Automatic Data Processing - A Leader as Always - FY24

As companies start to reveal their earnings for the fiscal year 2024, here are the results for a stock on my shortlist along with a business valuation.

Welcome to my summary of Automatic Data Processing’s ($ADP) earnings report for fiscal 2024. For additional context, please refer to my earlier post detailing my valuation methodology.

Year-End Results

Automatic Data Processing (ADP) is a leading global technology company that provides human capital management (HCM) solutions. It continues proving to be one of the most reliable companies in this industry.

Revenues increased by 7%.

Earnings per share (EPS) saw an increase of 11%, and adjusted EPS rose by 12%.

Dividends per share (DPS) increased by 15%.

The payout ratio stayed steady at 60%.

Operating cash flow (OCF) was $4.1 billion, and free cash flow1 (FCF) was approximately $3.9 billion.

The net profit margin was 19% ticking up slowly over the years.

The long-term debt-to-equity ratio has continued to decrease from 1.04 in 2022 to 0.73 in 2024. FCF to Total debt remained elevated at 1.16.

The annualized average growth rate of the share price was +10% over five years, 13% over three years, and +5% over the past year.

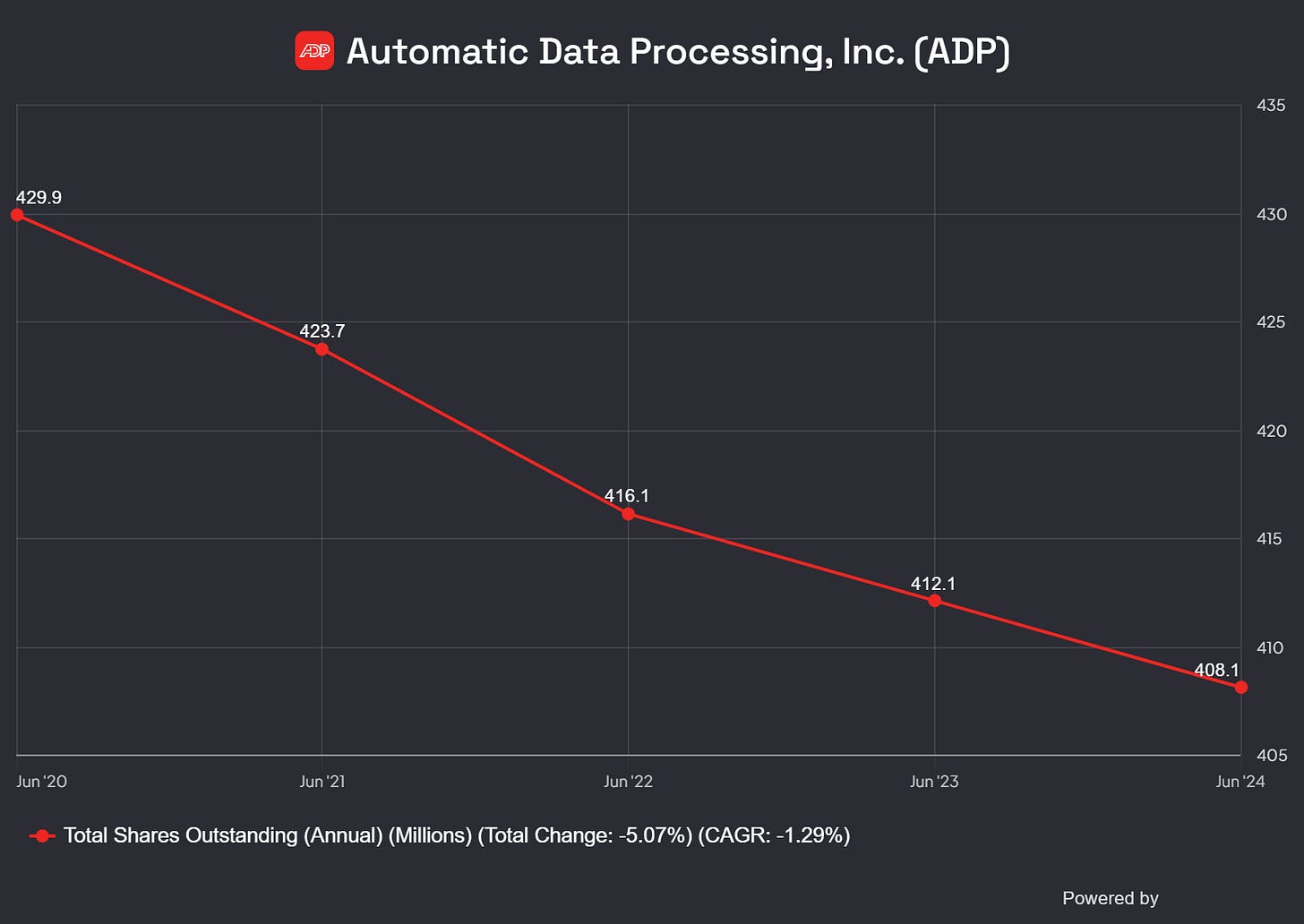

The number of outstanding shares has diminished further through buybacks.

Investor Call Highlights

Reputation at a High. A retention rate of 92.0% was achieved, surpassing expectations. The retention rate gauges a company's success in maintaining its customer base over a given period. Additionally, client satisfaction scores have attained unprecedented peaks.

Building on AI. Launched ADP Assist, a generative AI-powered cross-platform solution. Deployed generative AI tools to support service associates and drive implementation efficiencies.

Goodwill. Identified as a critical audit matter, a clean audit opinion was nonetheless obtained. Forecasting future revenue and operating margin for the Company's next-gen platform, which lacks extensive historical data, is a common challenge in AI initiatives. This was a key factor in determining the fair value of a reporting unit within the Employer Services segment, which held approximately $678 million in goodwill as of June 30, 2024. Due to the scant historical data on the Company's next-gen platform, considerable management judgment was necessary to project future revenues and operating margins for the fair value estimation of the reporting unit.

Although goodwill constitutes only 4% of the total assets, which seems insignificant, it is still prudent to monitor its growth, especially as the business increasingly integrates AI technologies.

