Visa - A Dominant Force - FY24

As companies start to reveal their earnings for the fiscal year 2024, here are the results for a stock within my portfolio along with a business valuation.

Welcome to my summary of Visa’s ($V) earnings report for fiscal 2024. For additional context, please refer to my earlier post detailing my valuation methodology.

Year-End Results

Visa (V) scale of dominance continues. A high-quality payment network facilitating transactions worldwide in more than 200 countries. It is simply a money-making machine.

Revenues increased by 10%.

Earnings per share (EPS) saw an 18% increase, whereas the adjusted EPS rose by 15%.

Dividends per share (DPS) increased by 16%.

The payout ratio stayed steady at 21%.

Operating cash flow (OCF) was $19.9 billion, and free cash flow1 (FCF) was $18.7 billion.

The net profit margin improved even more at 55%.

The long-term debt-to-equity ratio has consistently held at around 0.53.

The annualized average growth rate of the share price was +11% over five years, 6% over three years, and +19% over the past year.

The number of outstanding shares has diminished further through buybacks.

Investor Presentation Highlights

Global Recognized Brand. Supported by a high profit margin and strong free cash flows. A shareholder friendly company. Take it from management to say, “On capital return, the Board has declared an increase to our quarterly dividend by 13%, and we intend to return excess free cash flow to shareholders through buybacks.”

Key Business Drivers. Observing growth in these areas is heartening, yet taking a step back to view the broader context reveals that the growth rate has significantly diminished post-COVID-19 recovery. I anticipate that 2025 will continue this trend of growth, albeit along a similar trajectory.

Anti-Competitive? The U.S. Department of Justice is recognized for intimidating large, global companies; however, its success rate in confronting these entities is varied. Visa has dismissed the allegations as meritless. It will be worthwhile to monitor this situation in the upcoming year.

My Own Valuation

Visa is one of the best stocks out there in my own opinion. It’s dominance across the payment network is unbelievable and the cost advantages it holds makes it hard for any aspiring competitor to dethrone it. The same thing could be said about Mastercard. I’ve made it a goal for Visa to be a top five holding in my portfolio.

I also do tend to agree that the lawsuit against them is meritless. If you consider Visa’s attempt to monopolize the industry, then what is Mastercard to them? And how would you penalize such a highly efficient payment processor who makes life that much easier for businesses and consumers? Newcomers to this industry would need substantial investment to construct payment networks comparable to those established by the current leaders.

Just like a new telecommunications company looking to break into a market controlled by established players faces a significant challenge. The hefty investment needed to build infrastructure from scratch may not be worth the effort. The only alternative is to innovate on a grand scale, akin to Elon Musk's Starlink and its satellite internet service. This represents a threat similar to the one alternative payment providers pose to VISA's network. Yet, VISA's extensive moat and reach likely insulate it from any immediate or mid-term threats from these newcomers or growing payment networks.

As long as Visa maintains its competitive advantage, it will continue to command a premium price. Any decrease in its stock price may present a buying opportunity. While an economic downturn may temper its short-term growth, it is unlikely to diminish the company's overall quality.

