Bank of Nova Scotia - Mediocrity at Best - FY24

As companies start to reveal their earnings for the fiscal year 2024, here are the results for a stock on my watchlist along with a business valuation.

Welcome to my summary of Bank of Nova Scotia’s ($BNS) earnings report for fiscal 2024. For additional context, please refer to my earlier post detailing my valuation methodology.

Year-End Results

Bank of Nova Scotia BNS 0.00%↑ is attempting to recover from its unsuccessful business endeavors in the Latin American (LATAM) region. The company's performance has been lackluster, and there has been a decline in its dividend growth.

Revenues increased by 4%.

Earnings per share (EPS) saw an increase of 3%, but adjusted EPS remained very much unchanged.

Dividends per share (DPS) increased by 1%.

The payout ratio is currently at 72%, which is significantly above the company's target range of 40%-50%.

The net interest margin1 has been stagnating and remains around 2.17%.

The net profit margin remained steady at 26.2%.

The loan-to-deposit ratio (LDR2) remains around 80%, which is considered adequate for a bank.

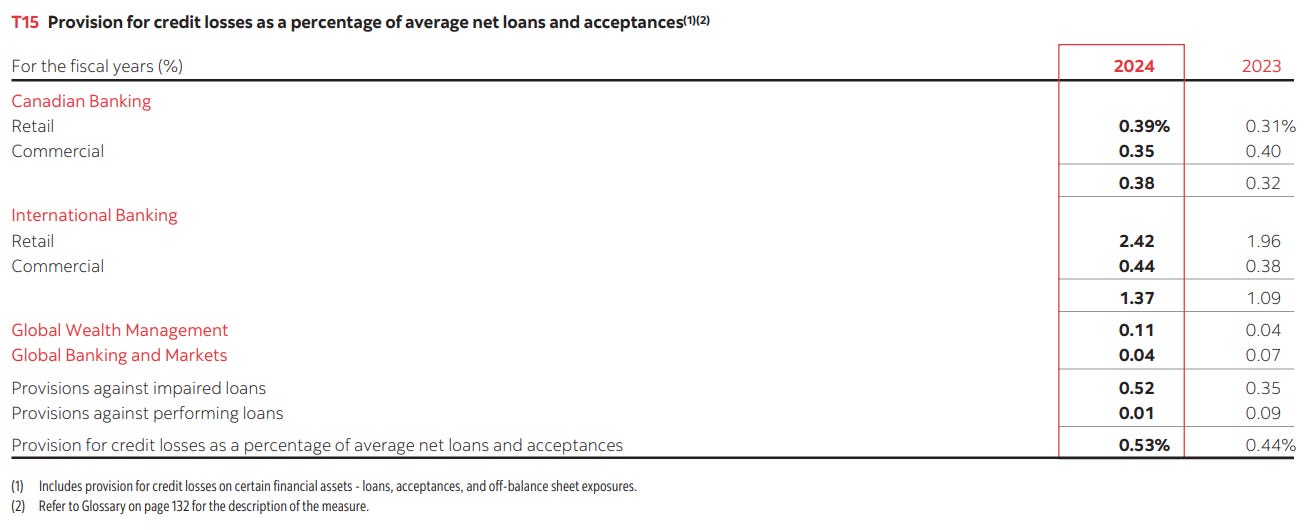

Provision for credit losses (PCLs3) have increased from $3.4 billion to $4.0 billion.

The annualized average growth rate of the share price was -2% over five years, -5% over three years, and -2% over the past year.

The number of outstanding shares has slightly increased above 2019 levels.

Investor Call Highlights

Moving Away from Low Growth Americas. Divestitures from certain parts of the Latin Americas (LATAM) as a part of new CEO’s strategy to focus on more high growth areas. BNS’ previous move to the LATAM’s was a hopeful diversification attempt but ultimately failed.

The expected growth in these countries is projected to remain positive but more modest than previously forecasted. The pace of interest rate cuts has slowed, and there is less certainty on near-term growth, particularly in Mexico, due to the period of presidential transition. The overall growth outlook for the LATAM region is cautious, with central banks stabilizing interest rates.

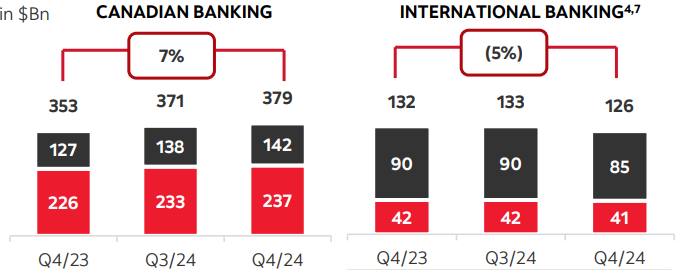

International Segment Lagging. Deposits in the Canadian sector continue to grow, yet the international segment struggles to gain traction.