My Own Valuation

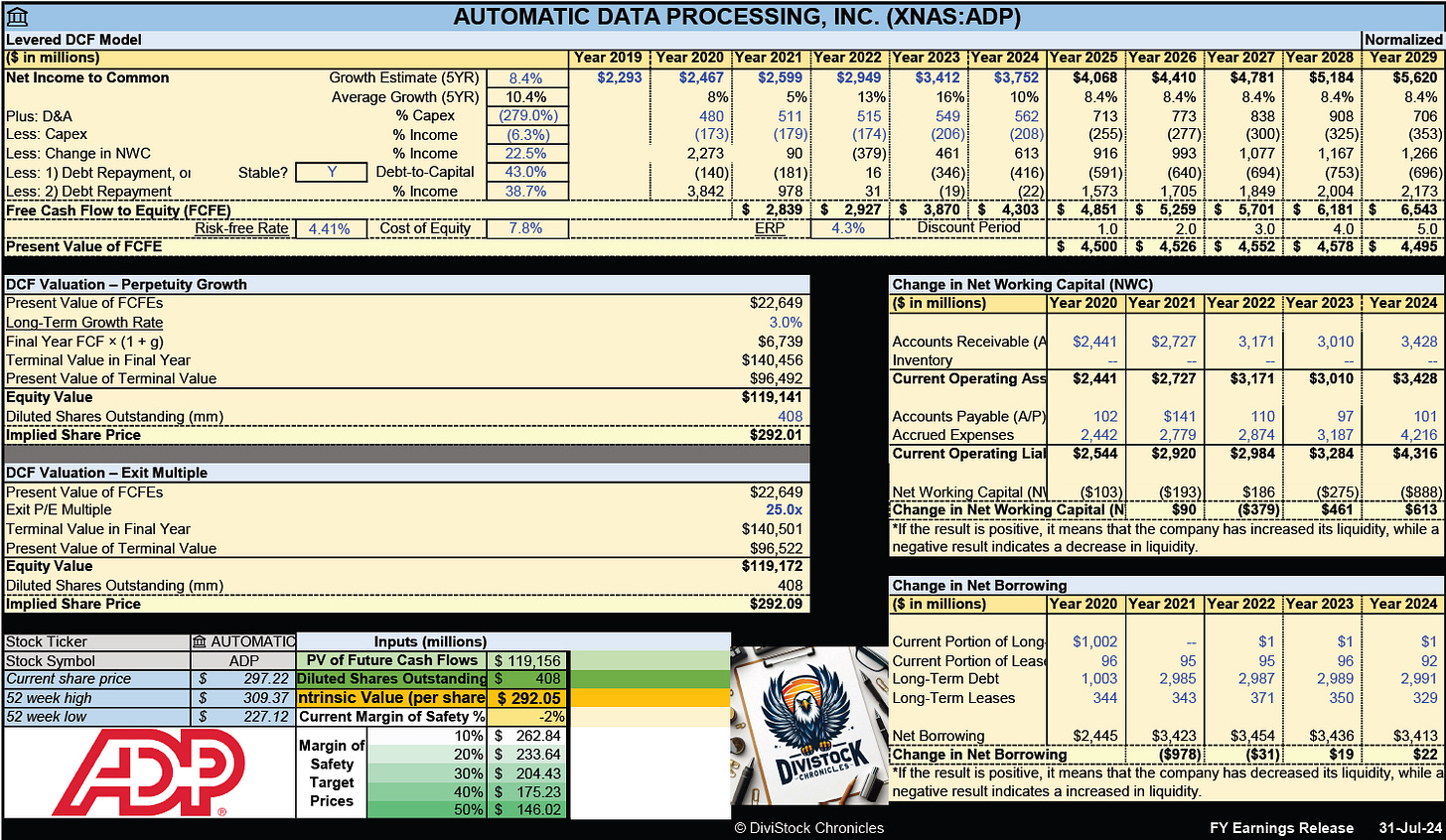

ADP has experienced a significant run-up since the end of its last fiscal year. With growth projections averaging around 8%, it is trading at levels considered acceptable as indicated.

Nevertheless, I prefer to incorporate a more conservative growth rate, reducing the overall growth projection from analysts by at least two basis points. Consequently, this provides a more cautious perspective. This adjustment returns the valuation to its point of origin at the beginning of this upward trend.

Regardless of the projected growth rate, the margin of safety provides the 'security' of investing in these companies. ADP is a leader in their industry, so their fundamentals don't concern me, but I would prefer to invest at a more comfortable price point.

Net Income Growth: The spreadsheet presents a growth estimate that reflects the company's anticipated rise in net income for the upcoming five years, based on the average of projections from multiple analysts. The estimate is additionally adjusted down to reflect a more conservative approach.

Free Cash Flow to Equity (FCFE): This is calculated for several years, showing the amount of cash that could be distributed to shareholders after all expenses, reinvestment, and debt repayments.

Discounted Cash Flow (DCF) Valuation: The spreadsheet includes a DCF valuation section, which is a method used to estimate the value of an investment based on its expected future cash flows. It provides two valuation methods:

Perpetuity Growth: Calculated using a long-term growth rate and discounting future cash flows.

Exit Multiple: Based on an exit price-to-earnings (P/E) multiple.

Current Share Price vs. DCF Value: A table compares the current share price of ATD with the estimated share price based on DCF valuation, suggesting whether the stock is undervalued or overvalued according to the model.

Disclaimer: The information provided in this valuation analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy, sell, or hold any specific stocks or securities. The valuation model presented here relies on certain assumptions, including projected future cash flows and discount rates.

Other FY24 Reviews

Free Cash Flow (FCF) is essentially Operating Cash Flow (OCF) minus capital expenditures. This figure may differ from the FCF reported in the company's financial statements.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!

Please refer to the details of the referral program below.

Invite your friends to read DiviStock Chronicles

Thank you for reading DiviStock Chronicles — your support allows me to keep doing this work. Join our referral program!