Brookfield Renewable Partners - A Diamond in the Rough - FY24

As companies start to reveal their earnings for the fiscal year 2024, here are the results for a stock in my portfolio along with a business valuation.

Welcome to my summary of Brookfield Renewable Partners’ ($BEP.UN/$BEPC) earnings report for fiscal 2024. For additional context, please refer to my earlier post detailing my valuation methodology.

Year-End Results

Brookfield Renewable Partners (BEP) continues its impressive growth as a company, but stock price still lags. Renewables will be a tough gig under the Trump administration. However, as part of the Brookfield group, it still stands to benefit from the US's focus on energy initiatives moving forward.

Revenues increased by 17%.

Adjusted EPS turned positive to $0.89.

Funds from Operations1 (FFO) increased by 10%.

Dividends, or distributions, per share (DPS) increased by 5%.

The payout ratio remained around 77%, which is just above the company’s target of 70%.

Operating cash flow (OCF) was $1.3 billion, and adjusted funds from operations2 (AFFO) was approximately $1.2 billion.

Total debt has increased, but the proportionate net debt to capitalization remains around 40%. AFFO to total debt ratio decreased slightly to 3.44.

The annualized average growth rate of the share price was +6% over five years, -12% over three years, and -7% over the past year.

The number of outstanding shares has marginally increased.

Investor Call Highlights

Market Sentiment. The renewable sector has experienced weaker sentiment in public markets due to potential policy changes from the new US administration. However, here is the exact response from the conference call:

“The simple fact is that the fundamentals for energy have never been better. The low cost renewable technologies that we have built our business on are the cheapest form of electricity production and are seeing greater demand than ever before. As a result, we believe that low cost renewables, which are readily available to deploy, will play a leading role in the requirements for any and all increases in generation capacity that we are already seeing unfold.”

Microsoft Agreement. BEP signed a landmark agreement with Microsoft to deliver 10.5 gigawatts of new renewable energy capacity by 2030, supporting Microsoft's data center growth and AI-powered cloud services.

Asset Recycling Stars. BEP generated $2.8 billion in proceeds from asset sales in 2024, boasting an impressive average return of 25% IRR. This figure represents approximately 2.5 times BEP’s invested capital, highlighting their exceptional performance in securing strong returns and generating significant capital to fund future growth initiatives.

IRR stands for Internal Rate of Return. It's a financial metric used to evaluate the profitability of an investment

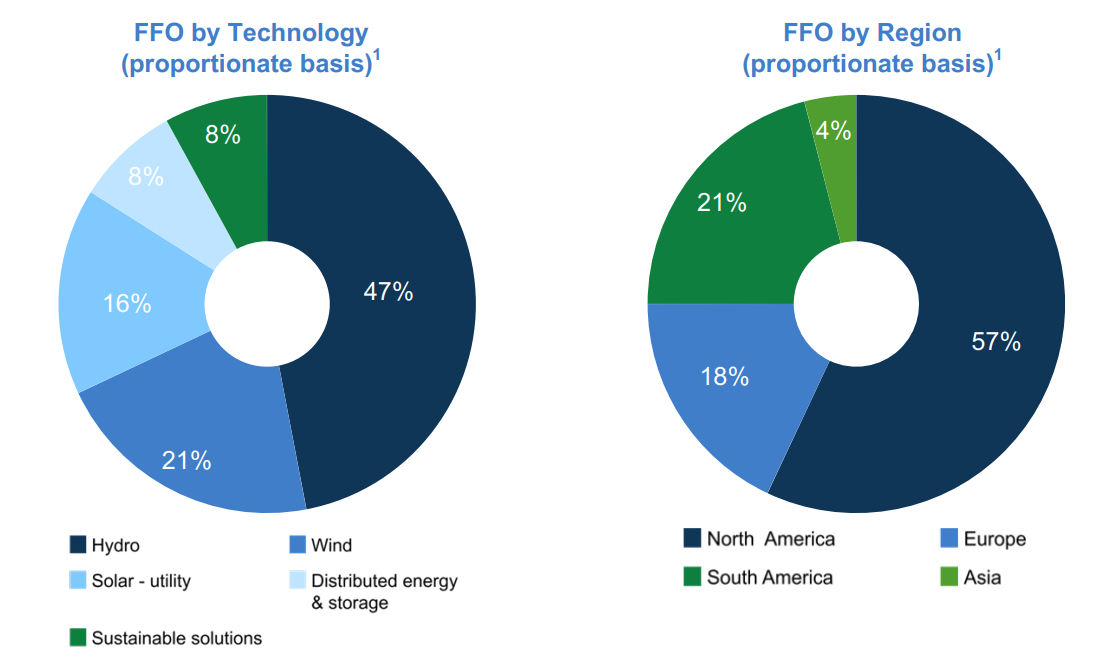

Diversified in All Areas. BEP understands the benefits of diversification and is fully aware of that not only in its technology, but also in its geographic presence.

