Apple - Cash is King - FY24

As companies start to reveal their earnings for the fiscal year 2024, here are the results for a stock within my portfolio along with a business valuation.

Welcome to my summary of Apple’s ($AAPL) earnings report for fiscal 2024. For additional context, please refer to my earlier post detailing my valuation methodology.

Year-End Results

Apple (AAPL) is a cash flow machine - there’s not much else to it. Brand loyalty remains robust, though there is a clear need for an innovative new product to boost product revenues. Meanwhile, service revenues have significantly increased, achieving a record high.

Revenues increased by 2%.

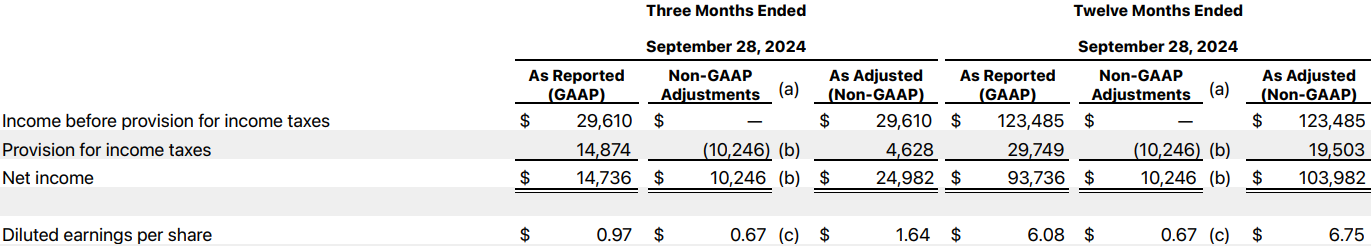

Earnings per share (EPS) saw a decrease of 1%, but adjusted EPS rose by 10%.

Adjusted EPS accounts for one-time income tax charge.

Dividends per share (DPS) increased by 4%.

The payout ratio stayed steady at 16%.

Operating cash flow (OCF) was $118 billion, and free cash flow1 (FCF) was approximately $109 billion.

The net profit margin was 27% after adjusting for one-time expense.

The long-term debt-to-equity ratio has consistently held at around 1.50 with a FCF to Debt of 1.12.

The annualized average growth rate of the share price was +32% over five years, 14% over three years, and +20% over the past year.

The number of outstanding shares has diminished further through buybacks.

Investor Call Highlights

Apple Intelligence. The extent of these features have yet to be fully realized with a slow roll-out across Apple products. The impact of the AI play once known, will have the biggest impact on the company’s share price. As it stands currently, the price reflects a massively positive impact, but only time will tell.

China. The most significant red flag in this report is the impact on sales within the Greater China region. Competition is intensifying, and Apple's market share is not as robust as it was in the past. Although this threat has been known for quite some time, its effects are only now becoming apparent.

Buybacks Continue. According to their earnings call, any surplus cash will be consistently returned to shareholders. Shareholders will continue to receive rewards as long as the company generates massive cash inflows.

My Own Valuation

Apple's premium valuation hinges on continued consumer loyalty to its products and services. Yet, at current prices, Apple requires a significant innovative product or service to drive further growth, and such innovation must be remarkably successful. This presents a limitation for Apple's future prospects. In my view, reliance solely on product refresh cycles is insufficient to justify the high premium on their stock.

As long as Apple maintains its robust liquidity and steady growth in cash flow, I will remain an investor. They are among the select companies with the capacity to rebound from an economic downturn more swiftly than their competitors and deliver value to shareholders via buybacks as a result of their strong balance sheet.

Net Income Growth: The spreadsheet presents a growth estimate that reflects the company's anticipated rise in net income for the upcoming five years, based on the average of projections from multiple analysts. The estimate is additionally adjusted down to reflect a more conservative approach.

Free Cash Flow to Equity (FCFE): This is calculated for several years, showing the amount of cash that could be distributed to shareholders after all expenses, reinvestment, and debt repayments.

Discounted Cash Flow (DCF) Valuation: The spreadsheet includes a DCF valuation section, which is a method used to estimate the value of an investment based on its expected future cash flows. It provides two valuation methods:

Perpetuity Growth: Calculated using a long-term growth rate and discounting future cash flows.

Exit Multiple: Based on an exit price-to-earnings (P/E) multiple.

Current Share Price vs. DCF Value: A table compares the current share price of ATD with the estimated share price based on DCF valuation, suggesting whether the stock is undervalued or overvalued according to the model.

Disclaimer: The information provided in this valuation analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy, sell, or hold any specific stocks or securities. The valuation model presented here relies on certain assumptions, including projected future cash flows and discount rates.

Other FY24 Reviews

Free Cash Flow (FCF) is essentially Operating Cash Flow (OCF) minus capital expenditures. This figure may differ from the FCF reported in the company's financial statements.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!

Please refer to the details of the referral program below.

Invite your friends to read DiviStock Chronicles

Thank you for reading DiviStock Chronicles — your support allows me to keep doing this work. Join our referral program!