TD Bank - A Restart is Needed - FY24

As companies start to reveal their earnings for the fiscal year 2024, here are the results for a stock in my portfolio along with a business valuation.

Welcome to my summary of TD Bank’s ($TD) earnings report for fiscal 2024. For additional context, please refer to my earlier post detailing my valuation methodology.

Year-End Results

TD Bank (TD) made headlines frequently throughout the past fiscal year, but not for positive reasons. The bank's performance was significantly impacted by an anti-money laundering (AML) scandal. The resulting $4.2 billion (CAD) penalty and subsequent restrictions in the US market led many investors to abandon their positions, while some viewed it as a chance to increase their investments.

TD Bank - A Big Uh-Oh!

TD Bank Group (TD) agreed to a plea deal with U.S. authorities to resolve multiple investigations into money laundering. As part of the deal, TD will pay $3.09 billion USD in penalties and face an asset cap on its U.S. retail banking operations. This asset cap limits the size of TD’s U.S. assets to about

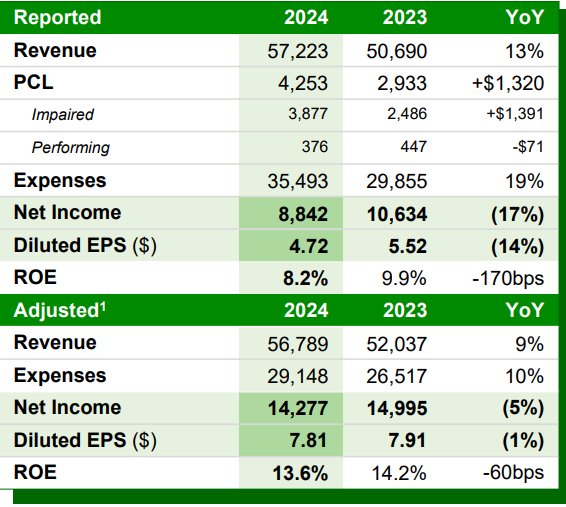

Revenues increased by 13%.

Earnings per share (EPS) saw a 14% reduction, and the adjusted EPS decreased by 1%, even after accounting for the AML impact.

Dividends per share (DPS) increased by 6%. The one positive.

The payout ratio increased to 86% due to the AML issue, significantly exceeding the company's target range of 40%-50%. Even excluding the AML impact, the payout ratio remained above the target at 52%.

The net interest margin1 hovered around the status quo of 1.7%.

The net profit margin has significantly decreased to approximately 16%.

The loan-to-deposit ratio (LDR2) maintains a healthy stance at 75%.

Provision for credit losses (PCLs3) have increased from $2.9 billion to $4.3 billion.

The annualized average growth rate of the share price was +2% over five years, 0% over three years, and -5% over the past year.

The number of outstanding shares continues to decrease as a result of buybacks.

Investor Call Highlights

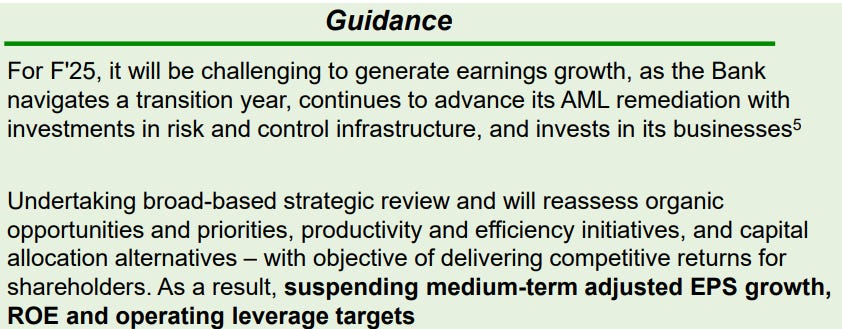

No Positive Guidance for 2025. Buckle up! Reminder that their EPS growth target was 7-10% and the ROE target was 16%. These are no longer feasible. Reassessment will occur during the next fiscal year.

Revenue Growth Strong. Despite various challenges, the revenue growth was notable. This was due to increased fee income from market-driven businesses, improved volumes and deposit margins in Canadian P&C, elevated insurance premiums, and the effects of reinsurance recoveries for catastrophic claims. However, this growth was offset by significant investments in TD's risk control infrastructure and numerous outstanding litigation settlements which are still expected going forward. Higher provision for credit losses, especially in the US Retail segment, also do not help the cause.

Commercial Real Estate (CRE). This represents $96 billion, or 10% of the Total Bank's gross loans and acceptances. This is one of the higher percentages among Canadian banks. The portfolio is diversified across various geographies and sub-segments:

56% of CRE portfolio in Canada and 44% in the U.S.

Office represents ~1% of total bank gross loans & acceptances.

31% of CRE office in Canada and 69% in the U.S.

Canadian Residential Mortgages. Similar to other Canadian banks, a substantial wave of mortgage maturities is anticipated between 2025 and 2027. The economy's performance notwithstanding, there will be repercussions at the time of renewal.

In 2020, the average 5-year fixed mortgage rate in Canada was around 2.79%

In 2021, the average 5-year fixed mortgage rate in Canada was around 2.15%

In 2022, the average 5-year fixed mortgage rate in Canada was around 3.40%

Based on the latest forecasts, here are the expected average 5-year fixed mortgage rates in Canada for the upcoming years:

2025: Around 4.11%.

2026: Approximately 4.14%.

2027: Expected to be around 4.18%.

U.S. Balance Sheet Restructuring. Plans to reduce U.S. assets by ~10% to support customer needs and maintain a buffer to asset limitations.

Investment portfolio repositioning is expected to be accretive to net interest income over the next 2-3 years.

My Own Valuation

TD was among the initial bank stocks in my portfolio. However, the returns have been challenging over the past five years. I have recently divested from roughly 80% of my stake in this bank. Refer back to my earlier piece on “TD - The Big Uh Oh”.

Valuation-wise, it would have been quite beneficial if the AML issue had not arisen. Had the ROE target of 16% been maintained and achievable, TD might have seen a price target in the $100 range. However, this is currently not the situation. Presently, we face numerous unknown variables, leading to a conservative valuation with a reduced ROE, excluding AML impacts. It may take several years to revert to this normalized level, after which TD could potentially ascend the ROE target ladder. Investors must consider whether to wait for the substantial dividends or to seek alternative investment opportunities.

Banks might profit from falling interest rates and continuous monetary expansion. Nevertheless, it is prudent to secure earnings before a potential crisis emerges. Notably, Canadian banks are often regarded as more secure than their American counterparts.