Canadian National Railway - A Rocky Track - FY24

As companies start to reveal their earnings for the fiscal year 2024, here are the results for a stock in my portfolio along with a business valuation.

Welcome to my summary of Canadian National Railway’s ($CNR/$CNI) earnings report for fiscal 2024. For additional context, please refer to my earlier post detailing my valuation methodology.

Year-End Results

Canadian National Railway (CNR) had a rough year. Too many unforeseen issues disrupted its operations. The results show it.

Revenues increased by 1%.

Earnings per share (EPS) experienced a 18% decrease, while the adjusted EPS decreased by 2%.

Dividends per share (DPS) increased by 7%.

The payout ratio elevated to 48%, exceeding the high of the pandemic 2020 year (46%).

Operating cash flow (OCF) was $6.7 billion, and free cash flow1 (FCF) was approximately $3.1 billion.

The net profit margin fell to 26%.

The long-term debt-to-equity ratio has risen to around 0.94 with a FCF to Debt of 0.15.

The annualized average growth rate of the share price was +7% over five years, +4% over three years, and +5% over the past year.

The number of outstanding shares continues to decrease as a result of the shareholder friendly buyback program.

Investor Call Highlights

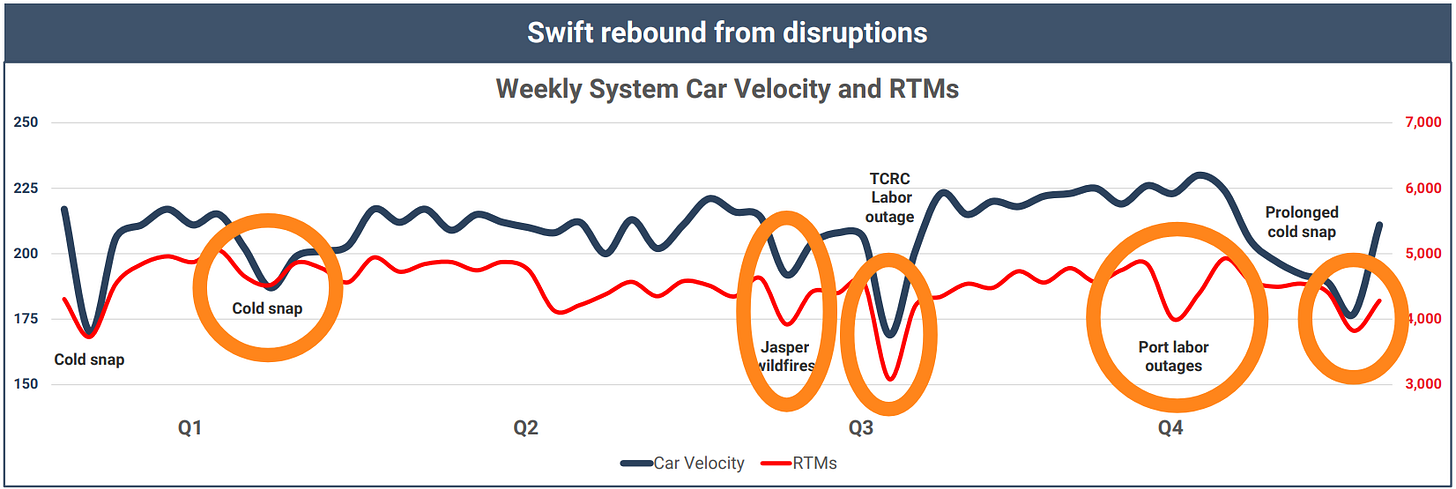

Disruptions Abound. One-off challenges certainly impacted the company’s performance in 2024. Labour disputes, port strikes, rail shutdowns were the main difficulties encountered. This was well acknowledged by management.

Car Velocity. This is one of the top measures in the rail industry of network health. Lower than the prior year, but still adequate considering all the obstacles faced.

Energy demand. Here is a great outlook chart on what CNR foresees to be the main drivers of volume. Energy seems to be a common trend. Automotives and lumber may continue to suffer.

Tariff Speculation. The implementation of tariffs is still unknown. Trump’s threats are real, but his actions are what matters. CNR remains optimistic about the prospects for growth in the North American economy and robust consumer demand. Although the future is uncertain, they plan to remain agile and respond swiftly as circumstances evolve. They have evaluated numerous options and formulated plans for different scenarios, assuming that the effects of tariffs and potential retaliatory measures will not be severe or long-lasting enough to trigger a recession in Canada or cause significant inflation in the U.S.

FX rate. The Canadian dollar is being hammered. A large amount of debt on CNR’s books is denominated in U.S. dollars (USD). However, the sensitivity is small - roughly every cent has an impact of $0.02 on the debt. On the other side, if it can stay at $0.70 (CAD/USD) it could represent a tailwind of about $0.15 on EPS.

My Own Valuation

CNR's 2024 fiscal year saw almost every metric worsen, offering little to be proud of. However, understanding CNR's business and its duopoly with Canadian Pacific Railway (CP) is crucial. The disruptions faced in 2024 are not expected to recur in 2025, as they have been addressed. The primary concern in 2025 will be tariffs, though their impact remains to be seen. While a recessionary environment could also pose a threat, there are currently no immediate signs of this.

CNR is trading at a discount due to its poor performance and looming 2025 threats. Addressing growth vectors will be crucial for CNR's recovery, but this process may take time. However, on a long-term basis, this downturn will likely be just a temporary setback.

Net Income Growth: The spreadsheet presents a growth estimate that reflects the company's anticipated rise in net income for the upcoming five years, based on the average of projections from multiple analysts. The estimate is additionally adjusted down to reflect a more conservative approach.

Free Cash Flow to Equity (FCFE): This is calculated for several years, showing the amount of cash that could be distributed to shareholders after all expenses, reinvestment, and debt repayments.

Discounted Cash Flow (DCF) Valuation: The spreadsheet includes a DCF valuation section, which is a method used to estimate the value of an investment based on its expected future cash flows. It provides two valuation methods:

Perpetuity Growth: Calculated using a long-term growth rate and discounting future cash flows.

Exit Multiple: Based on an exit price-to-earnings (P/E) multiple.

Current Share Price vs. DCF Value: A table compares the current share price of ATD with the estimated share price based on DCF valuation, suggesting whether the stock is undervalued or overvalued according to the model.

Disclaimer: The information provided in this valuation analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy, sell, or hold any specific stocks or securities. The valuation model presented here relies on certain assumptions, including projected future cash flows and discount rates.

Other FY24 Reviews

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.