikola and Virgin Galactic.

Rapid Market Growth: Both periods experienced rapid increases in stock prices, particularly in tech stocks.

Differences:

Company Fundamentals: Today's leading tech companies, like Apple, Amazon, and Google, have strong fundamentals and profitability, unlike many of the dot-com companies in the 2000s.

Market Composition: The tech sector now includes a broader range of industries, such as cloud computing, e-commerce, and electric vehicles, compared to the primarily internet-based companies of the 2000s.

Investor Perception: Tech companies today are often seen as defensive investments due to their resilience during economic downturns, unlike the speculative nature of the 2000s.

Now, instead of the internet craze, we have the AI craze. Is it just another hyped-up event, or will growing earnings materialize?

High valuations have yet to justify themselves, as earnings are still lagging behind the excessive valuations currently seen in major technology companies like Microsoft, Nvidia, and Apple, to name a few.

So where do we go from here?

Canada’s Faltering Economy

The projected growth in real GDP per capita is not something Canada should be proud of. Canada is expected to have the lowest average annual growth rate from 2020 to 2060 among the OECD (Organisation for Economic Co-operation and Development) countries.

Real GDP per capita is a measure of the average economic output per person, adjusted for inflation. It provides a more accurate representation of an economy's standard of living by accounting for changes in price levels over time.

If you look at Canada's main stock market index, the S&P/TSX Composite Index, it tracks the performance of around 230 companies listed on the Toronto Stock Exchange (TSX). Although financials make up a large part of its composition, it is followed by energy, materials, and industrials.

There was a time when business investment in these sectors outside of financials was booming. However, since 2015, coinciding with the Liberal government of Trudeau coming into power, business investment in the energy and mining sectors has dropped significantly from $102 billion to $50 billion. This decline is evident from the data below. Consequently, Canada's GDP per capita has fallen sharply, as these sectors are crucial to the country's productivity.

Do we really need to know where most disposable income goes? Just look at the enormous divide between house prices and disposable income in the chart below. This partly explains why financial institutions like Royal Bank and National Bank have seen such significant gains.

But look on the bright side—change is on the horizon. With the Trudeau Liberal government likely on its way out, the incoming US President, Donald J. Trump, who is a big supporter of the energy sector, and falling interest rates in Canada, there are promising opportunities ahead.

Snapshot of Investment Vehicles in Canada

In Canada, non-registered accounts are standard investment accounts that do not offer any tax-deferral benefits. Earnings within these accounts are subject to taxation annually, based on capital gains, dividends, or interest income. On the other hand, registered accounts, like Tax-Free Savings Accounts (TFSAs) and Registered Retirement Savings Plans (RRSPs), provide tax advantages. In a TFSA, investment earnings grow tax-free, and withdrawals are not taxed. With an RRSP, contributions are tax-deductible, and the investments grow tax-deferred until withdrawal, typically during retirement when one's income may be lower. Each type of account serves different financial goals and tax planning strategies for Canadian investors.

Diversification

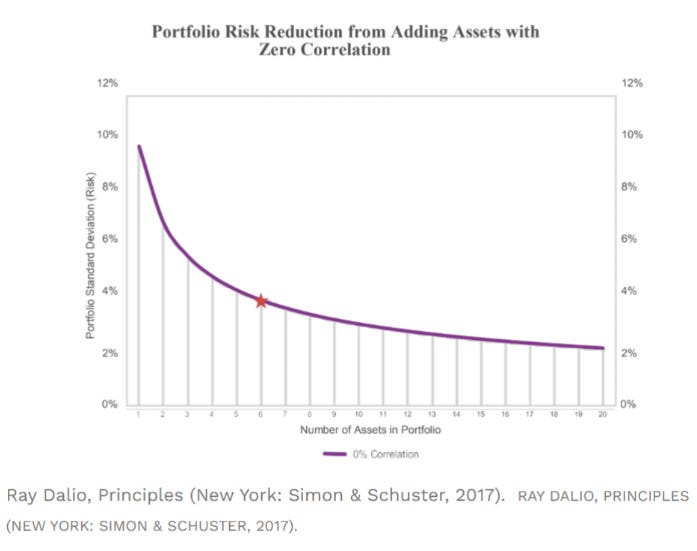

Absolutely, it still works. If you're a DIY investor adding individual stocks and essentially creating your own ETF, diversification can help spread your risk. Remember, each asset class behaves differently at various stages of the economic cycle. However, there comes a point where further diversification adds minimal impact on risk reduction.

According to the chart above, stagnation occurs when you hold 12-20 assets. Beyond this number, additional diversification offers limited upside. The key is to look across asset classes and select the best of the best. Keep this in mind as you build your portfolio.

Past Editions

Includes: 1) Yield Curve Inversion, 2) Tech Bubbles, 3) Gold vs. Treasuries, and 4) VIX.

Includes: 1) Trade Balances, 2) Deflation from China, 3) Global Reserve Currency, and 4) 2024 US Election Aftermath.

Includes: 1) S&P 500 Historical Growth, 2) Risk Terminology, 3) WFH Case, and 4) CRE Debt Crisis.

Includes: 1) Purchasing Power, 2) Global Liquidity, 3) Currency Debasement, 4) Hurdle Rate, and 5) Liquidity Cycles.

Includes: 1) Tough Industries to Invest In, 2) First Rule of Compounding, 3) CDN Focused Portfolios, and 4) Beta.

Includes: 1) MOATs, 2) Portfolio Recession Crashes, 3) Capital Allocation, and 4) CDN vs US Dividend Growers.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!

Please refer to the details of the referral program below.

Invite your friends to read DiviStock Chronicles

Thank you for reading DiviStock Chronicles — your support allows me to keep doing this work. Join our referral program!

References

Crescat Capital. 2024. Crescat Firmwide Presentation. September. https://www.crescat.net/wp-content/uploads/Crescat-Firmwide-Presentation_September-2024_-8.pdf.