National Bank - A Quiet Gem - FY24

As companies start to reveal their earnings for the fiscal year 2024, here are the results for a stock in my portfolio along with a business valuation.

Welcome to my summary of National Bank’s ($NA) earnings report for fiscal 2024. For additional context, please refer to my earlier post detailing my valuation methodology.

Year-End Results

National Bank is a quiet, smaller player in the Canadian market. While most others look beyond it, it continues to expand and produce fabolous results.

Revenues increased by 13%.

Earnings per share (EPS) experienced a 16% increase, while the adjusted EPS also rose by 10%.

Dividends per share (DPS) increased by 9%.

The payout ratio remained around 40%, which is at the lowest of the company's target range of 40%-50%.

The net interest margin1 has deteriorated from above 1% to 0.64%.

The net profit margin remained steady around 33%.

The loan-to-deposit ratio (LDR2) maintains a healthy stance at 73%.

Provision for credit losses (PCLs3) have increased from $397 million to $569 million.

The annualized average growth rate of the share price was +12% over five years, +8% over three years, and +14% over the past year.

The number of outstanding shares has marginally risen.

Investor Call Highlights

Acquisition of Canadian Western Bank (CWB). Approvals progressing well and expected to contribute to domestic growth in 2025 once it closes. Maximum integration of synergies though, specifically on the commercial side, to be realized between 2 to 4 years.

Declining Trend. Net interest income in every quarter of 2024, except the fourth quarter, was down from the corresponding quarters of 2023. These decreases stemmed primarily from trading activity revenues in the Financial Markets segment.

In their annual report, they avoid giving specific details but advise examining the segment as a whole, taking into account all revenues from trading activities (net interest and non-interest income). Ultimately, there's nothing concerning since the total sums have shown an increase year-over-year, yet it remains prudent to monitor.

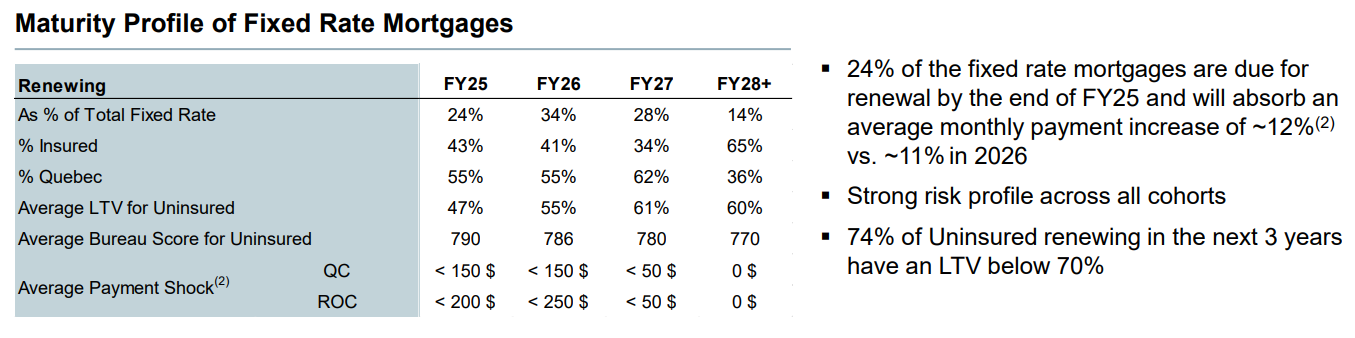

Canadian Residential Mortgages. Similar to the Bank of Nova Scotia and the Royal Bank, the National Bank of Canada's mortgage portfolio maintains a balanced composition with 70% fixed-rate and 30% variable-rate mortgages. Like all Canadian banks, a significant wave of mortgage maturities is expected between 2025 and 2027. Regardless of the economy's performance, there will be an impact at renewal time. However, when analyzing National Bank, greater focus should be placed on the Province of Quebec, as the majority of its mortgages originate there.

In 2020, the average 5-year fixed mortgage rate in Canada was around 2.79%

In 2021, the average 5-year fixed mortgage rate in Canada was around 2.15%

In 2022, the average 5-year fixed mortgage rate in Canada was around 3.40%

Based on the latest forecasts, here are the expected average 5-year fixed mortgage rates in Canada for the upcoming years:

2025: Around 4.11%.

2026: Approximately 4.14%.

2027: Expected to be around 4.18%.

Warnings Shots. The Canadian economy is anticipated to experience slower growth in the first half of 2025, attributed to restrictive interest rates. A continued softness in the labor market, consumer spending, business investments, and the credit environment is expected.

My Own Valuation

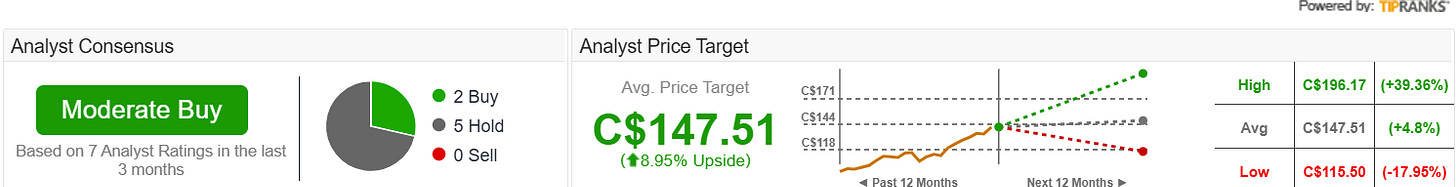

Similar to Royal Bank, which commands a significant premium over other Canadian banks, NA also holds a premium, albeit a smaller one. It has consistently outperformed its peers and continues to be favored by many investors.

It has been noted before that the Canadian economy may not be as robust as some perceive, contending with various challenges that must be addressed. Given the uncertainties ahead, hesitance to acquire additional shares of a stock already trading at a premium is understandable. Should conditions deteriorate, the financial sector is likely to be the first to experience the impact.

Banks may benefit from decreasing interest rates and ongoing monetary expansion. However, it is wise to secure profits before a potential crisis occurs. Notably, Canadian banks are generally considered more secure than their American counterparts