Wind energy technology is likely to crater under this US administration. However, BEP presents a comprehensible case. Almost the entirety of their wind exposure in the US is onshore and on private lands. Any issues around this should be resolved quickly as cheaper, available energy would be hard to find.

AI Driven. The biggest demand driver for power going forward will be artificial intelligence (AI). This is above crypto, and above cloud solutions. BEP management seems unworried, even with DeepSeek’s potential insight into less power demand. Here are two takes from the earnings call:

Supply-Demand Imbalance: Given all the AI growth forecasted, there is not enough power to support it.

Efficiency of AI technologies: Adopting a devil's advocate stance, BEP management believes that if this scenario unfolds, costs will decrease, spurring more prevalent growth in the sector and consequently increasing the demand for power.

My Own Valuation

Certainly, this is a riskier business segment within the Brookfield portfolio. However, it remains one of the top performers in the renewable energy industry. There are numerous potential deterrents, particularly from the new US administration, which may not favor renewables. Nevertheless, the essential point is that if energy is to be abundant, renewables will inevitably play a crucial role.

The Microsoft agreement has brought significant attention to BEP. However, it's important to recognize that this agreement will only come into effect in 2026, and a lot can change between now and then.

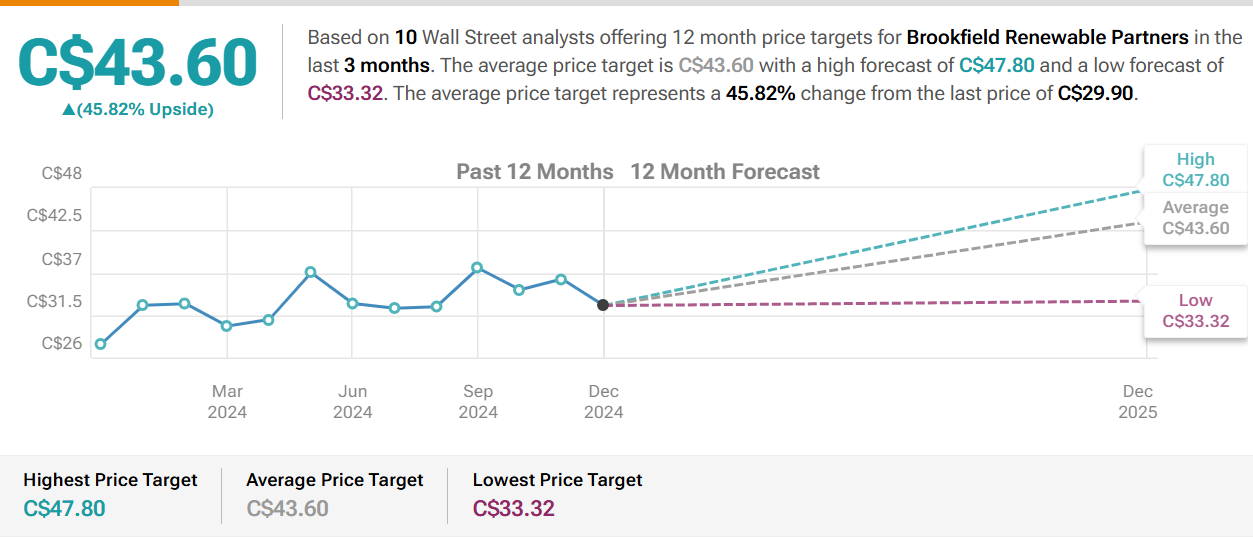

From a market perspective, it has been out of favor for a long time since its all-time highs. Although somewhat speculative, its potential for growth going forward is appealing. The price is currently holding at the $30 level, but there is concern about the rollback of renewables under the Trump administration.

Net Income Growth: The spreadsheet presents a growth estimate that reflects the company's anticipated rise in net income for the upcoming five years, based on the average of projections from multiple analysts. The estimate is additionally adjusted down to reflect a more conservative approach.

Free Cash Flow to Equity (FCFE): This is calculated for several years, showing the amount of cash that could be distributed to shareholders after all expenses, reinvestment, and debt repayments.

Discounted Cash Flow (DCF) Valuation: The spreadsheet includes a DCF valuation section, which is a method used to estimate the value of an investment based on its expected future cash flows. It provides two valuation methods:

Perpetuity Growth: Calculated using a long-term growth rate and discounting future cash flows.

Exit Multiple: Based on an exit price-to-earnings (P/E) multiple.

Current Share Price vs. DCF Value: A table compares the current share price of ATD with the estimated share price based on DCF valuation, suggesting whether the stock is undervalued or overvalued according to the model.

Disclaimer: The information provided in this valuation analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy, sell, or hold any specific stocks or securities. The valuation model presented here relies on certain assumptions, including projected future cash flows and discount rates.

Other FY24 Reviews

Brookfield Infrastructure Partners - Growth is Promising - FY24

Welcome to my summary of Brookfield Infrastructure Partners’ ($BIP.UN/$BIPC) earnings report for fiscal 2024. For additional context, please refer to my earlier post detailing my valuation methodology.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.