Canadian Residential Mortgages. The mortgage portfolio in Canada is balanced respectfully with 70% in fixed and 30% in variable. As with all Canadian banks, there is a huge wave of maturities from 2025 through 2027. Nevertheless, I believe BNS stands in a strong position in this regard, despite a significant portion of their loan portfolio being allocated to residential mortgages.

In 2020, the average 5-year fixed mortgage rate in Canada was around 2.79%

In 2021, the average 5-year fixed mortgage rate in Canada was around 2.15%

In 2022, the average 5-year fixed mortgage rate in Canada was around 3.40%

Based on the latest forecasts, here are the expected average 5-year fixed mortgage rates in Canada for the upcoming years:

2025: Around 4.11%.

2026: Approximately 4.14%.

2027: Expected to be around 4.18%.

Keycorp. The bank has made an investment in KeyCorp as part of its strategy to profitably deploy capital into the U.S. market.

KeyCorp is a bank holding company based in Cleveland, Ohio. It operates through its subsidiary, KeyBank National Association, providing a wide range of retail and commercial banking products and services.

Provision for Credit Losses (PCLs). Despite the year-over-year increase in PCLs, there was a notable quarter-to-quarter decrease (from Q3 to Q4 2024, by 11 basis points). This decline can be attributed solely to the improved macroeconomic outlook in Canada, coupled with the ongoing reduction in interest rates.

Management expects an elevated PCL ratio in the first half of 2025, but with an improvement in late 2025 (I have my doubts…)

This represents the highest number of PCLs in the past decade, excluding the anomaly of the 2020 pandemic year.

My Own Valuation

In early 2022, I decided to divest from BNS, one of my initial investments, and redirected all the funds into Royal Bank RY 0.00%↑. This proved to be a wise decision. My original investment in BNS was driven by their expansion into the LATAM market, but unfortunately, it didn't yield the anticipated benefits for investors.

Despite this, I maintain a stable outlook on BNS's future prospects. However, the superior performance of other Canadian banks cannot be ignored. BNS may take a while before it unleashes fruitful gains. Even so, BNS has made a comeback and is currently trading around the intrinsic value I had calculated in my assessment. Maintaining a margin of safety is crucial for investing in banks operating in an environment filled with uncertainty.

Banks are likely to benefit as interest rates are reduced and monetary expansion persists. However, it's wise to secure profits before a potential crisis occurs. It's worth noting that Canadian banks are generally considered safer than their American counterparts.

Net Income Growth: The spreadsheet presents a growth estimate that reflects the company's anticipated rise in net income for the upcoming five years, based on the average of projections from multiple analysts. The estimate is additionally adjusted down to reflect a more conservative approach.

Free Cash Flow to Equity (FCFE): This is calculated for several years, showing the amount of cash that could be distributed to shareholders after all expenses, reinvestment, and debt repayments.

Discounted Cash Flow (DCF) Valuation: The spreadsheet includes a DCF valuation section, which is a method used to estimate the value of an investment based on its expected future cash flows. It provides two valuation methods:

Perpetuity Growth: Calculated using a long-term growth rate and discounting future cash flows.

Exit Multiple: Based on an exit price-to-earnings (P/E) multiple.

Current Share Price vs. DCF Value: A table compares the current share price of ATD with the estimated share price based on DCF valuation, suggesting whether the stock is undervalued or overvalued according to the model.

Disclaimer: The information provided in this valuation analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy, sell, or hold any specific stocks or securities. The valuation model presented here relies on certain assumptions, including projected future cash flows and discount rates.

Other FY24 Reviews

Net Interest Margin (NIM): Measures the difference between the interest income generated and the amount of interest paid out to lenders, relative to the amount of their interest-earning assets. A good NIM for banks typically falls around 3% to 4%

LDR: Measures the proportion of a bank's total loans to its total deposits. It indicates how much of the bank's deposits are being used to fund loans. The ideal LDR typically falls between 80% and 90%.

Provision for Credit Losses (PCLs): Funds that financial institutions set aside to cover potential losses from loans and other credit exposures that may not be repaid. PCLs are treated as an expense on the company's financial statements which reduces a company’s earnings.