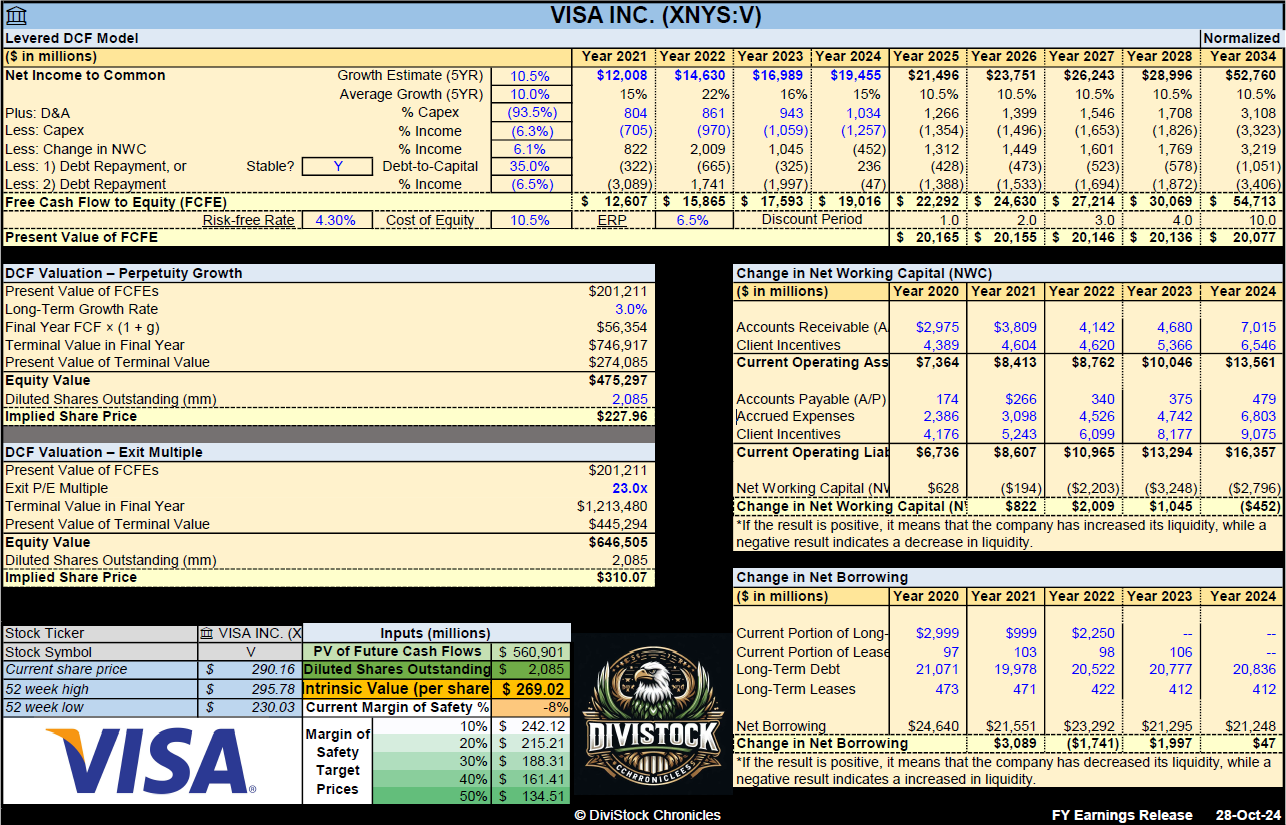

Net Income Growth: The spreadsheet presents a growth estimate that reflects the company's anticipated rise in net income for the upcoming five years, based on the average of projections from multiple analysts. The estimate is additionally adjusted down to reflect a more conservative approach.

Free Cash Flow to Equity (FCFE): This is calculated for several years, showing the amount of cash that could be distributed to shareholders after all expenses, reinvestment, and debt repayments.

Discounted Cash Flow (DCF) Valuation: The spreadsheet includes a DCF valuation section, which is a method used to estimate the value of an investment based on its expected future cash flows. It provides two valuation methods:

Perpetuity Growth: Calculated using a long-term growth rate and discounting future cash flows.

Exit Multiple: Based on an exit price-to-earnings (P/E) multiple.

Current Share Price vs. DCF Value: A table compares the current share price of ATD with the estimated share price based on DCF valuation, suggesting whether the stock is undervalued or overvalued according to the model.

Disclaimer: The information provided in this valuation analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy, sell, or hold any specific stocks or securities. The valuation model presented here relies on certain assumptions, including projected future cash flows and discount rates.

Other FY24 Reviews

Free Cash Flow (FCF) is essentially Operating Cash Flow (OCF) minus capital expenditures. This figure may differ from the FCF reported in the company's financial statements.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!

Please refer to the details of the referral program below.

Invite your friends to read DiviStock Chronicles

Thank you for reading DiviStock Chronicles — your support allows me to keep doing this work. Join our referral program!